This is an excerpt from “2022 Healthcare Provider IT Report — Post-Pandemic Investment Priorities”, published by Klas and Bain in October 2022, authored by Eric Berger, Laila Kassis , Aaron Feinberg , Michael Brookshire , John Day , Rebecca Hammond

Eric Berger, Laila Kassis , Aaron Feinberg , Michael Brookshire , John Day , Rebecca Hammond

October 2022

Site Editor:

Joaquim Cardoso MSc.

health systems transformation — center of excellence

October 22, 2022

At a Glance

- As healthcare providers emerge from a global pandemic, they are doubling down on software investments, even in the face of macroeconomic turbulence.

- Providers are focusing investments on revenue cycle management, patient intake, and cybersecurity.

- Providers are increasingly streamlining bloated tech stacks and looking to their electronic medical records (EMR) providers and other existing vendors for new solutions before evaluating new vendor offerings.

- Competition in the provider IT space shows no signs of abating: Early-stage capital, big tech, and scale EMR players continue crowding into more segments.

- This has significant implications for providers as they transition into a new disruptive period,

— for software players as they fine-tune go-to-market models for the current environment, and

— for private equity investors as they look to invest behind winning themes.

Infographic

This has significant implications for providers as they transition into a new disruptive period :(i) for software players as they fine-tune go-to-market models for the current environment, and (ii) for private equity investors as they look to invest behind winning themes.

INTRODUCTION

Covid-19 radically stretched healthcare providers in countless ways, including accelerating digitization and changing patient expectations about care delivery.

Some organizations adopted multiple systems to keep pace with the changes; others pressed pause.

Both sets of organizations are now regrouping, looking to be more focused with their investments and streamline their existing tech stacks.

Some organizations adopted multiple systems to keep pace with the changes; others pressed pause.

Both sets of organizations are now regrouping, looking to be more focused with their investments and streamline their existing tech stacks.

Provider organizations, regardless of size or sophistication, are emerging from the pandemic and taking stock of the software solutions they’ll need in the long term and determining where and how to invest.

As part of this reflection, many are seeking to better integrate new solutions and rationalize vendors.

In the short term, clinician shortages and wage inflation are driving demand for solutions that improve productivity and alleviate labor needs.

As part of this reflection, many are seeking to better integrate new solutions and rationalize vendors.

In the short term, clinician shortages and wage inflation are driving demand for solutions that improve productivity and alleviate labor needs

Against this backdrop, vendors face growing competition from large electronic medical record (EMR) incumbents pursuing product adjacencies, big tech, and innovative venture capital–funded start-ups.

In the current environment, it is critical that

- vendors understand the investment posture of their customers,

- properly segment them based on their needs and behaviors, and

- refine go-to-market (GTM) models by articulating their differentiated value proposition in a crowded field.

The healthcare information technology (HCIT) space has been historically attractive for investors, and it is expected to remain so despite recent macroeconomic turbulence.

Investors must maintain discipline amid this uncertainty and continue to pursue attractive themes

- while assessing the impact of potential headwinds from market conditions,

- rising vendor rationalization,

- and the risk of being boxed out from existing provider solutions (especially EMRs) as part of diligence.

FROM DISRUPTION TO DISRUPTION: How Provider IT Priorities Are Evolving

Post–Covid-19, providers are doubling down on software investments

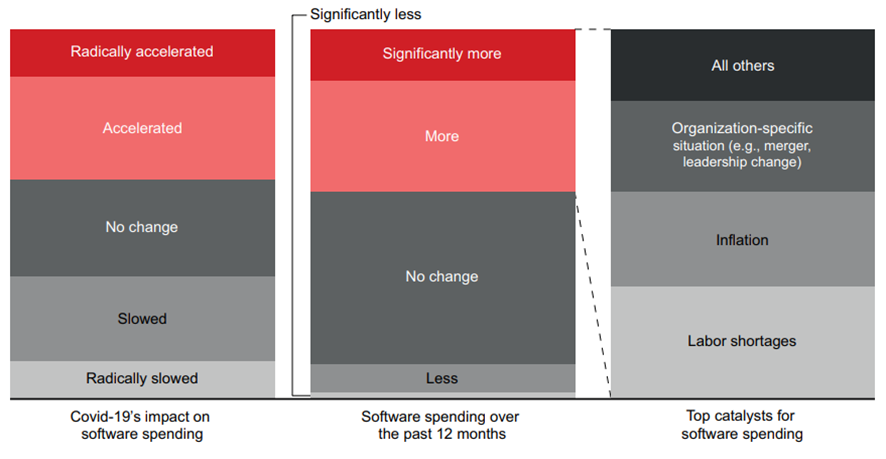

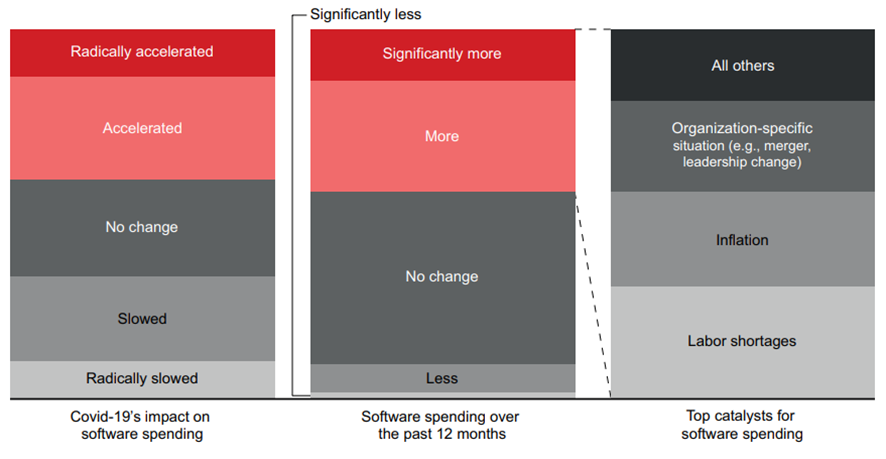

Covid-19 led to a bifurcation in providers’ approaches to their software investments.

Larger, urban organizations with a more innovative orientation accelerated HCIT investments during the pandemic.

Citing the challenges posed by Covid-19, they focused on telehealth, clinical systems, and clinical decision support.

Smaller, rural organizations with tighter budgets tapped the brakes during the pandemic, balancing investment priorities with financial pressures.

Many of these providers have fallen behind on pre–Covid-19 investment roadmaps and are struggling to navigate an explosion of vendor offerings.

As pandemic conditions eased, many providers ramped up their software investments.

Some 45% of providers accelerated software investment over the past year, with only 10% decelerating their spending.

This signals a turning point in the provider IT market as we emerge from the pandemic, with forward-thinking providers doubling down on technology roadmaps and many who spent the past few years on the sidelines looking to retool software roadmaps for a “new normal” that presents a host of new challenges, including macroeconomic pressures and long-term shifts in ways of working.

Some 45% of providers accelerated software investment over the past year, with only 10% decelerating their spending.

Of those accelerating investments over the past year, nearly 80% cite labor shortages, or inflation concerns, or specific organizational situations (e.g., M&A, change in leadership) as the top catalysts spurring new investments

Figure 1: Covid-19 bifurcated software spending, but nearly 45% of providers claim that they spent more on software over the past year

Sources: Provider interviews; Bain-KLAS 2022 Provider Executive Survey (N=289)

Of those accelerating investments over the past year, nearly 80% cite labor shortages, or inflation concerns, or specific organizational situations (e.g., M&A, change in leadership) as the top catalysts spurring new investments

Covid-19–era staffing shortfalls and burnout among physicians, nurses, and other clinicians, as well as IT and office personnel, continue to plague providers.

These shortages led to a pandemic-era spike in wage inflation, which has been further exacerbated by rising wages and product cost inflation in the broader economy over the past 12 to 18 months.

As a result, providers are looking to software solutions to boost productivity and automate tasks, with the ultimate goal of stronger financial outcomes and higher-quality patient care.

As a result, providers are looking to software solutions to boost productivity and automate tasks, with the ultimate goal of stronger financial outcomes and higher-quality patient care.

Additionally, the past few years also led to a variety of organizational shifts, including

- a flurry of leadership changes and retirements by provider executives who had prolonged their careers to lead their organizations through the pandemic, as well as

- a spike in consolidation as M&A activity boomed.

In connection with these changes, many providers are revisiting strategic plans and making investments to integrate acquisitions into more sophisticated parent company tech environments.

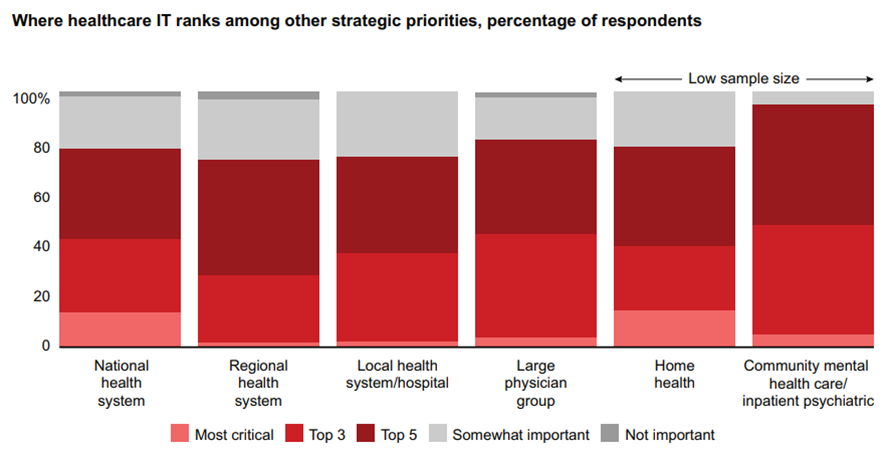

Software is now a top five strategic priority for nearly 80% of provider organizations and a top three priority for almost 40%

Figure 2: Healthcare IT is a top 3 strategic priority for almost 40% of providers and a top 5 priority for nearly 80%

Sources: Provider interviews; Bain-KLAS 2022 Provider Executive Survey (N=289)

Concerns about the macroeconomic environment are having an impact on investment plans. For now, though, we see few signs of a broad-based slowdown on provider software roadmaps.

Concerns about the macroeconomic environment are having an impact on investment plans. For now, though, we see few signs of a broad-based slowdown on provider software roadmaps.

Providers have displayed resilience during past recessions despite some adverse impact around elective procedure volumes and declining commercial insurance coverage amid rising unemployment.

Uncertainty remains, however, in the current environment.

The modern provider IT market has not experienced a pronounced period of high inflation, potentially tipping into a recession.

Similar to what we saw during the Covid-19 pandemic, our research indicates that a prolonged period of market turbulence would likely lead to a bifurcation of software investment postures, with large, sophisticated providers accelerating investments and smaller providers hitting the brakes.

This would result in a further widening of the gap between how different types of provider organizations use technology to deliver care, support clinicians and administrative staff, and boost the bottom line.

This would result in a further widening of the gap between how different types of provider organizations use technology to deliver care, support clinicians and administrative staff, and boost the bottom line.

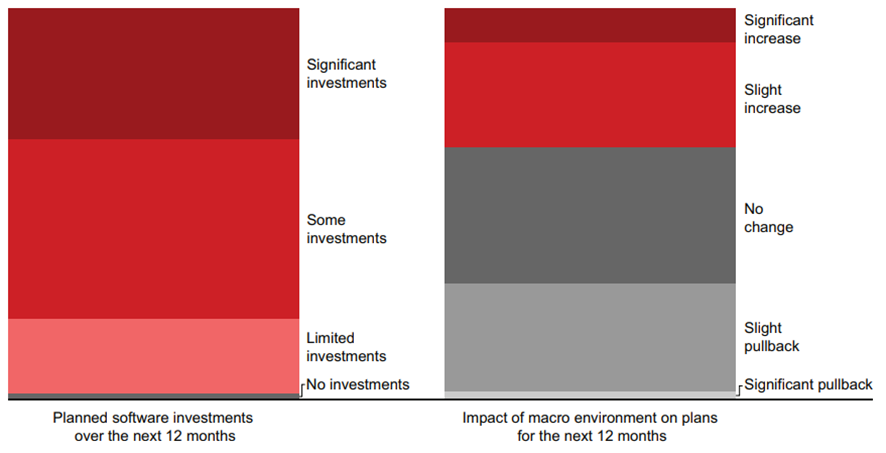

Over the next year, more than 95% of providers expect to make new software investments, with one-third planning significant new investments

Figure 3: A third of providers expect to make significant software investments, but the effect of macro conditions on spending varies

Sources: Provider interviews; Bain-KLAS 2022 Provider Executive Survey (N=289)

Roughly 35% of providers say that because of the current environment, they plan to spend more than usual over the next 12 months as they seek productivity and efficiency improvements to address rising margin pressure and labor tightening.

About 30% say that they will likely spend less than they would in more favorable conditions over the next year.

Leading hospitals, academic medical centers, and large physician groups will especially continue to prioritize clinical outcomes and innovation during a recession.

Most other hospitals and midsized physician groups will continue executing on current investment plans, although they may be more budget conscious.

At the tail, some smaller hospitals and provider groups with tight budgets might halt investments entirely.