MARCH 2022

IT Buyer Survey #3, BCG November 2021

Key takeaways Source:

.

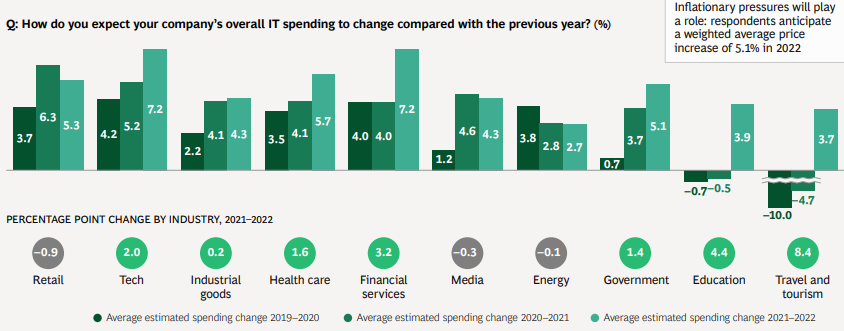

IT budgets are poised to increase as prices rise

- 82% of respondents expect their companies’ IT spending to grow in 2022, in part due to inflationary pressures,

- with respondents anticipating a 5.1% weighted average price increase

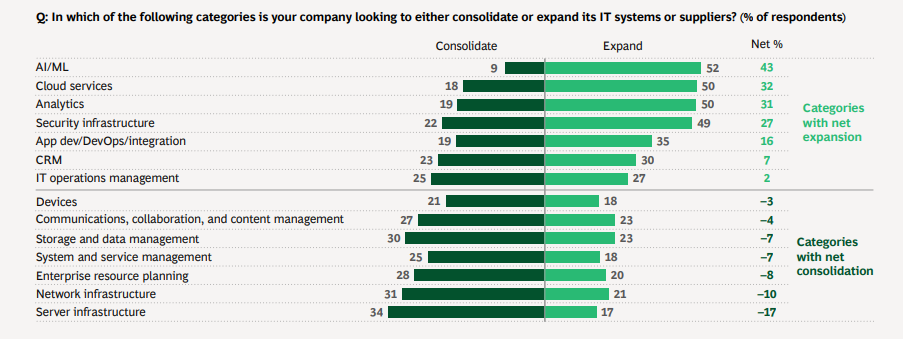

Half of respondents expect to expand their IT investments

- At least 50% of buyers expect to increase their AI, machine learning (ML), analytics, and cloud services systems or suppliers,

- while roughly a third expect to consolidate their server infrastructure

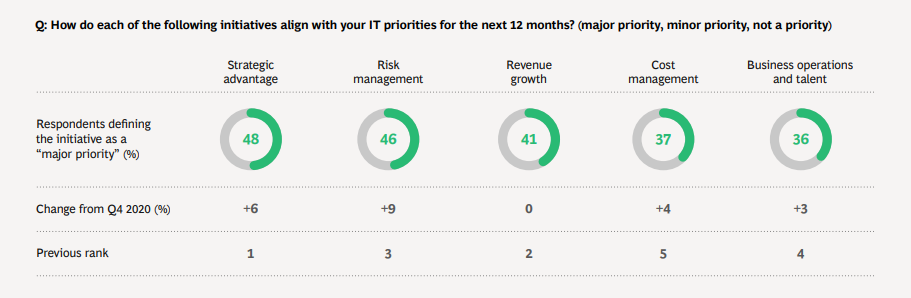

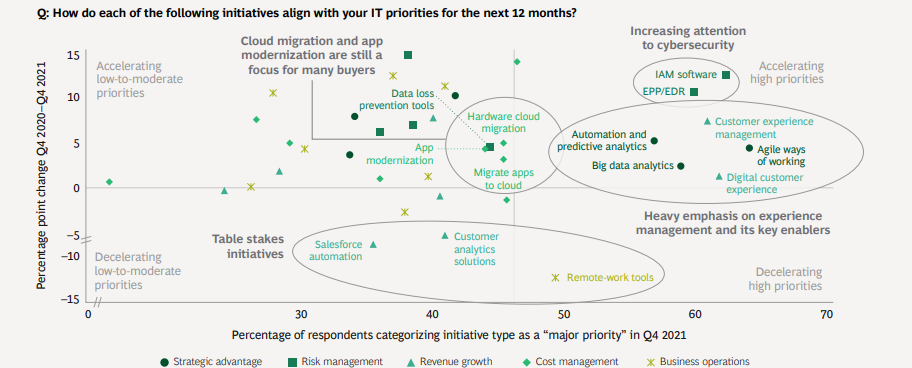

Risk management is an ever-increasing focus

- IT buyers increasingly choose risk management initiatives as a major IT priority, although strategic advantage initiatives are still the leading focus

Only marginal changes are expected in cloud investing

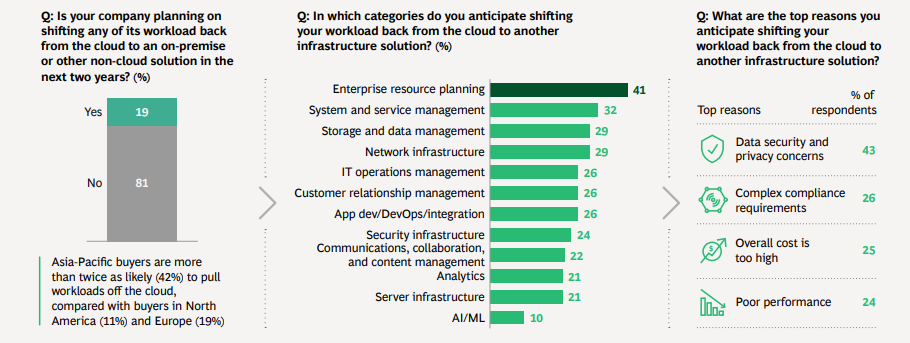

- Workloads remain heavily on the cloud,

- with less than 20% of buyers planning to shift any workloads off the cloud in the next two years;

- those shifting are mainly pulling back in enterprise resource planning because of data security concerns

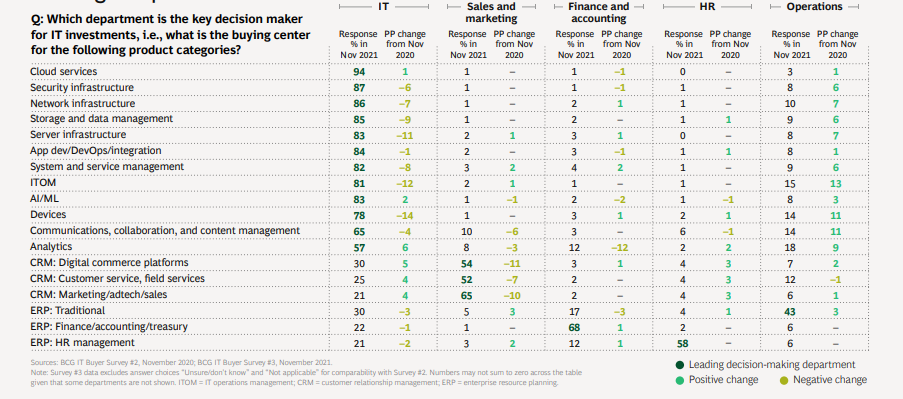

Decision-making power is diffusing slightly

- IT decisions are still predominantly made by IT;

- however, substantial power is shifting to operations teams, particularly in IT operations management and devices

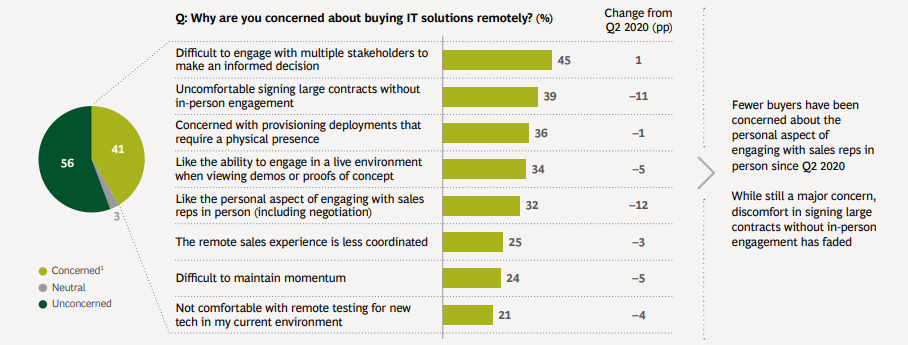

Remote-selling concerns are waning

- Many buyers have become more comfortable signing large contracts without in-person engagement

- and are more willing to sign new vendors remotely

IT spending is expected to increase in 2022 across most major industries, especially financial services, education, and technology — healthcare comes 4th (5,7%)

68% of buyers expect prices to rise in 2022, supported by budget expansion

Respondents expect to expand some areas of IT investment and consolidate others

Top expansion areas are : AI/ML; Cloud Services; Analytics; Servicy Infrastructure

Risk management is an increasing priority for IT buyers, although strategic advantage remains the leading focus

Risk management initiatives saw the greatest year-on-year acceleration

Less than 20% of buyers are shifting workloads off the cloud; those shifting are mainly pulling back in enterprise resource planning

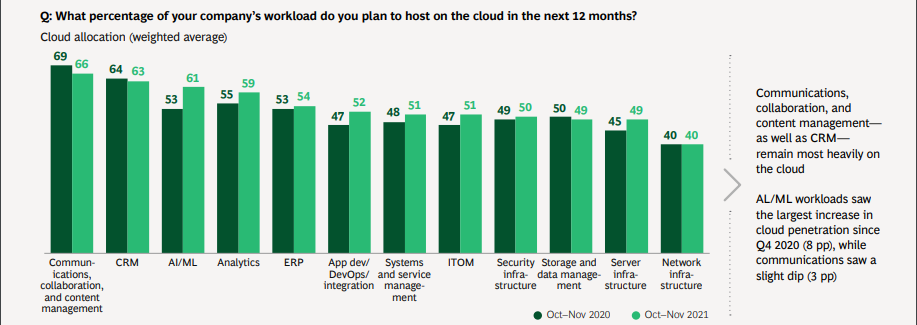

Workloads remain heavily on the cloud, at 40% to 70% per category, with marginal changes since Q4 2020

While still predominantly driven by IT, substantial decision-making power is shifting to operations

Concerns with remote transactions are waning slightly, although buyers are still more comfortable dealing with the vendors they know

Leading concerns with remote buying now revolve around stakeholder engagement

Originally published at https://web-assets.bcg.com