the health strategist

institute for

health transformation

& digital health

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

September 1, 2023

What is the message?

Generative AI is becoming a significant force in the insurance industry, offering transformative potential along with challenges.

It underscores the crucial role of humans in developing and using AI responsibly to ensure it creates value for society and aligns with ethical principles.

Ultimately, the article emphasizes that while AI reshapes human thinking and processes, it should be harnessed as a tool to drive innovation, efficiency, and progress, with its benefits far outweighing the risks when managed responsibly.

Key takeaways:

- Generative AI in Insurance: The article discusses the emergence of Generative AI as a significant topic in the insurance industry in 2023, highlighting its potential impact on the industry’s operations and services.

- Promise and Challenges of AI: While Generative AI holds promise, the article emphasizes that it also presents challenges. It acknowledges that AI has both clear potential and weaknesses, and this interplay is expected to continue evolving as the technology matures.

- Human Responsibility: The article underscores that the future of AI in insurance depends on the individuals who develop and use it. It stresses the importance of ensuring that AI creates value for society without negative side effects, emphasizing the quality of training data and responsible development.

- Core Purpose of Insurance: Despite AI’s transformative potential, the core purpose of the insurance industry remains unchanged, which is to provide risk transfer and mitigation solutions. AI may enable new solutions and business models but cannot alter this fundamental mission.

- AI Adoption in Insurance: The insurance industry is in the early stages of adopting AI, primarily using narrow AI for specific tasks like automating parts of the underwriting process without decision-making. Large language models, such as GPT, are being experimented with but not yet fully deployed.

- Data Analytics and Predictive Capabilities: The rapid development of the ability to process unstructured data is opening up new solutions to serve customers better. Enhanced data analytics and predictive capabilities are expected to facilitate the combination of insurance coverage with risk mitigation.

- Ethical Considerations: The article emphasizes the importance of addressing ethical concerns related to AI, including intellectual property, data privacy, data quality, and biases. It calls for actively shaping ethical AI development that aligns with societal values and needs.

- Human Role in Harnessing AI: Human involvement in harnessing AI’s power is crucial. The article recognizes that humans play a pivotal role in ensuring that AI applications benefit future generations and that AI enhances work while preserving the core purpose of the insurance industry.

- AI as a Reflection of Human Thinking: The article highlights that AI, including Generative AI, is a reflection and amplification of human thinking. It reshapes and remixes human knowledge and reasoning based on training data, emphasizing that it is a tool developed by humans.

- Balancing Risks and Opportunities: While generative AI presents challenges, the article asserts that the potential benefits, such as increased productivity, creative problem-solving, and resource management, far outweigh the risks. It sees AI as a digital extension of human thought processes that can be harnessed responsibly for societal progress.

- Democratization of Access: Generative AI has the potential to democratize access to information, services, and resources, making them more widely available and accessible, ultimately benefiting society and economic growth.

- Responsibility of Creators: The article underscores the responsibility of AI creators and stewards to ensure that AI benefits the collective good and advocates for shifting the narrative away from fear-driven perspectives toward the limitless potential of generative AI.

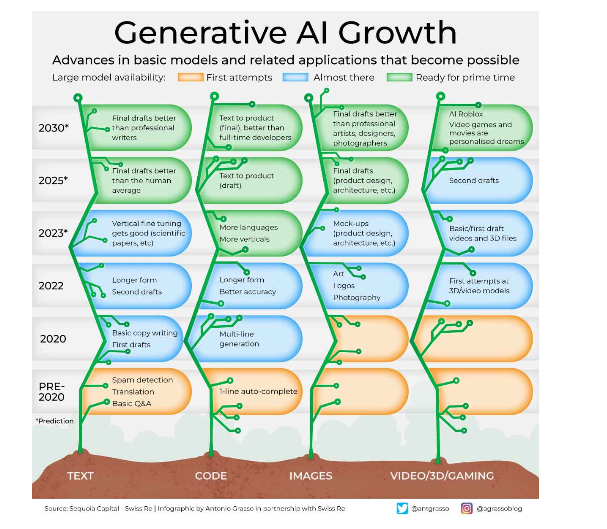

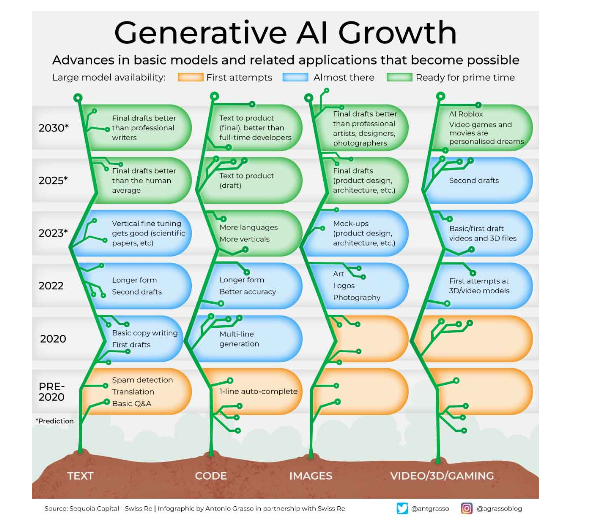

Infographic

DEEP DIVE

The future of AI in insurance – Part 4: Decrypting AI for insurance

SwissRe

Pravina Ladva and Antonio Grasso

June 5, 2023

In the first three parts of our series we looked at the vital elements that AI applications must fulfil to benefit the insurance industry, the countless possibilities it opens up, and what it will take to foster trust in rapid machine advancements. Now at least one burning question remains: What do these impending business changes mean for future generations working in the insurance industry?

Pravina Ladva´s view

It’s summer 2023, and the insurance industry finds itself in the midst of an emerging topic – Generative AI. It strikes me that AI is now taking center stage, provoking philosophical reflections on what truly differentiates human from machine intelligence.

The excitement – some might call it hype – surrounding AI is understandable. ChatGPT has provided a good example of the potential capabilities of Generative AI to us all making its impact tangible. However, along with its clear promise, AI has also revealed its weaknesses. This interplay of promise paired with challenges will likely continue moving forward, as this technology evolves.

What I find crucial: the future of AI hinges on the individuals who are developing and using it. It’s us humans who must ensure that AI creates value for society, without negative side effects. This truth remains relevant for the current situation, as well as all future scenarios involving AI. Ultimately, AI will only be as good as those people who develop and utilise and the quality of the underlying training data.

Unchanging core purpose

Despite the transformative potential of AI in the re/insurance industry, one constant remains: people’s need for risk transfer and mitigation solutions. AI may enable new solutions and business models, but it cannot alter the core mission of our industry. Hopefully, AI will help in closing the protection gap more efficiently.

Part 2 of our series delved into the immense opportunities AI holds for the insurance industry. Currently, the industry is in the early stages of adopting AI, primarily employing narrow AI for specific purposes like automating parts of the underwriting processes without decision making.

Many large insurance companies are experimenting with large language models (LLMs) such as GPT, though they are not yet fully deploying them. These models can have a significant impact on the re/insurance industry, not only by automating processes, but also by automating tasks such as code generation and analytics.

I find it very exciting that the rapidly developing abilities to process unstructured data (see graphic below) is opening our eyes to new solutions that will help us to serve our customers better. With enhanced data analytics and predictive capabilities, it will become easier to combine insurance coverage with risk mitigation. More and more AI use cases are emerging in the industry, one recent example is our partnership with CompScience for improved worker safety.

Shaping the future of AI now

The future of ethical and beneficial AI depends on actions taken today. Full enterprise maturity requires addressing various risks associated with LLMs and Generative AI.

Swiss Re’s latest edition of Sonar, our annual publication that tackles new emerging risks of often existential significance, explores risks of Generative AI relevant for the insurance industry. For example, Generative AI has unresolved intellectual property issues regarding training, its outcome and the creation of “plausible” content. The same goes for data privacy. The collection of the large data sets with the intent of producing something new from that material raises questions around rights to the underlying data, and also concerns about data quality and biases.

In order to guarantee that AI fulfills its future potential, it is important to actively shape the technology now. As an industry, we have an obligation to drive the development of ethical AI that benefits society, ensuring it aligns with our values and needs.

As we navigate the immense promise of AI, it is crucial to recognise the pivotal role humans play in harnessing its power so that future generations can benefit from AI applications.

With AI technology still really only in its infancy, we have an opportunity to forge a path in which AI enhances our work while preserving our core purpose in the ever-evolving world of insurance.

Antonio Grasso’s view

As we move further into the era of generative artificial intelligence (AI), it’s important to remember that AI is, at its core, a reflection and amplification of our human thinking. While this sophisticated technology is capable of creating content that appears original, it is fundamentally an echo of our input. It is not an independent entity but a tool we have developed to transform our thoughts, knowledge, and creativity into new forms at a scale and speed far beyond our capabilities.

Navigating the Ethical Landscape of generative AI

Within this premise, essential questions arise around generative AI, encompassing data ownership, quality, potential bias, and misuse. Far from being purely technological, these challenges serve as a mirror that reflects our ongoing societal and ethical struggles. Therefore, our approach to addressing these concerns requires advanced technical solutions and deep introspection about our collective values and guiding principles.

The Illusion of Synthetic Thought

As we navigate this ethical landscape, we encounter the notion of synthetic reasoning, which is often attributed to AI. It’s important to understand that what may appear to be synthetic thinking is actually a reconfigured version of our human reasoning, shaped by the training data we provide. AI doesn’t create knowledge; it reshapes and remixes the human knowledge it’s trained on. It’s our thoughts, amplified and modified by algorithmic patterns.

Harnessing the Immense Power of generative AI

Recognising this reshaping of our thinking underlines the transformative power of generative AI, which is as broad as deep. This technology has the potential to revolutionise efficiency, drive innovation and streamline processes across numerous sectors. To fully realise these benefits, however, we must thoughtfully guide the development and application of generative AI, maintaining a comprehensive understanding of its potential and limitations to ensure its responsible, strategic use.

Balancing Risks and Opportunities

While it’s true that generative AI poses significant challenges, I firmly think that the potential benefits far outweigh the risks, as I believe that the gains in productivity, creative problem solving, and resource management that can be derived from AI can drive societal progress and economic growth on an unprecedented scale.

Moreover, by recognising AI as a digital extension of our thought processes, we allay fears of AI as an independent entity, allowing us to maintain control over this technology and align its development with our collective ethical and societal norms. Finally, generative AI has the potential to democratise access to information, services, and resources, enabling widespread access to services once limited by human capacity.

As creators and stewards of AI, we are responsible for ensuring that this digital manifestation of our knowledge benefits the collective. In doing so, we shift the narrative toward the limitless potential of generative AI and away from the predominantly fear-driven perspectives. This belief underpins my conviction that the benefits of integrating generative AI into our society far outweigh the risks.

About the Authors

Pravina Ladva, Chief Digital & Technology Officer

Antonio Grasso, Entrepreneur, Technologist, Founder & CEO

Originally published at https://www.swissre.com