‘Pure pharma’ companies were the minority a decade ago but are now back in fashion

Financial Times

Opinion LEX

October 25, 2021

Novartis boss Vas Narasimhan has mooted the possibility of selling its generic drugs business Sandoz © Simon Dawson/Bloomberg

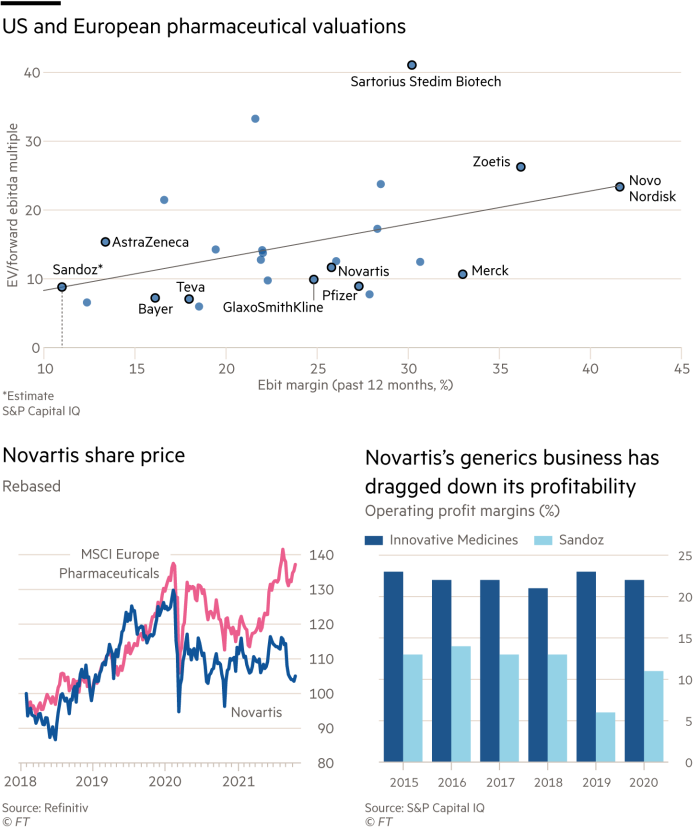

How fashions fade. A decade ago, “pure pharma” companies such as Roche and AstraZeneca were a shrinking minority. Novartis exemplified a trend for diversification.

Now, the Swiss giant is shedding non-core businesses.

Selling its generic drugs business Sandoz — a possibility mooted by boss Vas Narasimhan on Tuesday — would be the final step in creating a drugs giant narrowly focused on innovative medicines.

Novartis plans to complete its strategic review of Sandoz by the end of next year, exploring all options including hanging on to the unit. Third-quarter results showed why it might want to spin off or sell the generics business.

Novartis cut its profits guidance, saying that price pressures had dragged down sales. Competition is intense, particularly in the US.

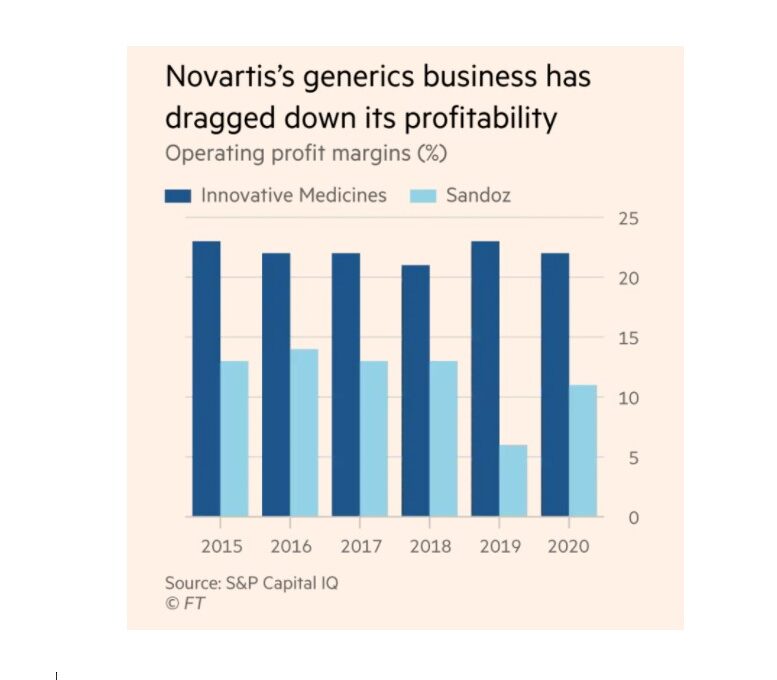

The generics division has long weighed on profitability.

For 2020, the unit’s operating profit margins were 11 per cent — half those of the innovative medicines division.

A post-Covid rebound in Sandoz’s profitability is likely.

It has pushed into fast-growing areas such as biosimilars, the large molecules manufactured using living cells.

That might justify a steeper EV-to-forward ebitda multiple than the seven times commanded by quoted generics companies Teva and Viatris.

The unit might fetch at least $15bn, according to Bernstein. A private equity buyout or a flotation would be options; antitrust concerns could prevent a trade sale.

The case for splitting off Sandoz is not conclusive.

A push by Narasimhan to make Sandoz’s manufacturing and other operations independent of Novartis is nearly complete.

But there are still some benefits from the combination. Sandoz gets greater access to technology and capital. In return, it supplies cash, stability and consistent growth.

A sale at a high price would stifle talk of “synergies” however.

This would bring in cash to strengthen Novartis’s pipeline. Future patent expiries are dragging on the share price.

Pure play pharma is back in fashion because scientific breakthroughs — most recently in the war on coronavirus — have shown how vital and profitable it can be.

Novartis would be aligned with the times in ditching Sandoz. It adds little to the business case.

Pure play pharma is back in fashion because scientific breakthroughs — most recently in the war on coronavirus — have shown how vital and profitable it can be.

Originally published at https://www.ft.com on October 26, 2021.