the health strategist

institute for strategic health transformation

& digital health

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

September 11, 2023

What is the message?

Private equity (PE) activity showed signs of recovery in Q2 2023, with a 15% increase in deals compared to the previous quarter, largely driven by a resurgence in Europe.

While take-private deals had dominated earlier in the year, this trend began to slow as markets stabilized, prompting PE firms to explore a broader range of deal types.

The industry remains focused on investing in high-quality assets in sectors with long-term growth potential, including technology, healthcare, and financials, despite ongoing macroeconomic uncertainty.

Key takeaways:

What was the key highlight of private equity (PE) activity in Q2 2023?

- Private equity activity in Q2 2023 saw a 15% increase compared to Q1, with firms announcing deals valued at US$114 billion.

- This increase was mainly driven by a significant rise in Europe, where firms announced acquisitions valued at more than US$38 billion, which was over four times the amount announced in Q1.

What factors influenced PE activity in the first part of the year?

- In the first part of the year, PE activity was affected by continued macroeconomic uncertainty, including rising interest rates and an uncertain economic outlook.

- This uncertainty weighed heavily on PE deals, resulting in deals valued at US$213 billion through the end of June, significantly lower than the US$545 billion announced in the first half of 2022.

What were the notable trends in the types of PE deals in Q2?

- Take-private deals were a powerful theme in the larger end of the market in Q2, accounting for 42% of deal activity. However, the trend of take-private deals started to abate as markets stabilized.

- Firms began focusing on a broader set of deal types, including secondaries, carve-outs, and acquisitions of private companies.

How did the exit market perform in Q2, and what were the driving factors?

- Exits in Q2 experienced a modest rebound, with firms announcing transactions valued at US$84 billion, a 42% increase by value from Q1.

- This increase was driven by a significant rise in sales to strategic acquirers, which grew nearly 90% from Q1.

- The IPO market remained largely closed, with only 13 companies backed by PE firms completing IPOs in the first half of the year.

How did fundraising in the PE industry fare in Q2 2023?

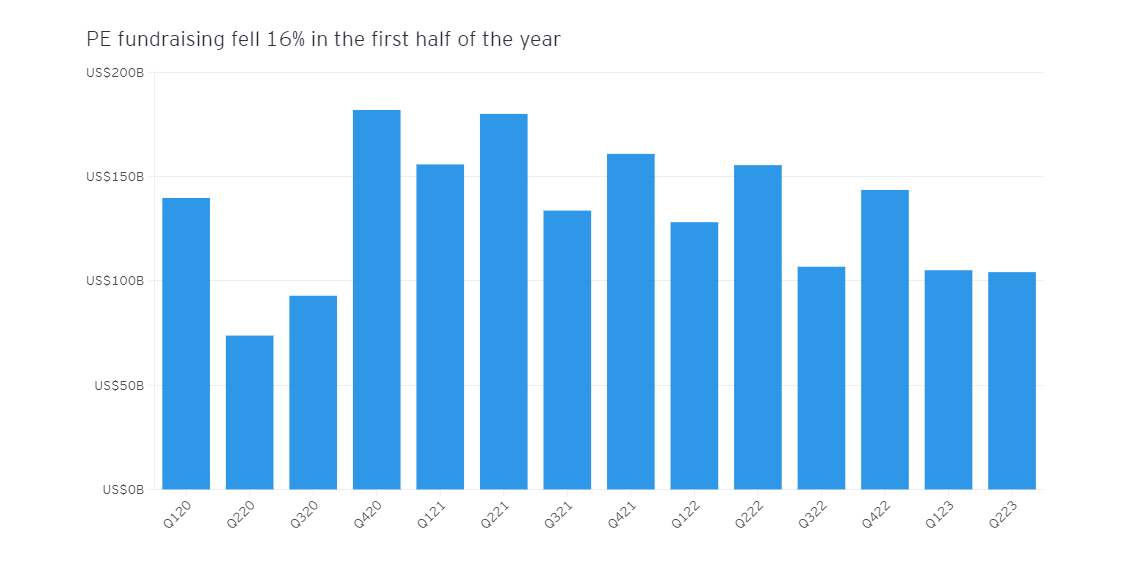

- PE firms raised US$104 billion in Q2, bringing the total to US$209 billion for the first half of 2023. This represents a decline of 16% from the second half of the previous year and a 26% decline from the first half of 2022.

- The fundraising environment faced challenges due to the denominator effect and difficulties in exiting investments.

What sectors were of interest to PE firms in terms of investments?

- PE firms remained interested in several key sectors, including technology, healthcare, and financials. Tech deals accounted for over one-third of PE’s total spending in the first half of 2023.

- Health care received 14% of total PE spending, with a focus on specialty medicines and direct-to-consumer drug delivery models. Consumer-focused targets also saw increased activity.

What is the outlook for the PE industry?

- The PE industry is expected to remain focused on investing in high-quality assets in sectors with clear long-term secular tailwinds.

- These sectors include software, media, logistics, and healthcare. Additionally, PE firms are expanding into asset classes like secondaries and credit.

- They will continue to work on optimizing their portfolio companies to thrive despite ongoing macroeconomic uncertainty.

Infographic

DEEP DIVE

Private Equity Pulse: Takeaways from Q2 2023

PE activity saw a modest uptick in Q2 on European resurgence.

EY

Pete Witte

August 17, 2023

In brief

- The take-private activity that dominated the first part of the year has showed signs of abating.

- PE firms will remain focused on acting opportunistically to invest in high quality assets in spaces with clear long-term secular tailwinds.

Private equity (PE) activity climbed 15% in the second quarter versus Q1, with firms announcing deals valued at US$114b. The increase was driven by a steep rise in Europe, where firms announced acquisitions valued at more than US$38b, more than four times the amount announced in Q1.

Continued macro uncertainty weighed heavily on PE activity in the first part of the year, as firms grappled with the impact of rising interest rates and an overall uncertain economic outlook. Through the end of June, PE firms announced deals valued at US$213b, precisely in line with the second half of last year, but significantly less than the US$545b announced in the first half of 2022.

Add-ons remain an important part of the market, accounting for 55% of deals by volume in the first half of the year, down from 60% last year.

At the larger end of the market, take private deals have been a powerful theme. In a typical year, roughly 20% of PEs deployed capital in such deals. In the first quarter of this year, nearly 70% of aggregate investment was in such deals as firms looked to capitalize on volatility in the public markets.

However, with markets stabilizing in recent weeks — in the US, for example, the S&P 500 rose more than 8% in Q2 — some of that bargain-hunting has begun to abate. Take-privates accounted for 42% of deal activity in Q2 — still high relative to historical standards, but off the record highs seen early in the year. Instead, firms are opportunistically focusing on a broader set of deal types including secondaries, carve-outs, and acquisitions of private companies, that had been largely absent in the preceding six months.

Exit market moves higher on sales to strategics

Exits experienced a modest rebound in the second quarter as well, with firms announcing transactions valued at US$84b in Q2, up 42% by value from Q1. Activity was driven by a marked increase in sales to strategic acquirers, which grew nearly 90% from Q1. The IPO window remains largely closed despite a small handful of high-profile exits over the last several months including Lottomatica, backed by Apollo Management, and Savers Value Village, backed by Ares Capital Management. In aggregate, just 13 companies backed by PE firms completed IPOs in the first half of the year.

As a result, firms and their investors continue to seek alternative sources of liquidity. According to Cobalt data, distributions from buyout funds in 2022 reached their lowest levels since the global financial crisis (GFC); just 14% of invested net asset value (NAV) was returned to investors, versus a long-term average of around 26%.

Consequently, both limited partners (LPs), and general partners (GPs) on their behalf, are increasingly turning to the secondary markets in order to generate liquidity. A recent survey by Coller Capital found that more than three-fourths of LPs intended to use secondaries to generate liquidity over the next two years. Fundraising for vehicles focused on the space is on pace for a record year, a dynamic that’s in sharp contrast to the broader fundraising market; so far this year, secondaries funds have raised more than US$32b, with additional large-scale closes expected to add to the total in the coming months. Anecdotal reports are also accumulating about the increasing use of NAV loans by GPs. These fund level facilities, generally secured by portfolio assets, can allow for liquidity in a period of constrained exit activity.

Tech, health care, consumer, and financials: all remain powerful themes

Tech remains a powerful theme — in the first half of last year, tech deals accounted for one-quarter of PE’s total spend; in the first half of this year, the percentage grew to more than one-third, the result of PE’s take-private push in the early months of the year. Cybersecurity remains a prominent area of focus as companies continue to increase their cyber budgets, and favorable valuations coupled with stable business models characterized by low client churn and high margins provide further tailwinds.

PE firms continue to see opportunities in a number of key sectors including tech, health care, and financials:

| Sector | Percentage of deal value – H1 2022 | Percentage of deal value – H1 2023 | Percentage of deal volume – H1 2022 | Percentage of deal volume – H1 2023 |

| Consumer | 13% | 8% | 23% | 27% |

| Financials | 5% | 14% | 6% | 7% |

| Healthcare | 6% | 14% | 10% | 9% |

| Industrials | 19% | 3% | 10% | 8% |

| Materials | 8% | 14% | 11% | 14% |

| Oil and gas | 1% | 1% | 1% | 1% |

| Real Estate | 14% | 1% | 3% | 1% |

| Retail | 0% | 1% | 2% | 3% |

| Technology | 25% | 35% | 29% | 25% |

| Telecom | 1% | 3% | 2% | 1% |

| Utilities | 8% | 5% | 3% | 3% |

Health care remains another key space, with firms devoting 14% of spend to the sector. Specialty medicines, direct-to-consumer drug delivery models, and other spaces are all attracting interest from PE.

Consumer-focused targets has seen increased activity as well, although average ticket sizes remain comparatively low. Undervalued carve-outs in the packaged goods sector and agribusinesses with headroom for growth from tech integration are among spaces where firms are focused.

Fundraising

PE firms raised US$104b over the course of the quarter, for a total of US$209b over the first half of 2023. This represents a 16% decline from the second half of last year, and a 26% decline from the first half of 2022. The impact of the denominator effect, wherein LPs become overallocated to private markets by virtue of steep declines in their public market holdings, and the challenges exiting investments continue to weigh heavily on new commitments.

Investors continue to favor larger managers and larger vehicles — in the second quarter, nearly half of all capital commitments were raised by a small handful of US$10b-plus funds. Despite the challenging fundraising environment, most private equity funds continue to have ample capital at their disposal, and the industry as a whole is highly unlikely to become capital-constrained in any meaningful way – in total, PE firms have nearly US$1.3t in dry powder available to fund new deals.

Outlook

While many economists have been calling for a recession for more than a year now, underlying macro performance has remained, in many ways, remarkably resilient. Inflation has moderated without the dramatic impacts on unemployment that many expected, and regulators have responded to shocks in the banking sector swiftly and decisively, ameliorating fears of systemic contagion, at least for the time being. The dichotomy of today’s operating environment — and the challenge for PE — is that these recessionary expectations are creating a stasis of uncertainty that’s keeping many participants locked in wait-and see mode.

PE firms will remain focused on acting opportunistically to invest in high-quality assets in spaces with clear long-term secular tailwinds — software, media, logistics, and health care, for example. They’ll continue their expansion and emphasis on additional asset classes, including secondaries and credit. In credit for example, the accelerated expansion of that asset class — which began in earnest last year when the large banks stepped away from financing PE transactions — will continue, with more companies in the middle market and upper middle market space turning to credit funds for their everyday borrowing needs.

Most important, they’ll remain focused on pulling all available operational levers to ensure that existing portfolio companies not only survive today’s macro uncertainty, but are positioned to outperform as economic growth begins to accelerate.

Originally published at https://www.ey.com