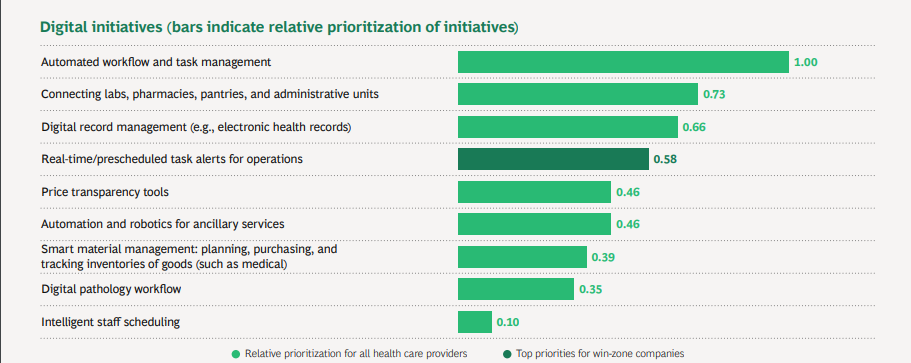

Digital Support Functions and Smart Operations comes third and fourth

This is an excerpt of the publication below, with the title above, focusing on the topic in question. For the full version of the original publication, refer to the second part of this post, below.

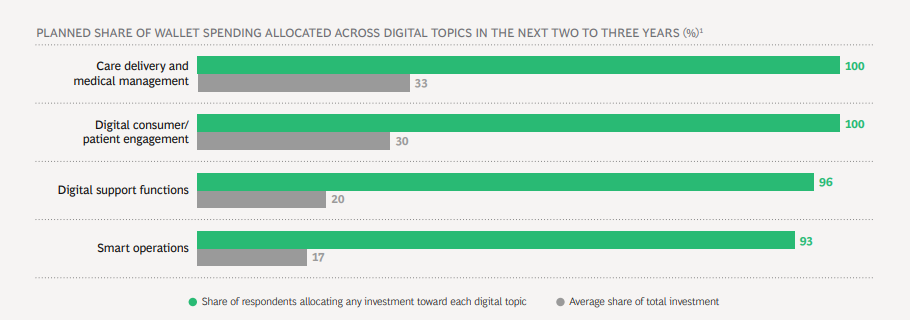

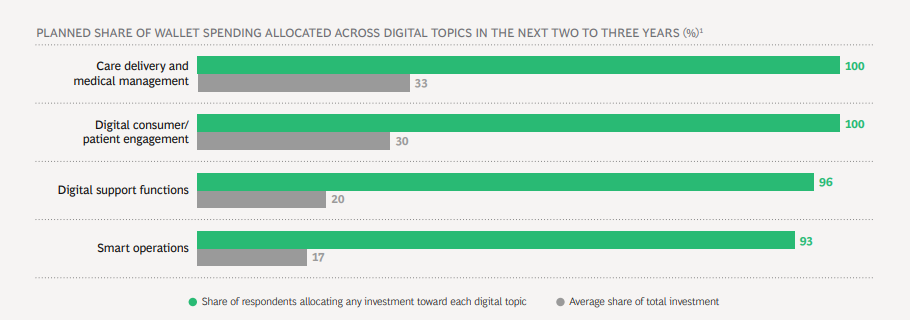

All providers plan to allocate more than 60% of spending on care delivery and medical management and on consumer and patient engagement

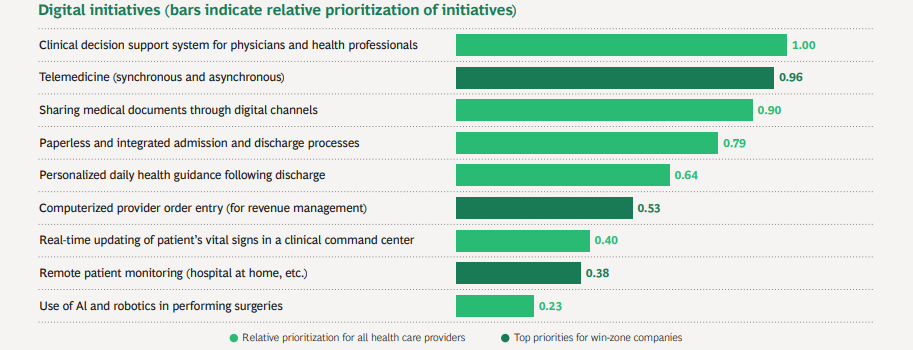

Health care providers’ digital priorities: Care delivery and medical management

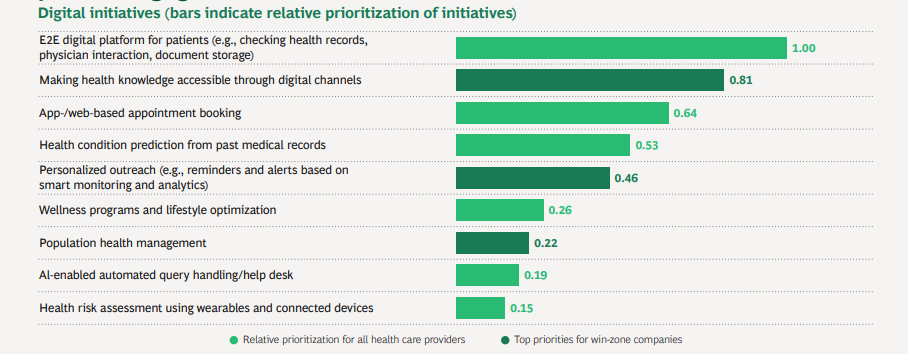

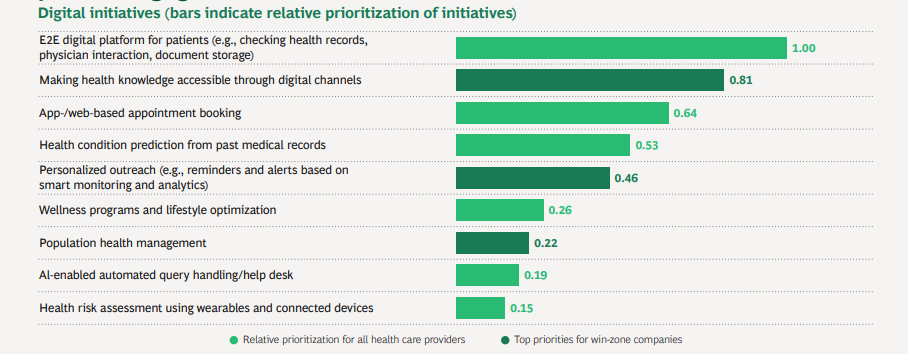

Health care providers’ digital priorities: Digital consumer and patient engagement

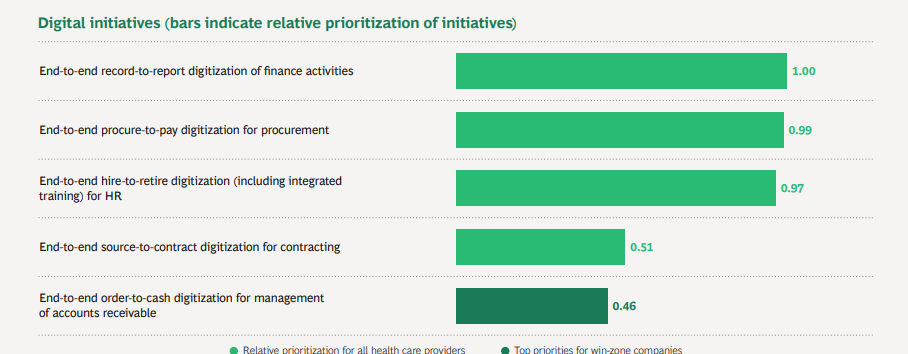

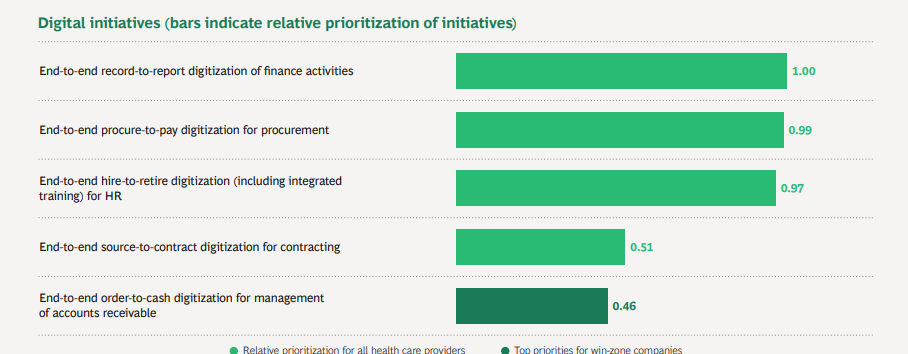

Health care providers’ digital priorities: Digital support functions

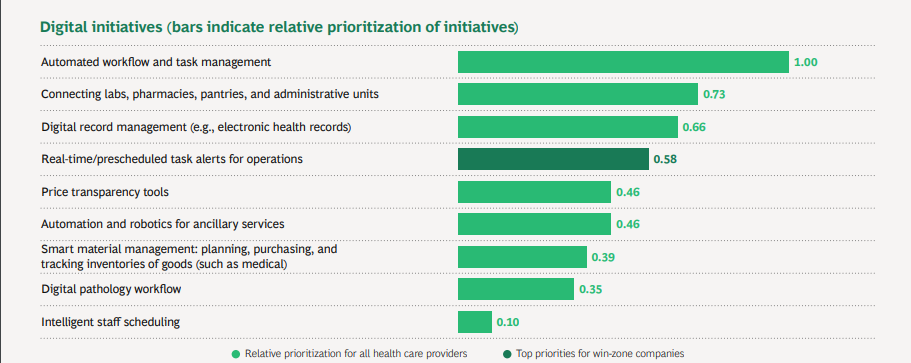

Health care providers’ digital priorities: Smart operations

Most Health Care Providers have low adoption and limited value creation in Digital Transformation — global survey

What is the Digital Adoption Index in Health Care Providers ? What are the plans for the future?

This is a republication of the article below, with the title above, highlighting the topic in question.

What the Data Tells Us About Digital Transformation, by Industry

JOHANNES THOMS, STEPHEN WADDELL, SANJAY SAXENA

June, 2022

Site version edited by:

Joaquim Cardoso MSc.

Health Revolution Institute

Digital Health Unit

June 29, 2022

What the Data Tells Us About Digital Transformation, by Industry

JUNE 29, 2022

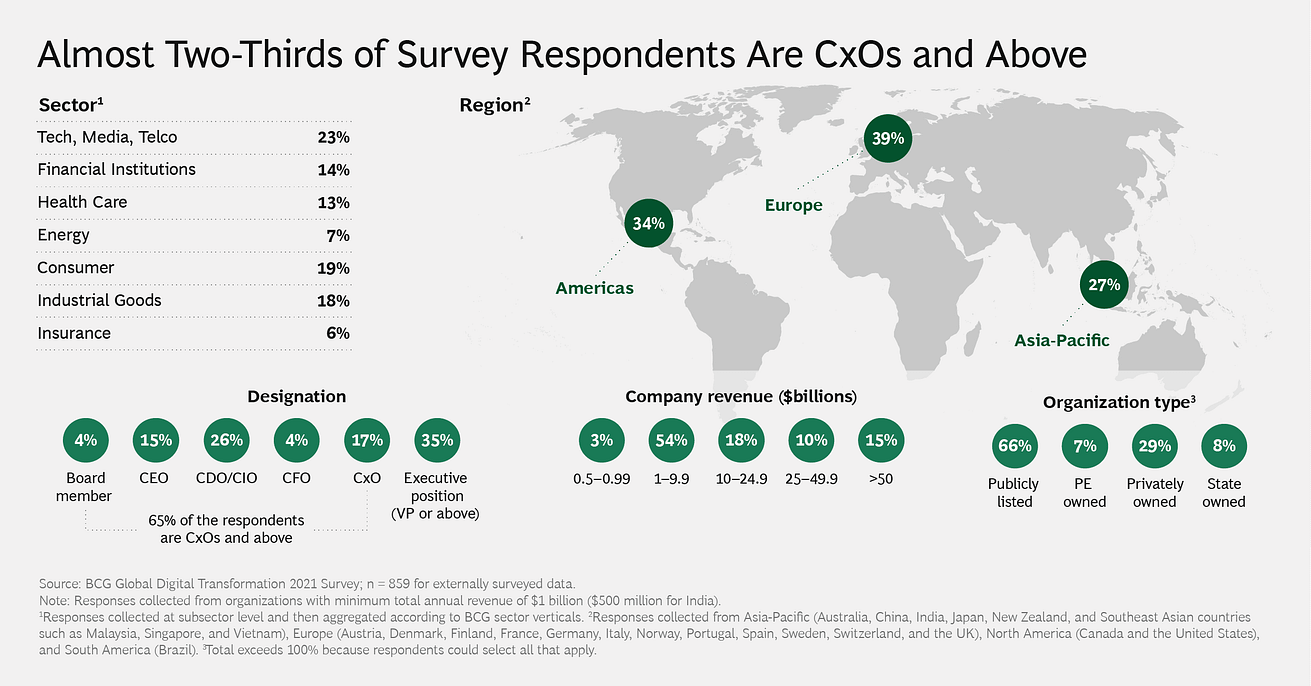

In our December 2021 report, Performance and Innovation Are the Rewards of Digital Transformation, we explored three questions that we hear a lot from clients.

- How are companies in my sector doing?

- Is there any proof that transformations deliver real results?

- And where are leaders focusing their transformation programs?

Our research into digital transformation success rates, goals, and priorities at more than 860 companies provided answers. (See “About Our Research.”) In the sector- and industry-specific slideshows below, we have broken those answers down to the industry level.

Each slideshow provides the following:

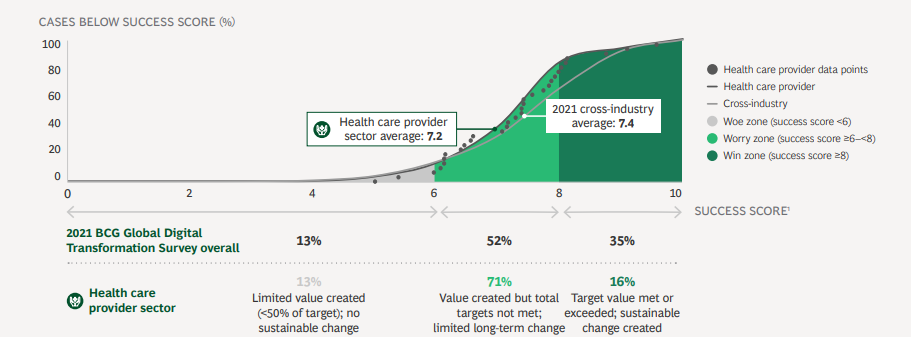

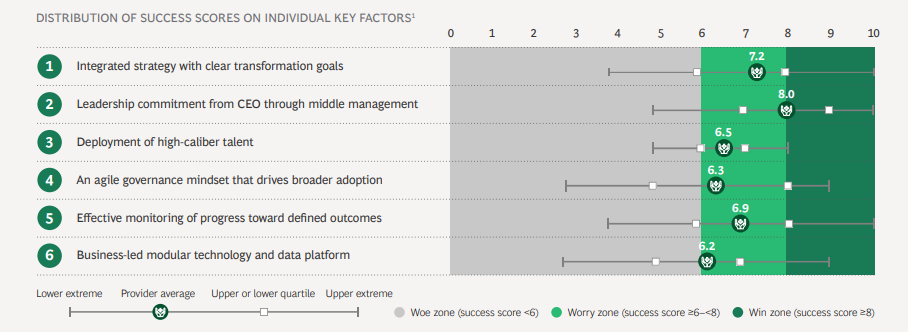

- Rates of Success. Overall, only about a third of transformations meet or exceed their target value and achieve sustainable change: these are the companies in the win zone. Worry-zone companies create some value but do not meet their targets and produce only limited long-term change. Companies in the woe zone create limited value and produce no sustainable change. See how each industry fares — and see how companies perform on the six success factors that our 2020 report, Flipping the Odds of Digital Transformation Success, identified as the keys to making transformations work.

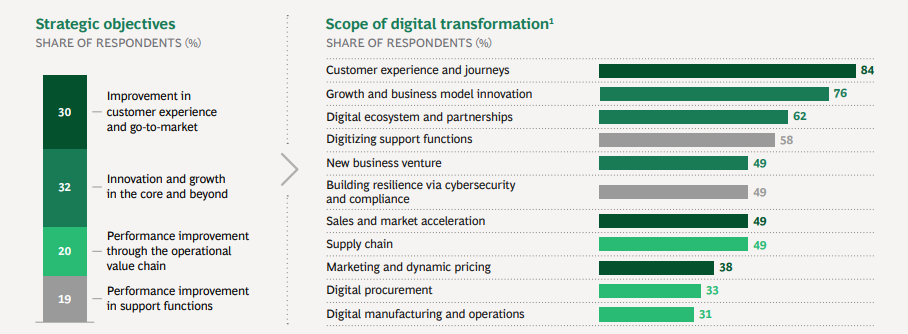

- Topics of Focus. The key areas of focus for digital transformation vary widely by industry and by company, both within and among four strategic objectives: improving customer experience and go-to-market, innovation and growth in the core and beyond, improving performance in the operational value chain, and performance improvement in support functions.

- Topics for the Future. Where do companies in each industry intend to invest for the digital future? Our data shows how companies are prioritizing their digital initiatives.

- Emphasis on Critical Human and Technology Enablers. Which human and technology enablers do companies see as most important to their future?

- Role of Environmental, Social, and Governmental (ESG) Issues. More than 60% of companies list ESG factors as a primary focus or a key criterion for selecting and prioritizing digital initiatives. Which industries are most active, and where are companies putting the emphasis among the E, S, and G?

We hope that you find this data helpful in assessing your own digital transformation efforts in the relevant industry or sector context.

The key findings for health care providers

- With only 16% of health care providers in the win zone, the sector

lags the cross-industry average success rate for digital

transformations by 50%. - The sector’s biggest areas of weakness are:

– modular tech and data platforms,

– agile governance, and

– deploying high-caliber talent. - Transformation priorities have included

– patient centricity and

– innovation (specifically, business model innovation and digital

ecosystems). - The priorities going forward, in order of importance and planned share of investment, are:

– digital care delivery and medical management,

– digital patient engagement,

– digital support functions, and

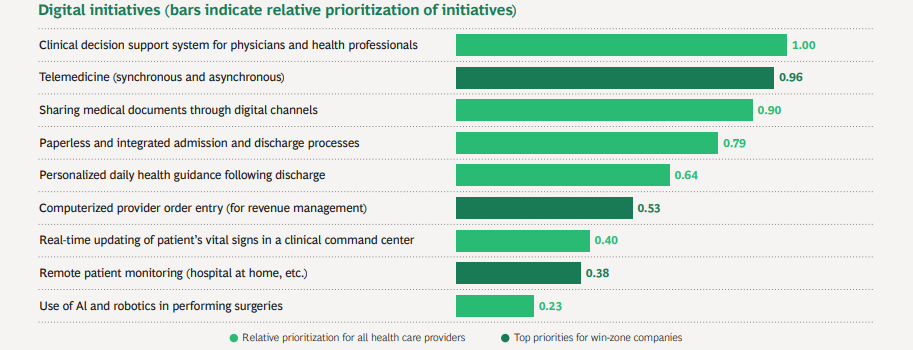

– smart operations. - Leaders are prioritizing

– telemedicine,

– making health knowledge available through digital channels,

– digitizing accounts receivable, and

– digitizing real-time and prescheduled task alerts for operations. - Health care providers emphasize the S and G in ESG;

– employee health and safety and

– protecting patient and employee data

are the sector’s top ESG digital priorities.

Only 16% of health care providers are in the win zone — less than half the cross-industry average, while the worry zone is 1.4 times larger

Providers struggle most with: business-led modular tech and data platforms, agile governance mindset, and deploying high-caliber talent

The transformation priorities for providers include: patient centricity and innovation (specifically, business model innovation and digital ecosystems)

All providers plan to allocate more than 60% of spending on care delivery and medical management and on consumer and patient engagement

Health care providers’ digital priorities: Care delivery and medical management

Health care providers’ digital priorities: Digital consumer and patient engagement

Health care providers’ digital priorities: Digital support functions

Health care providers’ digital priorities: Smart operations

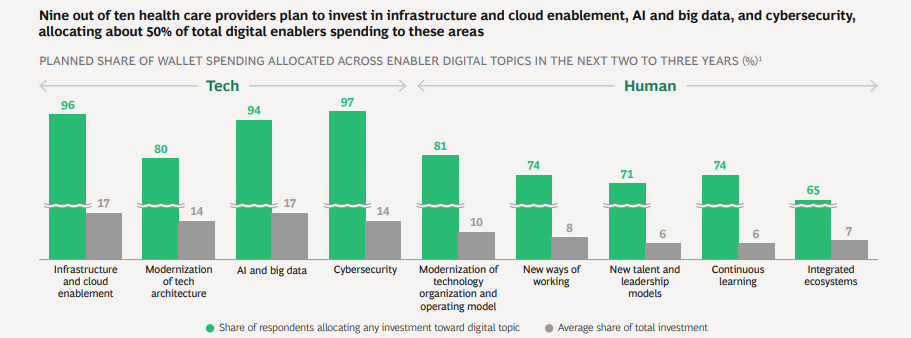

Health care provider companies intend to invest across a broad range of tech and human enablers, with especially strong emphasis on tech

About 86% of providers plan to increase ESG investments, above the cross-sector average — … with greater emphasis on S and G

Originally published at

https://www.bcg.com/publications/2022/digital-transformation-efforts-report

https://media-publications.bcg.com/BCG-HC-Providers-Digital-Transformation-by-Industry-June-2022.pdf