Racing to connect the whole house

CB Insights Research

March 8, 2022

Amazon

Since 1999, Amazon’s disruptive bravado has made “getting Amazoned” a fear for executives in any sector the tech giant sets its sights on. Here are the industries that could be under threat next.

Jeff Bezos once famously said, “Your margin is my opportunity.” Today, Amazon is finding opportunities in industries that would have been unthinkable for the company to attack even a few years ago.

Throughout the 2000s, Amazon’s e-commerce dominance paved a path of destruction through books, music, toys, sports, and a range of other retail verticals. Big box stores like Toys “R” Us, Sports Authority, and Barnes & Noble — some of which had thrived for more than a century — couldn’t compete with Amazon’s ability to combine uncommonly fast shipping with low prices.

Today, Amazon’s disruptive ambitions extend far beyond retail. With its expertise in complex supply chain logistics and competitive advantage in data collection, Amazon is attacking a whole host of new industries.

The tech giant has acquired a brick-and-mortar grocery chain, and it’s using its tech to simplify local delivery, such as machine vision-enabled assembly lines that can automatically sort ripe from unripe vegetables and fruit.

In June 2018, it acquired the online pharmacy service PillPack.

Now, it’s building out a nationwide network of pharmacy licenses and distribution with its Amazon Pharmacy product.

On its own Amazon Marketplace, the company is using its sales and forecasting data to offer de-risked loans to Amazon merchants at better interest rates than the average bank.

The tech giant saw a huge boost from the Covid-19 pandemic, as more consumers were shopping online and staying at home — Q3’20 profit hit $6.3B, up 200% from Q3’19. Although Q3’21 profits dipped to $3.2B, Amazon still has the spending power to tackle new industries.

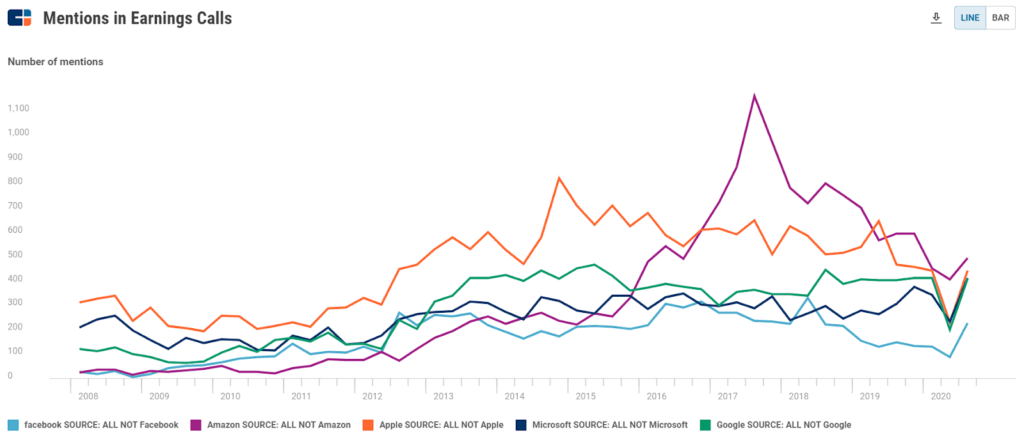

On calls with investors, executives of public American companies mentioned Amazon more often than they mentioned any other big tech company.

We researched the 5 industries where Amazon’s disruptive intentions are clearest today — pharmacies, small business lending, logistics, groceries, and payments — as well as 7 industries where Amazon’s efforts are more nascent.

The disruptive possibilities in these industries — home & garden, insurance, smart home, and luxury fashion — remain speculative for now, but with Amazon’s scale and advantages, they could soon be a reality.

Below, we lay out the case and the progress that Amazon has made thus far.

The 5 industries Amazon will disrupt in the next 5 years

- Pharmacies: Making drugs a low-margin commodity

- Small business lending: A direct, data-driven source of financing

- Fulfillment & delivery: Using the AWS model to create a new business line

- Online groceries and digitized stores: Changing the way customers grocery shop

- Payments: Giving small merchants a cheaper option

The 7 industries Amazon could go after next

- Insurance: Bundling value into the shopping experience

- Luxury goods and services: Bringing high fashion online and digitizing beauty salons

- Brick-and-mortar retail: Launching Amazon Style

- Smart home: Racing to connect the whole house

- Home & garden: Capitalizing on supply chain expertise

- Media & entertainment: Expanding into the gaming and audio markets

- Handcrafted goods: Amazon Handmade takes on Etsy

Amazon has significant ambitions in the smart home industry, though the market has been slow to take off and likely won’t become a full reality for years.

Amazon has long set its sights on dominating the smart home market, and launched its first smart home product — the Amazon Echo smart speaker — in 2014. Many competitors like Google Home or Sonos have gained traction since then, but Amazon still held 69% market share of the smart speaker market as of August 2021.

However, the smart speaker is only the start of a complete smart home.

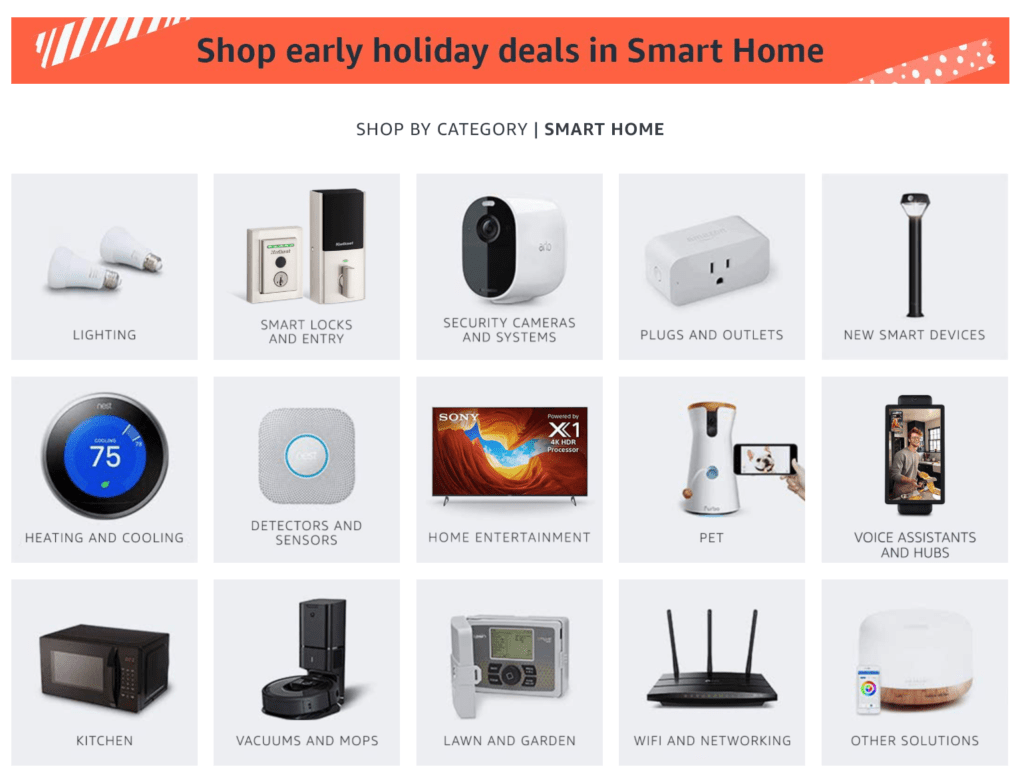

Smart houses bring connected devices into many aspects of home living, from heating to lighting to kitchen appliances. Since 2018, Amazon has been rolling out Amazon-branded smart devices that integrate the Alexa voice assistant capabilities, from microwaves to clocks.

Many smart home systems are not interoperable — in other words, they don’t work with other products from outside systems. Smaller, cheaper appliances and items — such as smart locks — allow Amazon to get customers more comfortable with Amazon-branded smart products while also ensuring that customers stay within the Amazon universe when looking to build out a connected home.

In 2018, the retailer partnered with Lennar, one of the largest home construction companies in the US. New Lennar homes offer built-in smart home capabilities powered by Alexa, from thermostats to doorbells.

Amazon has also invested in about 30 smart home-related deals through its Amazon Alexa Fund, and has acquired smart home companies including:

- Doorbell and smart camera startup Blink for $90M in 2017

- Connected doorbell Ring for $1B in 2018

- Wi-Fi mesh network startup Eero in February 2019

The number of smart home appliance users in the US is expected to more than double to reach 64M by 2025.

With these acquisitions, Amazon is preparing to win big as the market takes off.

Originally published at https://www.cbinsights.com.

TAGS: Smart Home