the health strategist

institute, portal & consulting

for workforce health & economic prosperity

Joaquim Cardoso MSc.

Servant Leader, Chief Research & Strategy Officer (CRSO),

Editor in Chief and Senior Advisor

January 10, 2024

This executive summary is based on the article “The AI premium: AI startups raise at much higher valuations”, published by CBInsights, on January 9, 2024.

What is the message?

AI startups have emerged as the darlings of venture capital, commanding significantly higher valuations compared to their non-AI counterparts.

The trend is evident across various funding rounds, indicating a robust investor appetite for companies leveraging artificial intelligence technologies.

ONE PAGE SUMMARY

What are the key points?

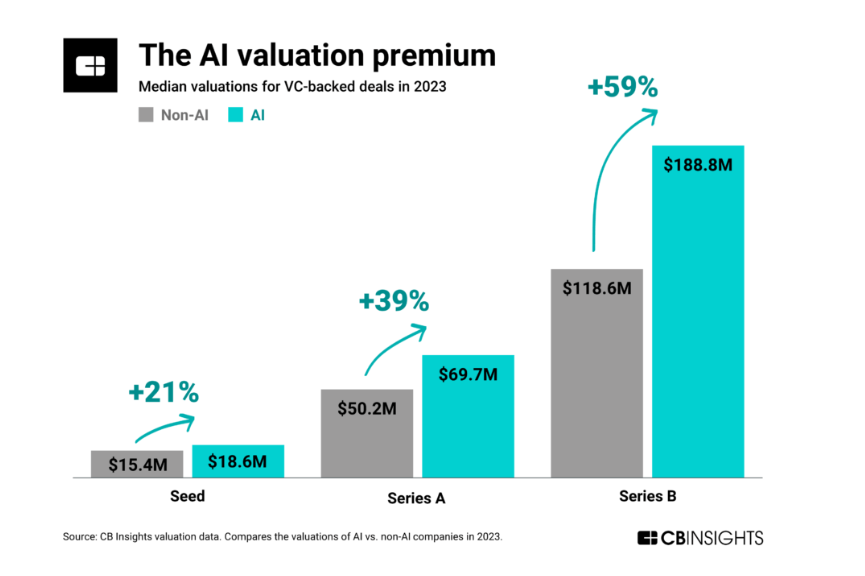

Valuation Disparity: Valuations for early-stage AI startups in 2023 were more than 20% higher than those of non-AI companies raising fresh funding. This premium persists into later stages, with Series B rounds for AI startups securing valuations over 1.5 times higher than their non-AI counterparts.

Generative AI’s Impact: Advances in AI, notably the rise of generative AI, have played a pivotal role in driving investor interest. The ability of AI technologies to create innovative solutions and enhance various industries has heightened their appeal in the startup landscape.

Corporate Embrace: Large corporations, especially in the tech sector, have shifted their focus to AI, contributing to the premium in AI startup valuations. The scramble among incumbents to harness AI’s potential has created a favorable environment for startups in this domain.

Decline in Funding: Despite the surge in interest, the overall funding to AI startups has experienced a decline since the peak in 2021. Total equity deals in 2023 reached their lowest point since 2017, mirroring a broader trend in the venture capital landscape.

Flight to Quality: The diminishing number of VC deals suggests a strategic shift, indicating an industry-wide “flight to quality.” In this scenario, AI startups that manage to capture investor attention benefit from heightened leverage, enabling them to negotiate better deal terms and secure higher valuations.

What are the key statistics?

Valuations for early-stage AI startups in 2023 were over 20% higher than non-AI counterparts.

Series B rounds for AI startups secured valuations over 1.5 times higher than non-AI counterparts.

Total equity deals to AI startups in 2023 declined to the lowest level since 2017.

What are the key examples?

Generative AI technologies contributing to the allure of AI startups.

Big tech corporations actively seeking to incorporate AI into their strategies, intensifying the competition for promising AI startups.

The decline in venture funding despite increased interest in AI across sectors, indicating a selective investment approach.

Conclusion

While the broader venture capital landscape witnesses a decline in funding activities, AI startups stand out as beneficiaries of an industry-wide shift towards quality over quantity.

The premium in valuations underscores the pivotal role AI plays in shaping the future, attracting investors despite a reduction in overall deal volumes.

AI’s continued influence, coupled with corporate enthusiasm, positions AI startups favorably in negotiations and funding rounds, solidifying their status as high-value entities in the startup ecosystem.

To read the original publication, click here.