With telehealth adoption and the rise of digital solutions for specialty and prescription drugs, it’s time for pharma companies to take the opportunity presented by the acceleration of digital health

BCG Digital Ventures, Oct 9, 2020

By Alex Baxter, André Heeg, Steve King, Amaryllis Liampoti, and Gunnar Trommer,

The COVID-19 pandemic has triggered a shift to digital across industries, with store closures and lockdown measures leading to a step change in how consumers buy products.

Online solutions that were just one channel in a multichannel mix before the pandemic are now integral to business.

This has led many companies to reconsider their e-commerce operations and to ask themselves what they can do to optimize for the new reality.

One area which has strong potential for new, accelerated e-commerce models is the pharmaceutical sector.

The increased adoption of telemedicine solutions combined with warming consumer sentiment towards online channels and a more sympathetic regulatory climate has presented a big opportunity for pharma companies willing to take a new look at how they sell their products.

End-to-end e-commerce solutions are a promising possibility in a world where consumers increasingly expect to be able to get what they need online.

This opportunity has so far been taken up by those offering generic drugs. Pharma companies should look to accelerate their e-commerce operations and offer their own branded products; doing so would not only benefit patients by providing them with the comprehensive digital experience the COVID-19 crisis has demonstrated an appetite for, it would also give the companies the means to take control and increase their margins, help them to understand patients through access to data, and give them a valuable advantage over competitors.

The Acceleration of Digital Health

With the onset of the COVID-19 crisis, consumers moved online.

The surge in e-commerce activity during pandemics is clear in the food and beverage industry.

- Just as SARS triggered an online shopping boom in China (Alibaba grew by over 50% in 2003), and

- the MERS pandemic marked a turning point for e-commerce grocery sales in the Republic of Korea (which now has the highest penetration of online grocery use globally),

- COVID-19 has triggered a surge in online grocery shopping.

In the United States, the downloads of the top three grocery shopping apps have increased by 100–200%, and in the United Kingdom, multiple retailers have had to place limits on online orders in order to to cope with the surge in traffic.

The healthcare sector is no exception to this trend.

The recent onset of global challenges has driven new forms of healthcare delivery, with a significant takeup of telehealth solutions.

A BCG study demonstrates how COVID-19 has accelerated telehealth adoption.

In the United States, there are additional factors that have driven the accelerated adoption of telehealth by physicians. These include

- laws ensuring on-par reimbursement with an in-person consultation,

- recent deregulation legislation at the federal level (adopted in April 2020

- and access to telehealth services for Medicare patients.

On the other side of the coin, healthcare providers have been more amenable to the use of telehealth services because of the assurances that they will receive comparable payments.

Another show of the increasing strength of telehealth offerings is the recent investment into the area: Earlier this year telehealth company Anwell raised $194m in funding for its series C round.

Beyond telehealth consultations, there has also been an uptick in remote care more generally, which includes issuing prescriptions and filling in scripts for medication.

A BCG patient sentiment survey indicated that 29% of patients viewed remote care as an important factor in selecting a provider, with 53% of patients viewing remote care options as ‘more important’ post-onset of COVID-19.

Mail order services are also bolstering remote care.

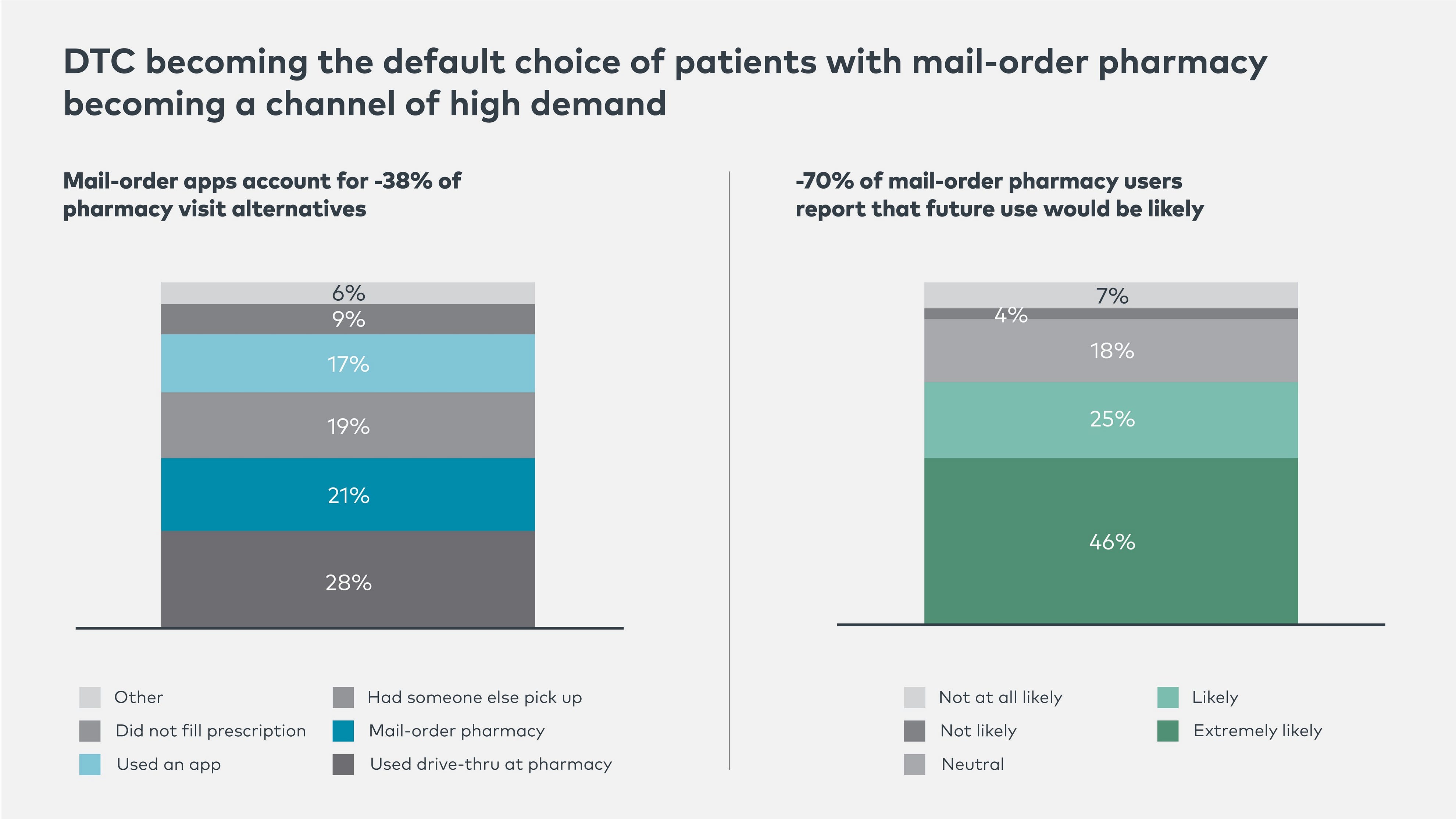

The data collated in BCG’s study indicates that direct-to-consumer (DTC) services are becoming the default choice for patients, with mail-order pharmacy channels in high demand.

- Mail order services and apps accounted for around 38% of the alternative channels to visiting a pharmacy in-person to fill a prescription,

- with approximately 70% of users reporting that they would likely use these services in the future (see data below).

This combination of an increase in telehealth and remote care uptake demonstrates that patients are ready to move a significant part of their medical care to digital channels.

Despite the clear patient appetite, outside of limited specialized offerings that offer generic drugs, full end-to-end experiences are limited.

Most current solutions are piecemeal:

- Telemedicine providers,

- prescription services,

- e-commerce platforms, and

- pharmacies

are separate entities, leading to an inefficient process and a subpar patient experience — and money left on the table by pharma companies who have the ability to bring the value chain together for their own and their patients’ benefit, while offering their own branded drugs.

There remains a significant opportunity to bring the entire value chain together for the benefit of the patient, partnering each element of the telehealth service in order to create an end-to-end e-commerce experience.

The Rise of End-to-End Platforms for Generics

While full end-to-end solutions are currently limited, some specialized areas have shown the potential for bringing the consumer value chain together, offering generic drugs through end-to-end e-commerce channels.

Specialized healthcare areas in which patients may value discretion, such as sexual health, women’s health services, mental health, and male pattern hair loss are a good example here.

Patients can access an app or website providing a one-stop-shop for their needs, from a doctor’s consultation and digital script, to mail-order medication delivered in discreet packaging.

- PillClub, SimpleHealth, nurx and hers are all women’s health offerings that provide birth control in the form of generic oral drugs (hers’ twin company hims provides sexual health services to men.)

- For mental health, services like Cerebral and Brightside provide generic scripts for antidepressant medications with strong brand recognition such as Prozac (Fluoxetine), Lexapro (Escitalopram), and Zoloft (Sertraline).

- In Europe, too, there are trends towards similar solutions; Spring is a German digital healthcare platform for men’s sexual health, similar to hims.

Recently, there have been signs of companies starting to widen their offerings after recognizing the potential for an end-to-end solution that goes beyond offering specialized treatments.

- Telehealth company Ro offers treatments for issues such as erectile dysfunction, hair loss, premature ejaculation, menopause, and smoking cessation,

- and now has an online pharmacy offering a wider range of generic drugs, widening the berth of its prescription service.

The success and growth of these solutions highlights the potential that end-to-end platforms could offer for pharma companies to offer their own solutions that carry their own branded drugs.

A patient may want a prescription for Viagra rather than Sidenafil given its well-known brand name as a solution for erectile dysfunction, or prefer a prescription for Lexapro as opposed to the generic Escitalopram to treat depression and/or anxiety issues.

An end-to-end service launched by a pharma company tying together the patient value chain and offering prescriptions for the branded drugs they produce would fill a gap that general pharmacies or specialized treatment providers cannot.

There is also potential for pharma companies to sell off-patent drugs through these end-to-end services, given their very high profit margins.

Last year, Pfizer announced plans to spin off its off-patent business UpJohn and merge with generic drugmaker Mylan to form one off-patent group with projected global annual revenues worth about $20 billion.

Patent protections also expire, and pharma companies frequently prepare to siphon off new launches of generic medications just as the so-called ‘patent cliff’ hits.

Whether for branded or off-patent drugs, building an end-to-end platform that puts the patient at the center presents a huge opportunity for pharma companies who execute effectively.

Building a Patient-Centric Solution to Unlock the Emerging Opportunity for the Pharma Industry

Regulation

Despite the clear opportunity for pharma companies to build their own end-to-end platforms and take advantage of the associated upside, there are several issues that have, historically, made it difficult to wade into this area.

Regulatory factors have played a part in slowing progress. Current regulatory considerations in Europe include compliance with EU healthcare directives and the wider regulatory environment. The recent adoption of the GDPR complicates the regulatory landscape for telemedicine and epharma in the EU, as companies will have to ensure that patient data is handled correctly.

In the US, HIPAA compliance also complicates the delivery of telehealth services; when Congress adopted the Health Insurance Portability and Accountability Act in 1996, it was with the aim of protecting patient records. HIPAA, however, complicates a patients’ ability to access their own health records and, for example, transfer providers. Electronic Medical Records (EMR) are used by doctors to store data, but are governed by a billing system rather than a patient care system (BCG Digital Ventures has written more extensively about the future of EMR and telemedicine here.)

However, these regulatory requirements are hurdles to be overcome in an environment which is trending towards patient-centricity. Notably, in the US, the Office of the National Coordinator for Health IT (ONC) adopted new federal rules around data sharing earlier this year, enabling patients to access their health information and share it with third-party apps. This in turn will help drive a growing patient-facing telemedicine economy with scope for e-pharma companies to capitalize on this trend. In Europe, steps have been taken to regulate e-prescription use across borders, with a 2011 EU Directive mandating that a prescription from an EU country must be recognized in other EU member states. The eHealth Action Plan is an ambitious, high-level document providing a roadmap for ‘digitizing’ healthcare in the EU. These initiatives demonstrate the opening up of the regulatory environment, clearing the path for patient-centered innovation.

Building an End-to-End Solution

The key challenge comes in building the solution itself.

Pharma companies have, in the past, delegated key areas of the customer journey to other parties because they lie outside their areas of expertise and require familiarity with multiple areas across a disparate value chain.

In order to be successful, an end-to-end solution would have to encompass not only telehealth, distribution, and prescription, but also digital marketing, digital experience, ecosystems and partnerships, and omnichannel capabilities.

It is now easier than ever to overcome this complexity.

As demonstrated by some of the newer generics and specialist end-to-end platforms, it’s now possible to build an effective end-to-end platform using a series of building blocks, extending over every step of the value chain. The traditional model involved pharma companies taking responsibility for manufacturing before handing their products off for marketing, prescription, and patient or insurer payment. With new e-commerce solutions, digital marketing platforms and backend tools, a fully integrated patient solution can be provided by pharma companies, from manufacture to payment and distribution. We’ve seen many examples of this from consumer industries, with companies who used to hand off their retail operations to distributors taking active ownership of the customer journey. While there are similarities to traditional DTC e-commerce offerings, there are also key differences that need to be taken into account.

For over-the-counter drugs, the e-commerce consumer journey is fairly similar to other areas.

In the US (not in Europe), the manufacturer is able to move to direct marketing and online sales, intended to accelerate demand generation through e-commerce-specific ad units. This includes Google Product Listings Ads and Local Inventory Ads, and marketplaces where the company establishes and executes on selling relationships with players such as Amazon, Walmart and eBay.

The primary difference with other sectors is compliance: OTC drugs must meet required standards in terms of advertising key information (expiration date, product calls, abuse risks etc.) Once these standards are met, OTC drugs can be marketed directly to the consumer, with the pharma company capturing direct payments and creating fulfillment and delivery capabilities. In Europe, the direct marketing of drugs is not permitted.

For Rx drugs, the process requires partnering with licensed healthcare providers who can prescribe drugs.

This would ideally be tied into a telehealth component either owned by the pharma company or provided by a third party.

Digital marketing is not necessary in the classic e-commerce sense, as consumers come to their prescribed drugs through the guidance of a healthcare practitioner.

The payment layer also differs, with traditional insurance companies factored in alongside direct payment. It should be noted that there are some complications around physician interaction here that will need to be addressed, with physicians likely to be less open to prescribing drugs through a direct platform, thereby limiting their existing channels. For more on how pharma sales to doctors have changed (and continue to change) due to the COVID-19 pandemic, see BCG’s report What Doctors Want and What This Means for Biopharma Now.

A further question arises around whether the entire process can be managed virtually, or whether in-person steps are required.

Steps associated with physicians, such as blood tests, should be accommodated, and capabilities such as mail-order or drive-through testing (an area which is developing rapidly in response to the COVID-19 pandemic) can be factored into the end-to-end patient journey. With increasing uptake of digital health, these capabilities will be expanded further in the future.

To truly unlock the potential their solution offers, ‘no regret’ investments should be made very early on in the process.

Advanced analytics and a personalized omnichannel experience provide a means to begin reaching patients directly.

This helps companies to gain a comprehensive understanding of patient behavior in order to deliver a personalized experience, which can then be tied to a comprehensive e-commerce offering and used as a strong foundation for continuous engagement.

These projects can be approached through the inception of flagship projects or ventures, which later expand.

In all cases, pharma companies would be required to develop capabilities around fulfillment. These can be built up through third-party logistics and fulfilment providers, who handle ‘pick, pack, and ship’ functions.

Looking at the issue with a 360-degree perspective grants companies the opportunity to set themselves up for success.

There are ten enablers that need to be addressed in order to navigate the building of an end-to-end solution with confidence, ranging from e-commerce strategy to patient experience and provider enablement. The figure below outlines the enablers required to build a successful solution.

A Clear Path

For companies with potential in this area there is a clear path, using a modular approach, to tie together the entire pharma value chain and reap the benefits of higher margins, a deeper understanding of patient data, and clear channel advantages over competitors who persist with the manufacture-only model.

Further benefits would be a strategic advantage for branded drugs through increased patient adoption of a more seamless solution and the ability to deleverage from analog sales channels to a digital future (we have already seen how doctors have moved their interactions with pharma companies to virtual channels.) Pharma companies who choose this path will, with the right approach and guidance, be looking at a bright future.

Originally published at https://medium.com on November 13, 2020.