CAPS Research, BCG

Bryan Fuller, Geoff Zwemke, Daniel Weise, Alex Dolya, Chitt Jha

May 2022

The Future of Supply Chain Management

Every five years, the Center for Advanced Procurement Strategy (CAPS), a joint initiative of the Institute for Supply Management (ISM) and Arizona State University, conducts a global survey of practicing supply chain executives and knowledge experts, asking about the challenges they expect to face and their strategies and performance goals in the coming years.

For the 2021 survey, CAPS worked with BCG to query 157 supply management leaders across industry segments, including discrete manufacturing, process manufacturing, and service industries.

We gained their insights on a host of important topics, including:

- Supply chain market dynamics

- Cost savings and efficiency

- Risk and resilience

- Environmental, social, and governance (ESG) regulations and initiatives

- Supplier management

- Supply chain operations

- Human resources

- Technology

Key Insights from Procurement and Supply Chain Leaders

Two trends in the new survey stand out.

First, fulfilling environmental, social, and corporate governance (ESG) goals has assumed paramount importance.

The second notable trend is a greater emphasis on achieving resilience in the face of unpredictable raw materials shortages and logistical challenges, which were greatly exacerbated by the pandemic.

Two trends in the new survey stand out: (1) fulfilling environmental, social, and corporate governance (ESG) goals ; (2) … a greater emphasis on achieving resilience

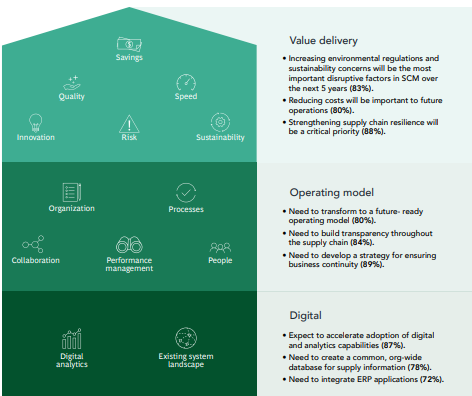

The schematic below summarizes some of the survey’s most important findings.

Summary Figure: Highlights from the 2021–2025 CAPS and BCG global survey of procurement leaders

ZOOM VIEW

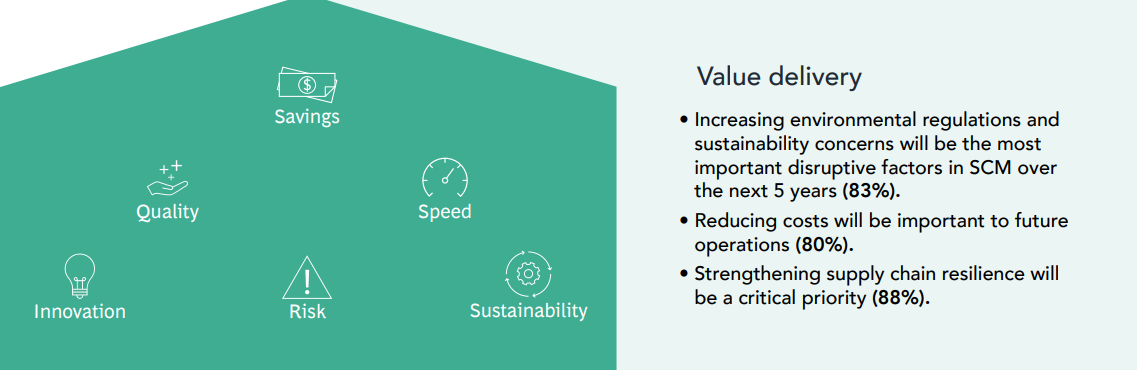

Value delivery

- Increasing environmental regulations and sustainability concerns will be the most important disruptive factors in SCM over the next 5 years (83%).

- Reducing costs will be important to future operations (80%).

- Strengthening supply chain resilience will be a critical priority (88%).

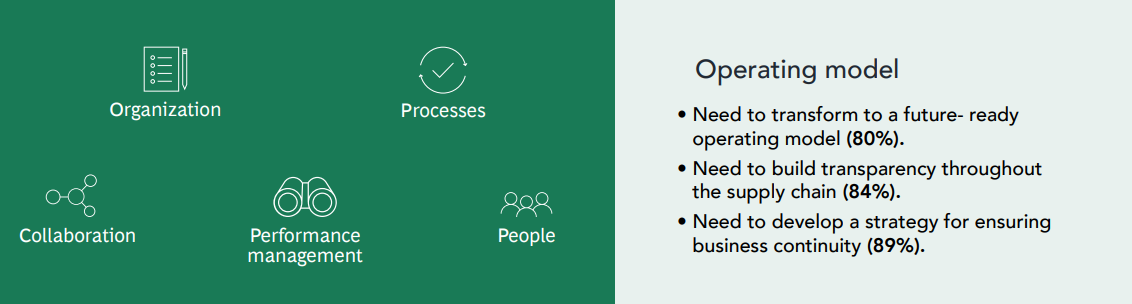

Operating model

- Need to transform to a future- ready operating model (80%).

- Need to build transparency throughout the supply chain (84%).

- Need to develop a strategy for ensuring business continuity (89%).

Digital

- Expect to accelerate adoption of digital and analytics capabilities (87%).

- Need to create a common, org-wide database for supply information (78%).

- Need to integrate ERP applications (72%).

“Going forward, CPOs will need to constantly balance tradeoffs between sustainability, resilience and cost.

CPO KPIs and capabilities will need to evolve respectively to reflect all these priorities. This will be the most challenging task for the next five years,” — Alex Dolya

CPOs need also to rethink through their approach to suppliers, given their need to balance priorities.

If in the past, cost savings were primary objective of supplier engagement, today CPOs need to ensure that suppliers can deliver in the face of decarbonization, supply resilience and cost competitiveness.

Getting the equation right could prove tricky.

CPOs need also to rethink through their approach to suppliers, given their need to balance priorities. Getting the equation right could prove tricky.

Structure of the report

· The Future of Supply Chain Management

· Key Insights from Procurement and Supply Chain Leaders

· The Rising Importance of Sustainability

· The Need to Improve Supply Chain Resilience

· Sustainability and Resilience Top Cost Concerns

· 2021 vs. 2016: Different Change Drivers, Different Strategies

· Upgrading Supply Chain Technology

· Looking Forward

DETAILED REPORT (full version)

The Rising Importance of Sustainability

The vast majority of respondents across industry segments believe increasing environmental regulations and growing sustainability concerns will be the most important disruptive factors in supply chain management over the next five years. Other experts agree.

“At ISM®, we’re also seeing and hearing about the continued focus on sustainability and ESG. It’s a driver for decisions about business, suppliers, and talent as companies set themselves up for successful future operations.” — Tom Derry

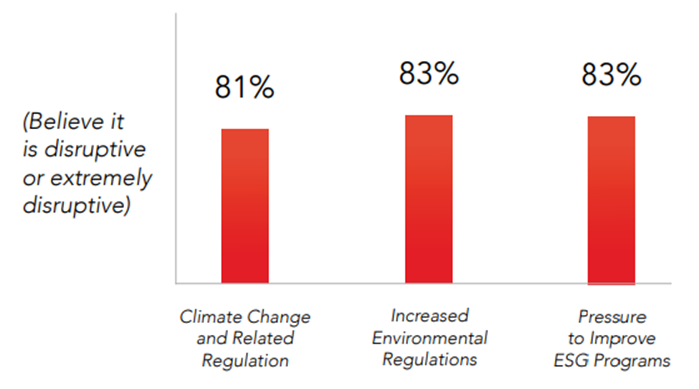

Over 80% of respondents expect to see climate change and pressure to improve their ESG profiles driving an increase in regulations, which will have a strong disruptive impact on their operations (Figure 1).

Figure 1: Supply chain executives foresee extreme disruption to their operations due to increasing environmental regulations and sustainability concerns

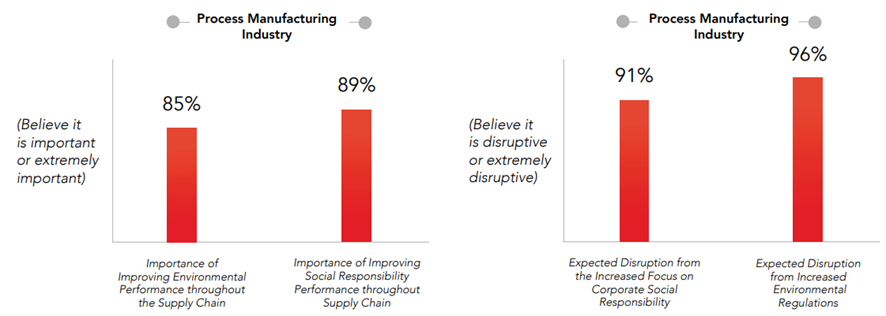

Among industry segments, process manufacturers place the greatest emphasis on improving sustainability and social responsibility performance — and they also expect to experience the most disruption from doing so (Figure 2).

Figure 2: Process industry leaders place the highest value on achieving social and environmental goals — and expect to experience the most disruption from pursuing them.

It’s important to note that environmental-related disruption, while it may require operational changes causing initial stress, can also result in positive outcomes.

When BCG analyzed 500 companies and interviewed 50 supply chain leaders for the 2020 report “Your Supply Chain Needs a Sustainability Strategy ,” we found that over time, improving environmental performance can help companies significantly boost business results.

There are several reasons for this.

While sustainable processes and materials are more expensive, environmental commitments enhance a brand’s reputation. Our research found that many consumers are willing to pay a premium to purchase sustainable products.

Environmentally-friendly companies are also better positioned to attract talent in today’s highly competitive market.

A greener profile will make companies more attractive to investors in general, and is essential for those focused on ESG objectives.

Firms that can demonstrate a clear commitment to sustainability are gaining access to more investor resources, speeding growth and innovation.

The Need to Improve Supply Chain Resilience

The pandemic made companies painfully aware that they need to bolster their resilience in the face of unexpected changes.

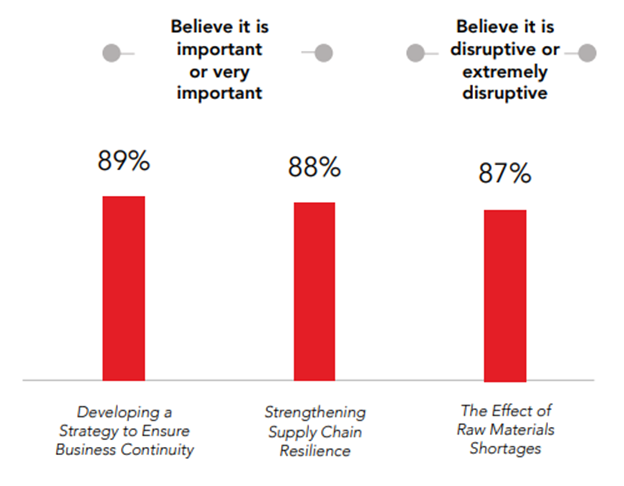

- In the survey, 88% of respondents said making the supply chain more resilient will be a critical priority in the coming years.

- Nearly 60% expect periodic shortages of raw materials to occur, and 87% believe these shortages will be extremely disruptive to operations.

- An overwhelming majority of respondents emphasized the importance of business continuity. To achieve it, 88% said that supply chain resilience needs to be strengthened (Figure 3).

An overwhelming majority of respondents emphasized the importance of business continuity. To achieve it, 88% said that supply chain resilience needs to be strengthened

Figure 3: Disruptions and the importance of developing supply chain resilience and business continuity

“Through numerous rounds of ISM® research on pandemic supply chain impacts, the need for resilience, risk management and agility became highly visible and critical for supply chain teams.

Organizations are tasked with ensuring minimal disruption to the continuity of resources, and that now requires a resilient approach.” — Tom Derry — CEO of the Institute for Supply Management® (ISM)

To achieve greater resilience, companies will need to make changes to their processes, including improving their communications.

- Nearly all of the survey respondents (95%) agree that building better relationships and fostering collaboration among supply chain partners will be essential to success.

- Respondents also say gaining better Tier-N visibility into supplier operations will improve their response to disruptions, and

- 78% say better sharing of knowledge within and among departments will help them align their goals and deal with problems faster.

Companies cited the importance of carrying excess stock in case of emergencies and strengthening cybersecurity measures to prevent disruptive attacks.

BCG research has found that resilient companies experience less impact than others when a shock occurs, and they also recover faster. That ultimately strengthens the bottom line.

A recent BCG report, “Transform for Resilience: An Imperative for Good Times Too ,“ found that two-thirds of companies designated as long-term high performers were able to handle shocks better than their peers.

Sustainability and Resilience Top Cost Concerns

Lowering costs and improving margins have always been key goals for supply chain managers.

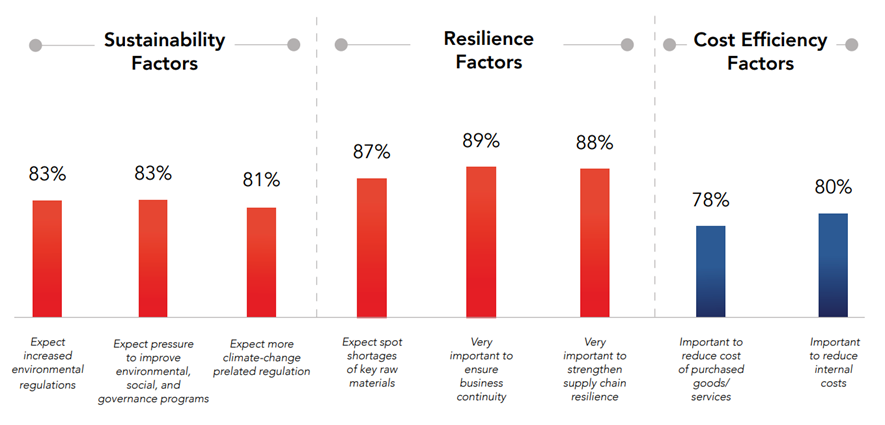

But while they remain important, this year’s survey shows they have been displaced in the hierarchy of concerns by environmental sustainability and resilience considerations (Figure 4).

Figure 4: The comparative importance of sustainability, resilience, and cost efficiency factors in supply chain operations

These responses are consistent with feedback from BCG’s recent engagements with supply chain executives.

As inflation pushes up prices for both raw materials and labor, executives say they would like to contain these cost increases to the extent that they can, but they are more focused on sustainability and resilience than they are on seeking further cost reductions.

As inflation pushes up prices for both raw materials and labor, executives say they would like to contain these cost increases to the extent that they can, but they are more focused on sustainability and resilience than they are on seeking further cost reductions.

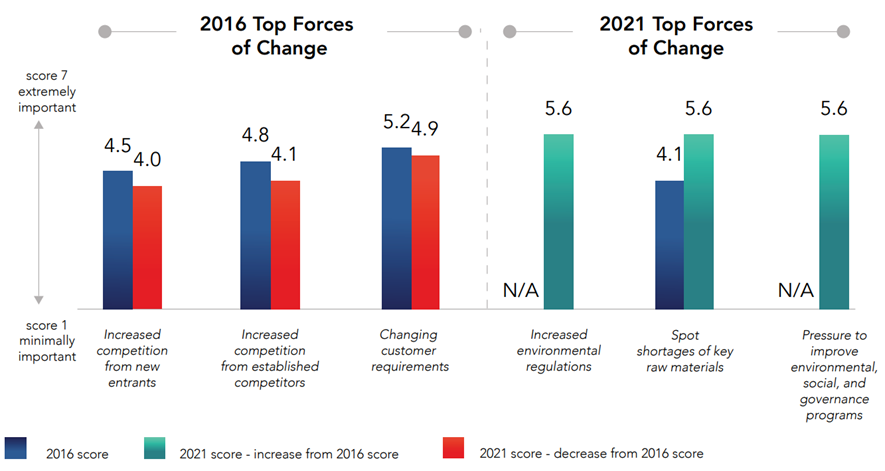

2021 vs. 2016: Different Change Drivers, Different Strategies

Survey dimensions have evolved since last edition of this survey in 2016, in line with the changing dynamics of the supply chain world.

We have added new categories for sustainability and resilience, reflecting manufacturers’ growing concerns about these issues.

Over the past few years, managers focused on removing redundancies in the supply chain to lower costs, but the pandemic made them realize they had taken these measures too far, and they needed to balance their business model by improving supply chain security and resilience.

Because companies are more focused on these new areas, they are less concerned about other factors, such as searching for ways to beat the offerings of new and existing competitors (Figure 5).

Figure 5: Worries about competition have diminished as other concerns have become top of mind

Ensuring business continuity has gained importance, aligning with the new focus on resilience.

In addition, companies say accelerating the adoption of digital process and analytics — another new category — will be extremely important in the years ahead.

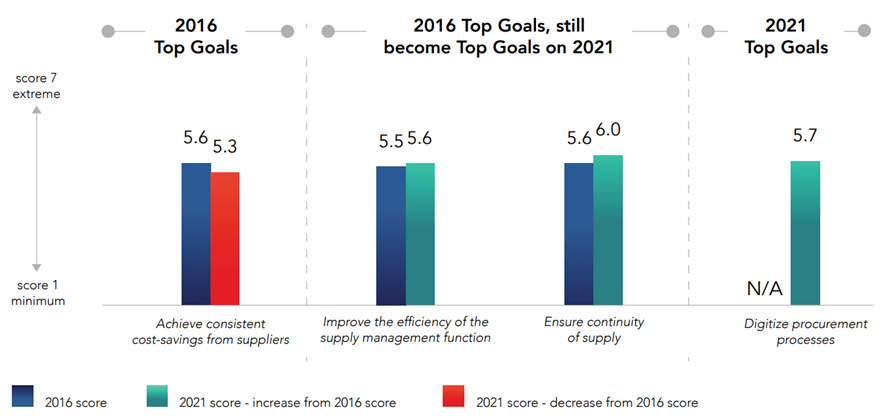

Aligning with the shift in business strategies, cost savings is not the top supply chain goal for 2021–2025. However, respondents still see the importance of improving efficiency.

As mentioned above, concerns about costs, though still important, have receded in the face of new initiatives. Boosting resilience, in particular, requires a tradeoff on costs. This is reflected by a shift in companies’ top goals (Figure 6).

Figure 6: Top supply goals and performance expectations, 2016 vs. 2021

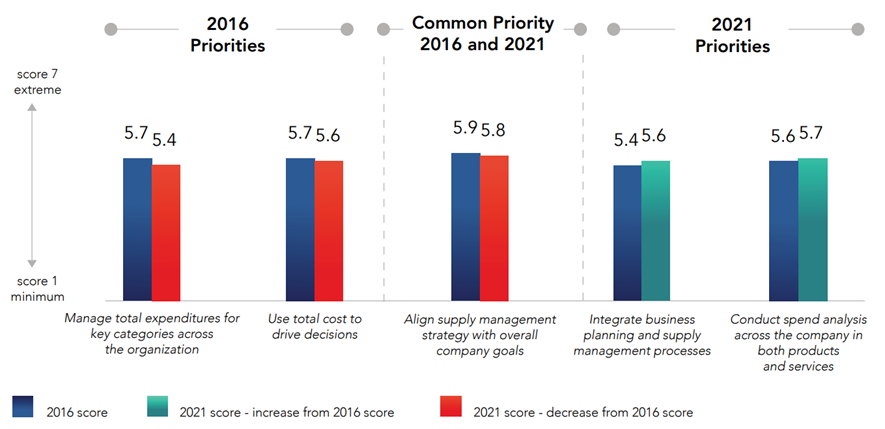

Respondents in both surveys were asked how they intended to achieve their goals, listing specific strategies and processes they planned to adopt to facilitate progress.

Here again, we see a trend of less reliance on cost reduction measures and more emphasis on better integrating plans.

There is also a slightly higher emphasis in 2021 on analyzing spending for products and services.

This may reflect the new focus on analytics as much as it does the continuing need to monitor expenses (Figure 7).

Figure 7: Top priority supply strategies, processes, and goal enablers, 2016 vs. 2021

Upgrading Supply Chain Technology

Supply chain executives believe adopting digital processes and analytics are critical initiatives going forward.

While the vast majority of respondents are eager to embrace new technologies that enable them to share information more easily and become more transparent and efficient, the survey found that process manufacturers and service companies have a more technology-forward bent than discrete manufacturers.

For example, when asked about transforming to a future-ready operating model, 83% of process manufacturing executives and 80% of service executives said doing so is extremely important, compared with 78% of overall respondents.

While the vast majority of respondents are eager to embrace new technologies that enable them to share information more easily and become more transparent and efficient …

Executives are also keen to increase the use of analytics, which will help them discover trends and make predictions about their own operations and those of their partners — information they can use to improve efficiency and eliminate bottlenecks.

Executives are also keen to increase the use of analytics, which will help them discover trends and make predictions about their own operations and those of their partners — information they can use to improve efficiency and eliminate bottlenecks.

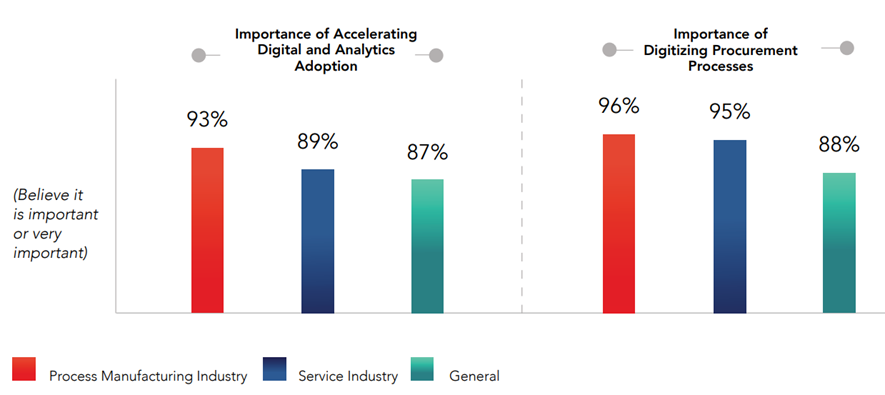

Accelerating digital and analytics adoption was listed as a high priority by 93% of process manufacturers, 89% of service companies, and 87% of overall respondents.

Service companies and process manufacturers placed an even higher value on digitizing the procurement process, with over 95% saying it’s extremely important to do so (Figure 8).

Accelerating digital and analytics adoption was listed as a high priority …Service companies and process manufacturers placed an even higher value on digitizing the procurement process …

Figure 8: The drive to adopt analytics and digital processes

Respondents across the board emphasized the importance of better information sharing, …

with 78% overall and 80% of process manufacturing executives citing the importance of creating a common, organization-wide database for supply information.

Sharing market intelligence across business units also got high marks.

Respondents across the board emphasized the importance of better information sharing, … executives citing the importance of creating a common, organization-wide database for supply information.

Sharing market intelligence across business units also got high marks.

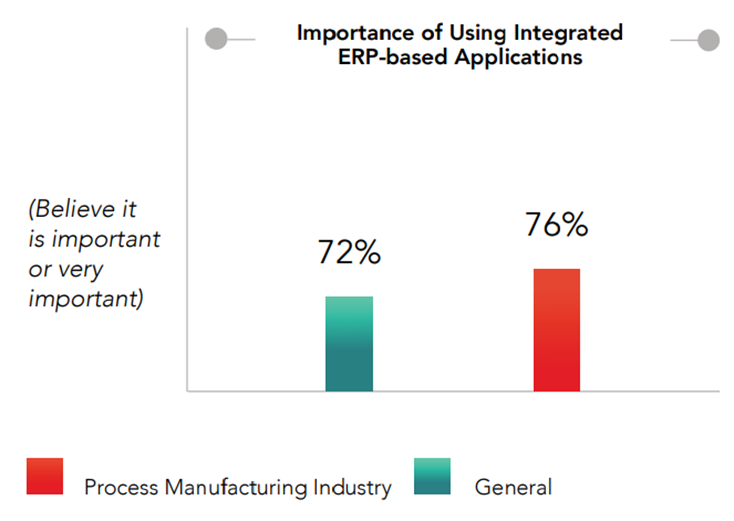

In addition, executives expressed a strong interest in better integrating their technology.

That was especially true for process manufacturers — nearly three-fourths said they believe it’s extremely important to use integrated ERP-based applications for supply management. Seventy-two percent of all respondents agreed (Figure 9).

In addition, executives expressed a strong interest in better integrating their technology.

… saying it’s extremely important to use integrated ERP-based applications for supply management

Figure 9: The use of ERP-based applications for supply management

Increased virtual and digital management of suppliers

Eighty percent of service companies, which have widely adopted digital technology to increase efficiency in recent years, are strongly in favor of increased virtual and digital management of suppliers, and nearly three-quarters of overall respondents agree.

Transfer IT services to the cloud

Service companies are also more likely to transfer IT services to the cloud, where many are already reaping the benefits of digital applications.

Acquiring new technologies as long as they supply clear economic value.

Companies are also interested in acquiring new technologies as long as they supply clear economic value. Over 80% cited developing new value-added technology as an extremely important goal.

Main technology interests are: (1) Increased virtual and digital management of suppliers; (2) Transfer IT services to the cloud; and (3) Acquiring new technologies as long as they supply clear economic value.

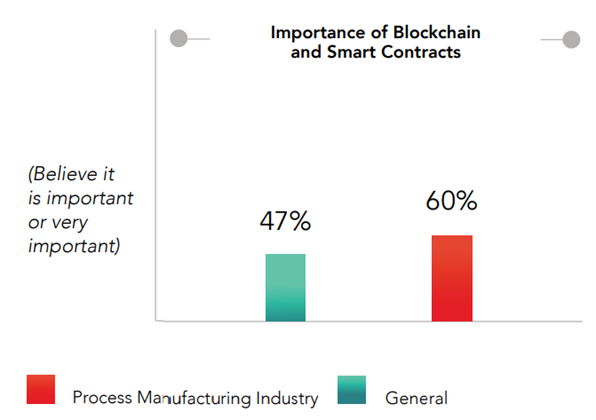

Cutting-edge technologies like blockchain could be an interesting development to watch for.

More than half of respondents — especially in the service industry — are intrigued by the prospect of managing unalterable, smart contracts on the blockchain (Figure 10).

Figure 10: The importance of blockchain and smart contracts

While it may take some time to gain widespread adoption, a blockchain initiative fits nicely with the existing high-priority goal, cited by 84% of respondents, of building transparency throughout the supply chain.

Looking Forward

Supply chain executives face some serious challenges in the years ahead.

Worries about burgeoning environmental regulations, as well as investor and consumer expectations for pursuing ESG initiatives, are taking center stage at a time when companies are also under pressure to boost their resilience and modernize their technology stacks.

“Today’s procurement teams must provide multi-dimensional value. In addition to keeping costs down, they ensure sustainability, speed, quality, innovation, and risk control.” — Daniel Weise

Achieving these goals will be no easy task, but because they are also key objectives for the C-suite, pursuing them will elevate the role of supply chain managers.

It will also bring elevated expectations.

“Over the next five years, the supply management function will continue to expand its role in the company and align more closely with corporate objectives. Supply executives will be expected to leverage emerging technologies and advanced analytics.”

Mastering these technologies in the coming years could become the key to success, Fuller believes.

“Those who are able to successfully implement the right technologies will be able to accelerate operational efficiency, minimize third party risks, increase transparency, and above all, ensure that ESG objectives are embedded in all levels of the supply chain.” — Bryan Fuller

Appendix: Methodology

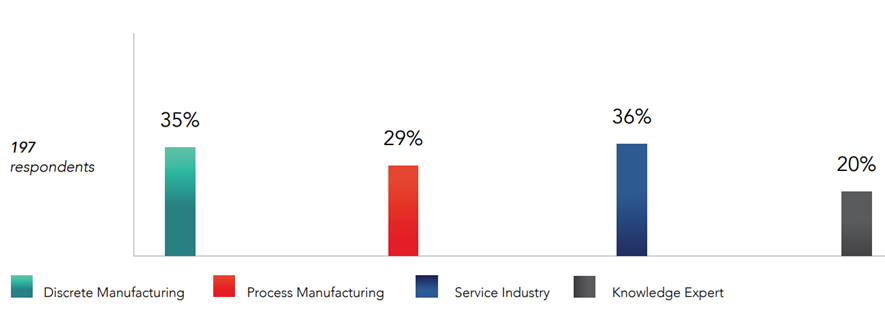

The CAPS Research survey was conducted in Q4 2021. It obtained responses from a total of 197 supply management professionals, including 157 practicing supply management leaders across industry segments and 40 knowledge experts.

Supply chain managers from discrete manufacturing, process manufacturing, and services Industries were all represented in the survey (Figure 11).

Figure 11: Respondent Demographics

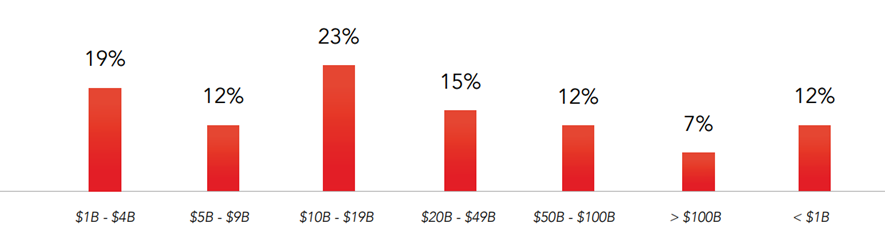

The business practitioner respondents come from companies with an operating and marketing presence around the world. The Revenue ranges from under $1 billion to more than $100 billion (Figure 12).

Figure 12: Respondents’ company revenue profile

Report Authors

Bryan Fuller

Senior Director, Procurement, Solidigm, Former Executive Director, CAPS Research

Geoff Zwemke

Director of Product, CAPS Research

Daniel Weise

Managing Director and Partner, BCG, Global Leader for BCG Procurement Practice, CEO of Inverto

Alex Dolya

Managing Director and Partner, BCG, Asia Pacific Leader for BCG Procurement Practice, Global Leader for Procurement and SCM in Energy and Mining, BCG

Chitt Jha

Partner and Associate Director, BCG, BCG Global Expert on Procurement Resilience, Sustainability, and Digital

Originally published at CAPS Research.