the health strategist

platform

the most compreehensive knowledge portal

for continuous health transformation

and digital health- for all

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

December 5, 2023

What is the message?

The article emphasizes that many existing climate technologies can significantly contribute to deep decarbonization, but the key challenge lies in accelerating innovation and scaling them up to achieve both technical and commercial breakthroughs.

The authors argue that 12 categories of climate technologies, if scaled collectively, could potentially reduce up to 90 percent of total man-made greenhouse gas emissions.

However, the maturity levels of these technologies vary, with only 10 percent being commercially competitive. To achieve climate goals, there is a need for sustained growth in climate tech investments, reaching approximately $2 trillion by 2030, equivalent to about 1 to 2 percent of global GDP.

What are the key points?

Existing Technologies and Accelerating Deployment:

- The deployment of mature climate technologies has accelerated in the past decade, outpacing expectations.

- 12 categories of climate technologies could potentially reduce up to 90 percent of total man-made greenhouse gas emissions if scaled collectively.

- The interdependency among these technologies is high, requiring them to scale together.

Maturity Levels of Climate Technologies:

- Only 10 percent of climate technologies are commercially competitive, while 45 percent are commercially available but require further cost reductions through innovation and scale-up.

- The remaining technologies hold promise but are in earlier stages of development.

Scaling Challenges and Investment Needs:

- Climate tech investments need to grow by about 10 percent each year, reaching approximately $2 trillion by 2030 to spur innovation and reduce costs.

- Achieving technical readiness and commercial maturity is crucial for scaling critical climate technologies.

Technology Categories and Maturity Levels:

- The 12 categories include batteries, carbon capture, circular technologies, energy storage, and more, each with varying maturity levels.

- Renewable energies are crucial but insufficient on their own to achieve net-zero goals.

Historical Growth and Forecast:

- Climate technologies, especially renewables like solar, wind, and batteries, have consistently outpaced forecasts over the past decade.

- Renewables and batteries need to sustain high growth rates to achieve 2050 climate targets.

Cost Reduction Trajectory:

- Cost reductions are crucial for commercially viable scale-up by 2030.

- Renewables and battery electric vehicles are on track to achieve cost parity by 2030 in many countries.

Scaling Historical Patterns:

- Historical patterns show that a twofold to eightfold reduction in costs is achieved for every 100-fold increase in deployment of climate technologies.

Challenges and Solutions for Scaling:

- Overcoming challenges such as creating at-scale supply chains, effective capital reallocation, and addressing system-level bottlenecks is crucial for scaling critical climate technologies.

- Infrastructure, financing structures, and overcoming resource constraints are keys to overcoming scaling challenges.

Physical Constraints and Solutions:

- Challenges related to infrastructure, permitting, land, water, raw materials, and labor need to be addressed for rapid acceleration.

- Acknowledging trade-offs, fostering innovation, and exploring alternatives are suggested solutions.

Critical Questions for Stakeholders:

- The article concludes by posing critical questions for companies, investors, and governments regarding cost reduction targets, sustainable financing for higher-risk technologies, and legislation to support innovation and deployment.

- The full report, planned for 2024, is expected to provide more detailed analysis and implications for stakeholders.

DEEP DIVE

Preview: What would it take to scale critical climate technologies?

McKinsey

Bernd Heid, Martin Linder, Sebastian Mayer, Anna Orthofer, and Mark Patel

December 1, 2023

Many of the climate technologies needed to achieve deep decarbonization already exist. The challenge now is accelerating innovation and scale-up to achieve technical and commercial breakthroughs.

The deployment of mature climate technologies that avoid, reduce, or capture emissions and can replace carbon-intensive incumbent technologies has accelerated significantly in the past decade, often outpacing expectations. Scaling of these climate technologies is now more critical than ever as countries seek to reach climate goals of limiting global warming to well under 2°C above preindustrial levels, a goal that 196 nations committed to in the legally binding 2015 Paris Agreement on climate change.

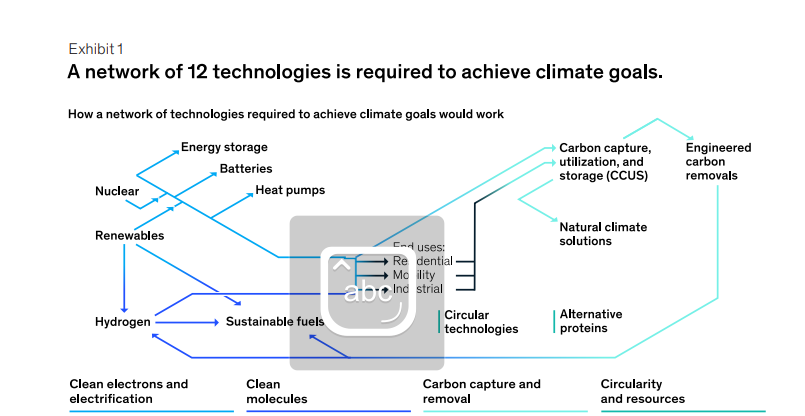

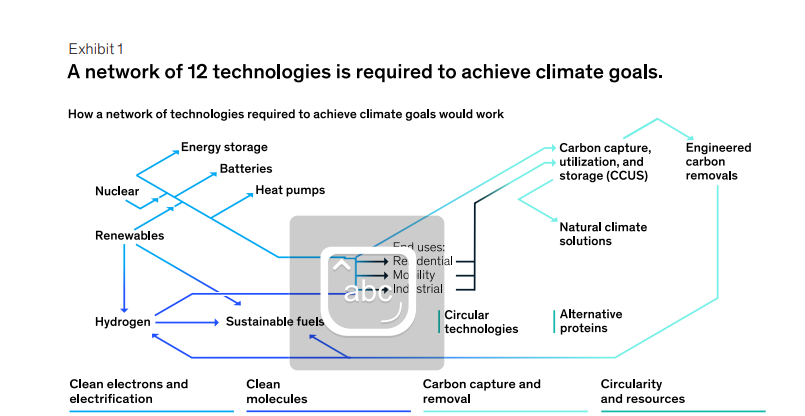

Our analysis suggests that, collectively, 12 categories of climate technologies could potentially reduce as much as 90 percent of total man-made greenhouse-gas (GHG) emissions if deployed at scale.1 The interdependency among these technologies is very high, meaning that they must scale together. These technologies will need not only to be proven technically (as many already have) but also to become commercially viable. And, critically, the search for sustainable tech solutions to drive decarbonization will need to be pursued in parallel with other goals such as affordability and energy security.2

The maturity levels of the 12 technology categories are uneven: only 10 percent are commercially competitive, while a further 45 percent are commercially available but will require further cost reductions through innovation and scale-up to become competitive. The remainder hold great promise but are in earlier stages. The highest priority is therefore identifying, understanding, and prioritizing technical and commercial scaling mechanisms.

This article is a preview of a full report on climate technologies that McKinsey plans to publish in 2024. It highlights the potential of these 12 technology categories along with their different maturity levels, the key scaling mechanisms, and some paths to overcoming scaling challenges. To spur innovation and reduce costs, our analysis suggests that climate tech investments would need to grow by about 10 percent each year and reach approximately $2 trillion by 2030, equivalent to about 1 percent to 2 percent of global GDP.3

Twelve categories of climate technologies with varying maturity levels hold the promise of large-scale emissions reduction

The 12 categories described here are interconnected through dependencies in both foundational science and system-level scaling mechanisms (Exhibit 1). Their maturity varies: for example, renewable energies such as solar and wind energy are increasingly being deployed and, in some regions, are already cost competitive with fossil fuels, whereas carbon removal technologies and alternative proteins are in an early development stage.4 Renewable energies underpin many of the others but will not achieve net-zero goals on their own.

Exhibit 1

12 CLIMATE TECHNOLOGIES

Batteries

Battery electric vehicles relying on lithium-ion batteries benefit from high “tank to wheel” energy efficiency. Their embedded lifetime emissions are as much as 85 percent lower than those of vehicles with internal combustion engines, although emission reductions depend on the local power mix and the carbon emission footprint of the battery pack, which typically accounts for 40 to 60 percent of upstream emissions of a battery EV. Batteries have achieved strong growth recently and are expected to continue growing by 25 percent year over year until 2030, while battery cell costs have been reduced by a factor of ten over the past decade, regularly beating forecasts and allowing battery EVs to get close to cost competitiveness with conventional combustion-engine vehicles. To further scale, batteries require substantial investments along the end-to-end value chain (including raw-material mining and refining, active material manufacturing, production equipment, and cell manufacturing ramp-up and yield improvement). Near-term technology innovations need to focus on improvements in energy density and fast-charging capability. This can be achieved, for example, by replacing some share of graphite in the anode with silicon nanostructures or advancing to both semi-solid-state and solid-state batteries to store more energy per kilogram of battery weight. Improvements in battery-recycling technologies would contribute to a circular battery material ecosystem by producing battery-grade recycled materials and reduce the environmental impact of sourcing battery materials.

Carbon capture, utilization, and storage (CCUS)

hese technologies capture CO2 emitted by industrial processes at point sources such as cement or steel plants and power generation facilities, and then transport it, convert it, or store it long term. They are also required for the production of low-carbon hydrogen from natural gas. CCUS can be used to abate residual emissions after other reduction efforts have been exhausted. Cost reductions will be required, as CCUS does not offer direct monetization routes and represents an added cost for industrial and power players. Some technologies are mature; for example, amine-based solvents have been used for decades to separate CO2 from natural gas and inject it into wells for enhanced oil recovery. Innovations are ongoing on other capture technologies, such as new liquid solvents, solid adsorbents, membranes, and cryogenic techniques. Each of these new technologies could reduce energy use and ultimately costs: non-amine-based solvents have demonstrated a 40 percent reduction in energy use by shrinking the power needed in desorption and compression processes, oxy-fuel combustion could reduce heat losses, and adsorption technologies could reduce regeneration energy.5 To scale up further, CCUS requires a clear regulatory and permitting environment for pipelines and storage.

5. Cate Lawrence, “Northern Gritstone invests in C-Capture’s unique carbon dioxide removal technology,” Tech.eu, September 18, 2023; Okon-Akan Omolabake Abiodun et al., “Assessing absorption-based CO2 capture: Research progress and techno-economic assessment overview,” Carbon Capture Science & Technology, September 2023, Volume 8; “Oxyfuel combustion,” in Fundamentals of low emission flameless combustion and its applications, edited by Seyed Ehsan Hosseini, Academic Press, 2022.

Circular technologies

These cover a range of approaches that aim to reduce the CO2 emissions from materials over their life span while simultaneously maximizing their lifetime value. The recirculation of materials such as aluminum, plastic, and chemicals moves production from primary to recycling and reduces the greenhouse-gas intensity of material. For example, greater efficiency reduces the amount of material required through product design to produce low-binder concrete and cement. Some material recirculation technologies are already commercially mature, such as electric-arc furnaces for recycling steel. Others, such as pyrolysis treatment for chemically recycling plastics, and sortation technologies such as laser-induced breakdown spectrometry and X-ray fluorescence require further innovation for commercialization. Scaling the recirculation of materials will require collaboration across the supply chain to manage collection, recycling, and reintroduction into the value chain—for example, through take-back programs, offtake agreements, and industry targets. Investment in additional waste infrastructure to deposit, sort, and treat waste will be crucial to enable circularity across industries.

Energy storage

Large-scale energy storage will be needed as renewable energies scale up. Technologies include lithium-ion battery systems for short- and medium-duration energy storage as well as other electrochemical, thermal, mechanical, and chemical systems for long-duration energy storage. According to our analysis, about 350 gigawatts (GW) of short- to mid-duration energy storage and about 400 GW in long-duration energy storage would be needed by 2030. While some storage technologies—such as pumped hydro, molten salt, and compressed air—are rather mature with utility-scale projects already deployed, innovation is needed on lower-cost and higher-performing materials such as sulfur and silicon to improve stationary batteries. A plant-as-a-product (for compressed-air storage) or gigafactory approach (for electrochemical batteries) will help reduce costs in manufacturing. A portfolio of storage technologies will likely be needed. This will differ by country and depend on local geological conditions and the extent of grid balancing required.

Engineered carbon removals

This refers to a range of technology-based methods of removing atmospheric CO2. These technologies include:

- direct air capture and storage (DACS), for which air passes through a solid sorbent or liquid solvent acting as a chemical filter to bind CO2, which is then stored

- bioenergy carbon capture and storage (BECCS), for which sustainably sourced biomass is used in industrial processes to produce, for example, biofuels, electricity, or heat, and the biogenic CO2 emitted in these processes is captured and stored

- biochar and bio-oil, produced by heating sustainably sourced biomass in the absence of oxygen to create carbon-rich material

- enhanced weathering, for which rocks and minerals are broken down to increase their surface area to remove carbon from the atmosphere and store it

The Intergovernmental Panel on Climate Change has indicated that engineered carbon removals are a critical tool for achieving net zero by 2050 because they enable businesses to remove residual carbon emissions after other reduction levers have been exhausted.6 However, carbon removal, such as CCUS, is an added cost for buyers, and rapid cost reductions are needed to make the business case work for buyers. The up-front costs of removal technologies in current use are high, and technology-specific innovations are needed to bring down these costs. Additionally, full transparency to buyers is needed to ensure credit value. This can be facilitated by establishing a clear system of standards and regulation for carbon-removal credits applicable across removal technologies.

6. Sixth assessment report, Intergovernmental Panel on Climate Change, 2022.

Heat pumps

Heat pumps are between 2.0 and 4.5 times more efficient than gas furnaces and boilers. They use a refrigerant cycle with gas compression and expansion to transfer heat from evaporator to condenser. Technologies include air-source heat pumps, which use outdoor air; geothermal (or ground-source) heat pumps, which use a buried external component to harness the Earth’s temperature; and water-source heat pumps, which use water from the ground, lakes, or rivers. While heat pumps are relatively mature, they still require innovation at a component level to reduce costs and improve the coefficient of performance (a measure of heat pump efficiency). Refrigerants with low global-warming potential, such as hydrocarbons, air, and water, need to be further developed, as do compressor technologies, which are the biggest energy and cost drivers of heat pumps. Scaling up the deployment of residential and commercial heat pumps requires business-model innovation and funding mechanisms to support households, especially renters. The upfront capital expense includes both switching to the heat pump itself and improving building insulation. A trained workforce will also be vital to install heat pumps at scale across geographies.

Hydrogen

Clean hydrogen (both renewable and low carbon) offers an option for deep decarbonization of sectors such as steel, cement, and chemicals, which currently account for about 20 percent of global emissions. Hydrogen and its derivatives, such as ammonia and methanol, can be used to power airplanes, ships, heavy vehicles, and other forms of heavy transportation. Hydrogen also facilitates the integration of renewable energies because it can store renewable energy as molecules and enable grid blending and transportation over long distances. Low-carbon hydrogen can be produced from natural gas, using steam methane or autothermal reforming with carbon capture and storage, and can reduce carbon emissions by 80 to 95 percent compared with conventional gray hydrogen. Technologies for low-carbon hydrogen production are mature but depend on further innovation and cost reduction in carbon capture and storage technologies. Renewable hydrogen can be produced from renewable energies using water electrolysis; alkaline electrolyzers and proton exchange membrane electrolyzers are the most mature technologies for this process today, with high-efficiency solid oxide electrolyzers, anion membrane electrolyzers, membrane-free or capillary-fed electrolyzers or seawater electrolysis, and other innovations in early stages of development. Currently, the main barrier to a faster scale-up of clean hydrogen is the challenge of securing long-term offtake at an early stage of the cost reduction curve. The clean-hydrogen project pipeline grew by 35 percent from May 2022 to January 2023 and continues to advance rapidly, but the lack of firm offtake is leading to delays in final investment decisions. The hydrogen scale-up therefore still relies on funding mechanisms such as production tax credits and contracts for difference. Once offtake is secured, the successful delivery of the first megaprojects for clean-hydrogen production will be decisive for scaling, significantly reducing uncertainty for future projects and opening access to cheaper financing.

Nuclear

Traditional nuclear fission technologies—that is, large-scale Generation II and Generation III+ nuclear reactors—are commercially mature technologies, with 440 reactors currently providing about 10 percent of global electricity generation. Challenges include high construction costs and cost overruns as well as unresolved questions of long-term storage of waste and spent-fuel storage in several regions. Faster innovation on traditional Generation III+ and Generation IV technologies is required for cost reductions. Factory-built small modular reactors could provide flexible (off-grid) power with shorter ramp-up timelines and lower up-front costs; however, they are not yet commercially mature. The scale-up of nuclear relies on the standardization of licensing requirements for plant construction, which can help avoid delays and additional costs. Public–private consortia are also key to accelerating less mature technologies—and coordination between industry and governments will be essential to address skilled-labor shortages through capability building.

Renewables

Renewable-power capacity almost doubled between 2015 and 2020. Most energy production technologies that use renewable resources such as solar, wind, hydro, geothermic sources, and biomass are already technologically mature; solar photovoltaics (PV) and onshore and offshore wind turbines have demonstrated the greatest growth and the most successful scaling. Electricity generated by solar PV grew 25 percent annually between 2015 and 2021, corresponding to a fourfold increase in the installed base. Challenges including intermittency still need to be overcome to prevent a slowdown in deployment in multiple geographies. Medium- and long-duration storage integration and slow-moving grid modernization, as well as long-term materials supply and access, among other issues, will need to be addressed. Specific technological innovation is required to further reduce costs of renewable generation. Foundational step changes will come from technological innovations such as perovskite solar cells, which provide higher efficiency, and organic thin film cells, which provide greater flexibility at lower costs, while floating offshore platforms and airborne-wind-energy systems have potential for mass commercial scaling.

Sustainable fuels

Transportation sectors account for more than 15 percent of total global emissions today, and alternatives to fossil hydrocarbon fuels are needed to decarbonize hard-to-abate sectors that cannot be electrified, including aviation, shipping, and some heavy-duty road transport. Sustainable fuels include conventional biomass-based fuels, drop-in sustainable fuels (including drop-in hydrogen-based e-fuels such as e-jet), and non-drop-in fuels that require engine or infrastructure retrofits (including e-ammonia and e-methanol). Some technologies for converting biomass to fuel are relatively mature, such as hydrotreatment of lipids to produce renewable diesel and kerosene. To bring costs down and increase availability, innovation is required—especially for most e-fuels, which are generally still in the demonstration and piloting phase. While the cost gap with biomass-based fuels remains high, e-fuels do not face the same constraints on biomass feedstock availability and collection as conventional biomass-based fuels. The wide variety of synthetic-fuel conversion techniques and the multiple steps involved in these techniques represent challenges and risks for first-of-its-kind investments—and sophisticated capabilities and assets will be required during downstream refining to produce high-quality fuels. These complex value chains mean collaboration among multiple value chain players will be key to scaling up.

Technologies supporting natural climate solutions

These nature-based projects remove carbon from the atmosphere or prevent emissions from being produced. They include terrestrial ecosystems, such as afforestation, reforestation, avoided forest and peatland degradation, peatland restoration, and fire and savannah management. They also include carbon removals and reductions on agricultural lands, such as using trees in cropland, optimizing grazing pathways, and leveraging cover crops. The technologies are already proven and deployed in various projects. To scale deployment, innovation needs to focus on further increasing the ability to scale and verifying the quality of these projects via regulatory standardization, technology-enabled transparency, and engagement with local communities. In ocean ecosystems, emerging natural climate solutions (NCS) include protecting and restoring natural salt marshes, mangroves, seagrass, and kelp forests, or creating seaweed farms for carbon removal and avoidance. Here, innovation is needed to provide full transparency into any knock-on impacts to natural systems, creating trust in the market. Revenue streams, such as biodiversity credits and other nature credits (for example, nitrogen or water), and financing instruments that can bridge the ten-year payback period typically required for forestry and related projects are a critical part of the scaling mechanism for NCS.

Technologies to produce alternative proteins

These include:

- plant-based proteins from soybeans, peas, wheat, and other plants

- microorganism-based fermented proteins from living microorganisms—for example, using microbial fermentation in which plant-based proteins are fermented through microbes

- cell-cultivated proteins from animal cells using bioreactors and centrifuges

Today, about 15 percent of global emissions comes from the production of animal-based protein such as meat, dairy, eggs, and aquaculture. Plant-based proteins are priced at a significant premium compared with their animal-based counterparts, and emerging alternatives such as cultivated meat are still largely precommercial. But in less than a decade, companies have reportedly reduced the production costs of cultivated meat by 99 percent. In plant-based proteins, near-term innovation is needed to adjust plant genetics and extrusion technologies to maximize health and sensory attributes and improve texture. Fermentation-based proteins offer opportunities to improve in process maturity, optimize site selection for lower-cost feedstock and utilities, and scale fermentation capacity beyond pilot scale. Cultivated proteins require further innovation in bioreactor technologies (including built-for-purpose large-scale bioreactors), lower-cost culture mediums, and purity in the cultivation and production process to improve the texture of the finished product. Achieving scale-up in alternative proteins will also require regulatory clarity to increase consumer and investor confidence.

Cost reductions for climate technologies require a combination of innovation and scaling

Climate technologies have advanced rapidly, and our analysis suggests that as much as 90 percent of 2050 baseline man-made emissions could be abated with existing climate technologies.

However, there is a gap between technical readiness and commercial maturity: based on our analysis, only 10 percent of abatement potential from climate technologies comes from those that are already fully commercially mature and in global deployment (Exhibit 2).7 These include nuclear, hydro, geothermal, aluminum recycling, and a share of solar and wind installations in advantaged regions with headroom in the grid. An additional 45 percent of abatement potential could come from technologies in early adoption and commercialization, including most solar and wind generation, electric vehicles, biofuels, heat pumps, and plastic chemical recycling. These technologies have already proved their ability to scale but require additional support to be competitive with incumbent technologies in the short to medium term.

Exhibit 2

A further 40 percent of abatement potential can be attributed to technologies that are in early innovation and starting to prove their scale-up potential in demonstration projects or prototypes, but still require large-scale opportunities to validate their technological readiness and prove their commercialization potential. These include small, modular nuclear reactors; solid-state batteries; direct air capture and storage; and concrete recycling.

Climate technologies are reaching maturity faster than in the past, and many of them—especially technologically mature ones such as solar, wind, and batteries—have been on impressive growth trajectories over the past decade, consistently outpacing forecasts. For example, the IEA’s 2019 forecast for globally installed solar PV capacity in 2030 is more than 20 times the equivalent forecast from 2006. Exhibit 3 shows the rapid growth of solar PV, wind, and hydrogen.

Exhibit 3

Innovations in technologies, processes, and business models contribute to this acceleration. For mature technologies, innovation focuses on accelerated deployment; for example, horizontal well drilling to increase the power capacity of geothermal plants or using robotics to accelerate solar PV installations. Less-mature climate technologies require more fundamental technological innovation to improve performance and efficiency, as well as to help bring novel solutions to market, such as DACS, Generation IV and small modular nuclear plants, or cultured proteins.

To reach climate targets, renewables and batteries would need to sustain historic growth rates at scale, with other technologies replicating the trajectory

Renewables and batteries will need to sustain their current high growth rates for 2050 climate targets to be achieved. Our analysis indicates that this would allow a more than fivefold increase in installed capacities by 2030 compared with 2021 (Exhibit 4).

Exhibit 4

Growth of this magnitude would be remarkably fast compared with previous changes in the energy system. For example, it took half a century for coal, crude oil, and natural gas to grow from 5 percent of global energy supply to 40 percent, 30 percent, and 20 percent of the total market, respectively.8 By contrast, if current growth rates are sustained, solar and wind would grow from around 5 percent of global energy supply in 2015 to 40 percent by 2030.

Sustaining this level of growth is bound to become more difficult for several reasons. First, our analysis shows that 80 percent of global renewables capacity was installed during a time of near-zero interest rates, and the return to higher interest rates since 2022 is already leading to higher costs and delays in investment decisions. Second, investments in transmission and storage infrastructure increase with the share of intermittent renewables in the power system, raising the overall cost. Third, the sheer quantity of projects that need to be built is leading to bottlenecks in the system, including decreased availability of land, labor, and materials.

For emerging and next-generation technologies such as CCUS and carbon removals, growth rates would need to accelerate to stay in line with climate targets. To harness their full potential, these technologies would need to replicate the growth rates experienced by solar and wind, a trajectory they are not currently on.

Scaling mature climate technologies will require further rapid and steep cost reductions

While many climate technologies have achieved remarkable cost reductions, further cost reductions are needed to support commercially viable scale-up by 2030 (Exhibit 5).

Exhibit 5

Our analysis indicates that two technology categories—renewables and battery electric vehicles—are on track to achieve cost parity by 2030 in many countries (but not in all countries and not for all use cases) without additional policy support. This is particularly the case in countries with abundant solar and wind resources, strong transmission grids, and relatively low penetration of renewables. However, marginal costs of deployment increase with the share of renewables already in the grid.

Climate technologies typically move through three stages of development on their way to cost competitiveness and global deployment

Looking at how climate technologies have scaled up historically, we observe that a twofold to eightfold reduction in costs is achieved for every 100-fold increase in deployment, measured in terms of carbon abatement (Exhibit 6).

Exhibit 6

Two essential drivers of this pattern are spending on innovation—such as R&D to boost efficiency—and achieving economies of scale through industrialization. The required ratio of the two drivers varies by stage:

- Early innovation. Technologies with low levels of technical maturity need to demonstrate their technical feasibility in order to scale. R&D in this stage is hence key to increase efficiency. In addition, they need to showcase the value of the product in the market with early adopters and establish early proof points on economies of scale. Historically, batteries achieved a fivefold cost decline in this stage. Direct air capture and storage is one technology currently in this stage. Projects in the lab started just over a decade ago, and first projects are now going live in the field, indicating that the technology is ready to benefit from economies of scale.

- Accelerated commercialization. After a product becomes technologically mature, the relative importance of industrialization increases. Historically, both solar and offshore wind achieved a twofold cost reduction. The emphasis in this stage is on the scale-up of supply chains and manufacturing in lockstep with deployment and customer demand. Supplier and customer relations need to be developed to achieve economies of scale, and finance needs to be secured to derisk investments. Industrialization also requires innovation. For example, alkaline electrolyzer technology from renewable hydrogen is mature, and electrolyzer manufacturers are currently focusing on industrializing production and project development to achieve stack-level cost reductions of more than 60 percent from 2020 to 2025. This requires predictable demand and a robust project pipeline. Government incentives in some countries, such as the clean-hydrogen-production tax credit in the US Inflation Reduction Act and end-use mandates for the industry in the European Union, support this build-up.9

- Global deployment. Once a technology reaches commercial maturity, the focus is on ongoing cost reductions and acceleration of scale-up through more and larger systems, larger plants, and automated assembly. Accelerating deployment allows for greater economies-of-scale benefits. Innovation, including learning by doing, can also improve technology and plant design and construction. For instance, solar PV achieved technological maturity and double-digit growth in deployment in the past year—now the challenge is to roll out a completely developed project faster and across the globe to accelerate scale.10

Mobilizing value chains, reengineering financing, and overcoming resource constraints are keys to scaling critical climate technologies

A range of challenges to full-scale deployment will need to be overcome to ensure rapid scaling of critical climate technologies. Here we outline three keys to overcoming them: creating at-scale supply chains and support infrastructure, embracing effective capital reallocation and financing structures, and addressing system-level bottlenecks to parallel scaling up. This section builds on and develops our prior research on requirements for a more orderly energy transition with a particular focus on the needs of climate technologies.

1. Creating at-scale supply chains and support infrastructure

Equipment and components manufacturing is currently concentrated in a few geographies, with a small number of companies controlling the supply chain for critical components. Policy support and local demand are restoring manufacturing in Europe and the United States for some climate technologies. Our analysis shows that around 80 percent of funding enabled by the US Inflation Reduction Act—a total of more than $400 billion—is being directed to manufacturing, as is around 75 percent of Green Deal Industrial Plan funding in the European Union—a total of about $275 billion.11

This creates opportunities for global players to mobilize and industrialize value chains. Companies that can innovate and scale rapidly while pursuing progress on cost reductions could be setting themselves up for exponential growth.

Efforts to innovate and industrialize individual climate technologies need to take into account the interdependence of these technologies: nine out of the 12 categories—all but nuclear, CCUS, and NCS—depend on the build-out of renewables, which in turn depend on several supporting technologies. These interdependencies can create system-level bottlenecks, because many climate technologies compete for the same resources, including financing, infrastructure, permits, labor, land, and raw materials (including rare earth and base metals). This can also create integration costs that make the next “wave” of installations of some technologies more expensive. Addressing these system-level constraints is critical to scaling climate technologies in parallel. At the same time, such interdependencies can be an accelerant for the scale-up, with progress in one technology benefiting others via a network effect. For example, transformers and rectifiers are used for renewables, electrolyzers, energy storage systems, and EV-charging infrastructure; our analysis suggests that more than 20 percent of the materials cost for fuel cell and battery electric vehicle powertrains is shared. And there are potential synergies in building infrastructure for both electrons and molecules—two infrastructures can be cheaper than one, given the increasing marginal costs of enabling a renewable energy system: hydrogen can reduce peak loads and necessary grid upgrades by helping to serve high-demand and hard-to-serve areas.12

2. Embracing effective capital reallocation and financing structures

Climate technologies are up to six times more capital intensive than incumbents, and recent interest hikes have had an unfavorable impact on their economics. While investor interest in climate technologies has been buoyant in the past few years, with more than 200 climate-focused funds created since 2021, the financing environment has become harder in 2023.13 Earlier-stage climate technologies require significantly more capital than venture capital firms tend to provide in other tech sectors (such as software) but have significantly higher risk profiles than private equity and infrastructure funds are willing to underwrite. To achieve deployment at scale will require a different approach to financing, one tailored to the new characteristics of climate technologies, including the unproven nature of immature technologies and sometimes steep up-front costs. Public-sector derisking mechanisms are needed to lower the weighted average cost of capital, thereby helping to attract private capital—for example, contracts for difference, production tax credits, and concessionary loans. Blended finance models are key to crowding in private money—especially in earlier-stage projects with higher risk profiles.

New asset classes such as infrastructure growth capital and industrial venture capital funds are also needed to meet the climate technology financing challenge. Infrastructure growth funds can support the financing of more-mature climate technologies while accepting different risk/return profiles; recent examples of infrastructure funds moving into climate tech include Ardian’s launch of the €2 billion Hy24 hydrogen infrastructure fund and Brookfield’s $500 million investment into Oxy1.5’s DACS plant.14 Industrial venture capital funds are needed to fund innovation in the required hardware and components; for example, Breakthrough Energy Ventures has invested more than $2 billion in climate technologies.15

3. Addressing system-level bottlenecks to parallel scaling up

A number of physical constraints stand in the way of the rapid acceleration of climate technologies in parallel, and some compensating mechanisms will be needed to address socioeconomic impacts. Here, we touch on ways to address some of the most important issues.

Infrastructure and permitting: Building an enabling environment. Nine of the 12 categories of climate technologies rely on renewables, and six of them will require significant new investment in grids, pipes, terminals, and storage facilities. To reach net zero, extending and strengthening electricity transmission and distribution will likely account for about 45 percent of total energy system capital costs in the 2030s and 2040s. Investment will be needed to overcome network inadequacy and instability from integrating renewables into existing power grids, to upgrade aging infrastructure, and to improve resilience in the face of extreme severe-weather events. Green-molecule trade can be a complement to power transmission build-out—for example, our analysis shows that a hydrogen pipeline can cost 10 to 80 percent less than an overhead power transmission line, depending on its location and capital expenditure costs.16 Market and regulatory incentives such as tax breaks, grants, or loan guarantees can engender significant investment in infrastructure build-out.

Energy infrastructure projects continue to face deployment risks from permitting delays and regulatory uncertainties. To overcome such challenges, several pillars must be addressed together: the need for rigorous environmental impact assessments, the needs and concerns of local communities, other demands for land use (such as agriculture), and the urgency of scaling climate technologies at the necessary pace. Countries are taking steps to speed up permitting processes and subsidy allocation by providing concise guidance and permitting criteria, streamlining the process, and consulting with stakeholders early on. For example, the Norwegian Ministry of Energy pre-allocates land for CO2 storage to grant licenses more quickly.17

Land, water, and raw materials: Accessing natural resources. The challenge of scaling climate technologies in parallel is evident in land, water, and raw-material constraints. For example, deployment of renewables generally requires 10 to 30 times more land than fossil-fuel incumbents, and available land is limited in many markets. Similarly, a fully clean energy system will require approximately 50 percent more water consumption than a fossil-fuel one.18

Acknowledging trade-offs, fostering innovation, bolstering the underlying systems (for example, enhancing water management broadly), and exploring alternatives can help ease constraints on land, water, and raw materials. The use of alternative lands—for example, wasteland, which is land degraded by human activities, or agrivoltaic land, which is used for both agriculture and solar photovoltaic energy generation—could help expand the area suitable for renewables installation. Innovative solutions such as floating solar PVs, floating offshore wind, and BECCS conversions of existing power plants could also maximize generation without running into significant land constraints. To reduce water competition will require innovation in new technological solutions such as ultrapure water generation technology and anaerobic digestion to improve biogas production. Promoting the recycling of raw materials, as done in the European Union and parts of the United States,19 and innovations in end products that require few or no rare raw materials can be important levers to reduce scarcity.

Labor and talent: Upskilling and reskilling. A skilled workforce is needed to build a decarbonized economy. Climate technology value chains will require approximately 200 million skilled workers by 2050. Our analysis shows that the United States already experiences an undersupply of around 400,000 construction workers in 2022, especially for megaprojects.20

While some jobs would be phased out as new climate technologies supersede legacy incumbents, an orderly transition would create a net gain in jobs. For example, accelerated decarbonization could lead to the creation of 18.0 million net jobs in India, 5.0 million in the European Union, and 3.8 million in Africa.21 There is a strong role for the government in setting the right incentives for commitment. However, cooperation with the private sector and firm-level initiatives can make a significant difference. Helping workers raise their skill levels will be key. For example, the UK government is subsidizing heat-pump training for 4,000 technicians.22 Individual firms can also take action: for instance, the German solar-energy company Enpal developed an in-house skills academy to train craftspeople as solar technicians in just two weeks.23

The critical task of scaling the 12 categories of climate technology raises key questions for companies, investors, and governments. What will it take to reach truly ambitious cost reduction targets that make these technologies both competitive and affordable? How can higher-risk technologies and first-of-a-kind projects be sustainably financed? How can legislation create targeted support mechanisms to accelerate innovation in earlier-stage technologies while encouraging deployment of mature ones in a way that balances decarbonization, affordability, competitiveness, and security concerns? In our view, these are the critical questions of our age. We will return to them in the full report in 2024, with more detail, new analysis, and implications for stakeholders.

Originally published at https://www.mckinsey.com