health transformation

institute

health & tech strategy

Joaquim Cardoso MSc

Chief Researcher for — Health Transformation Research

Chief Editor for — Health Transformation Portal

Chief Senior Advisor for — Health Transformation Advisory

May 21, 2023

This is an excerpt of the publication below, focusing on the topic in question. For the full version of the publication, refer to the second part of this post, please.

Clinical Data Integration Capabilities and Sourcing — Recommendations for U.S. Healthcare Payers

Gartner

Mandi Bishop, Rohan Sinha,

26 April 2021

CDI Is a Complex Value Chain, Not a Single Process — and Each Step Requires Specialized Skills

Interoperability and clinical data integration are top of mind for Gartner payer clients, as executives, care management, utilization management, quality and risk adjustment optimization leaders seek the richness and immediacy of data locked in providers’ electronic health records (EHRs).

CDI has been a high priority for payers since 2017, reaching a peak in 2020 with many pilot projects in play.

- Recent Gartner polling indicates that about half of all payers have implemented — or are in the process of implementing — one or more CDI use cases.

- However, few payers have achieved scale in their CDI efforts necessary to deliver the ROI business leaders expect.

- To that point, only 14% of respondents indicate that their CDI initiatives are ingesting data from more than 5% of their in-network providers.

To that point, only 14% of respondents indicate that their CDI initiatives are ingesting data from more than 5% of their in-network providers.

CDI at scale is elusive due to a number of factors:

Restrictive (or nonexistent) clinical data usage agreements that prohibit a single data exchange event from supporting multiple use cases.

- A lack of incentive alignment between payers and providers to encourage electronic data exchange, although value-based contract arrangements increase opportunities to address this barrier.

- A significant underestimation of CDI’s complexity and the required competencies as well as the level of effort needed to deliver value in alignment with business expectations.

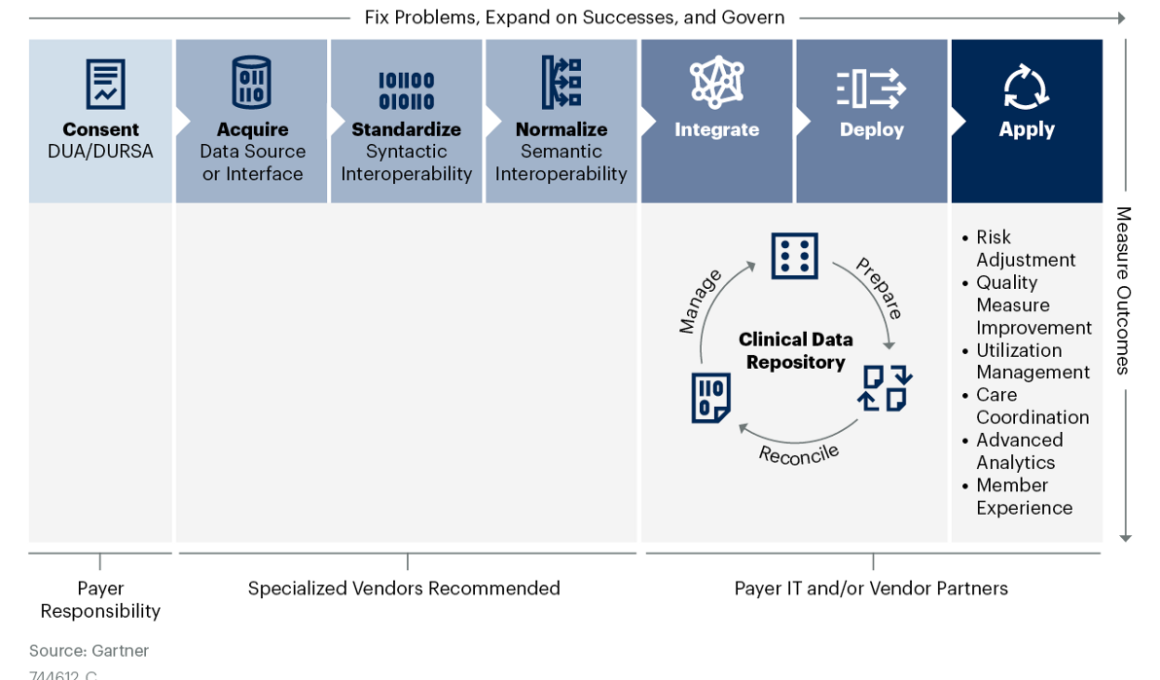

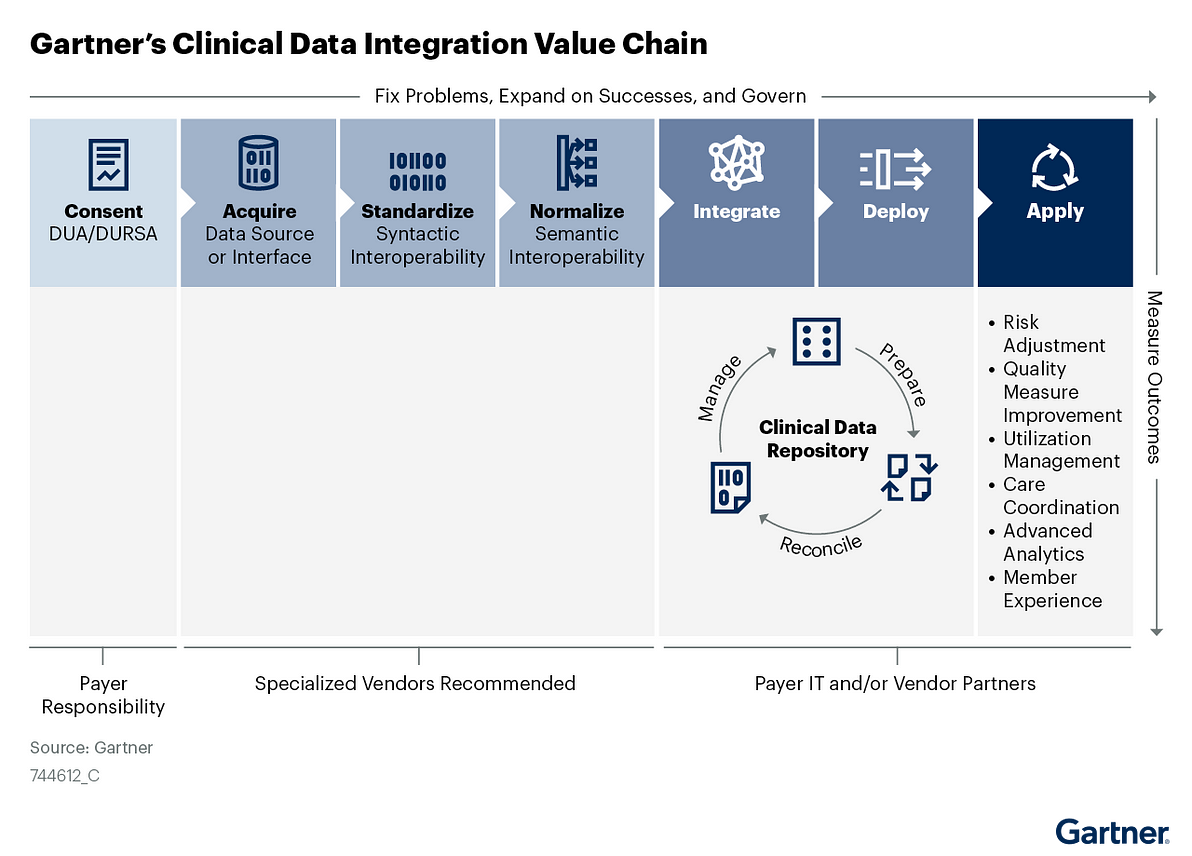

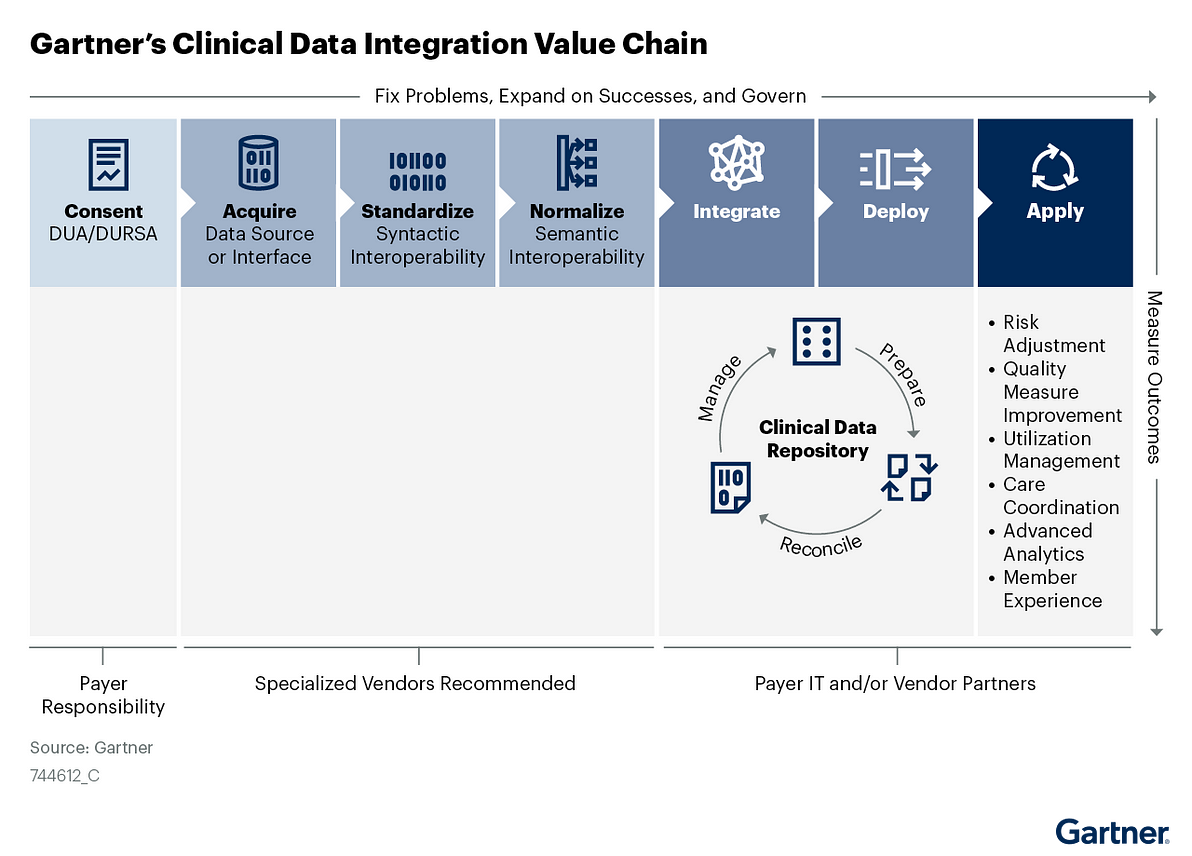

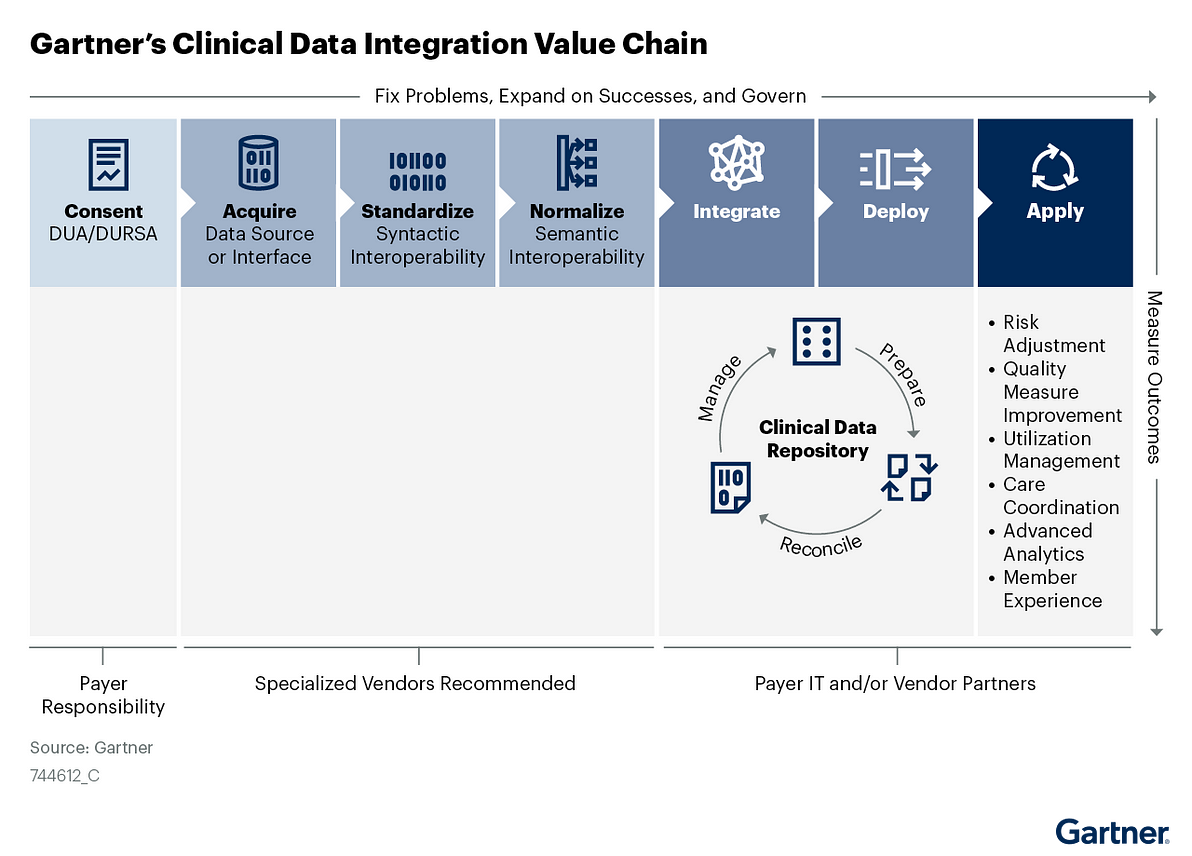

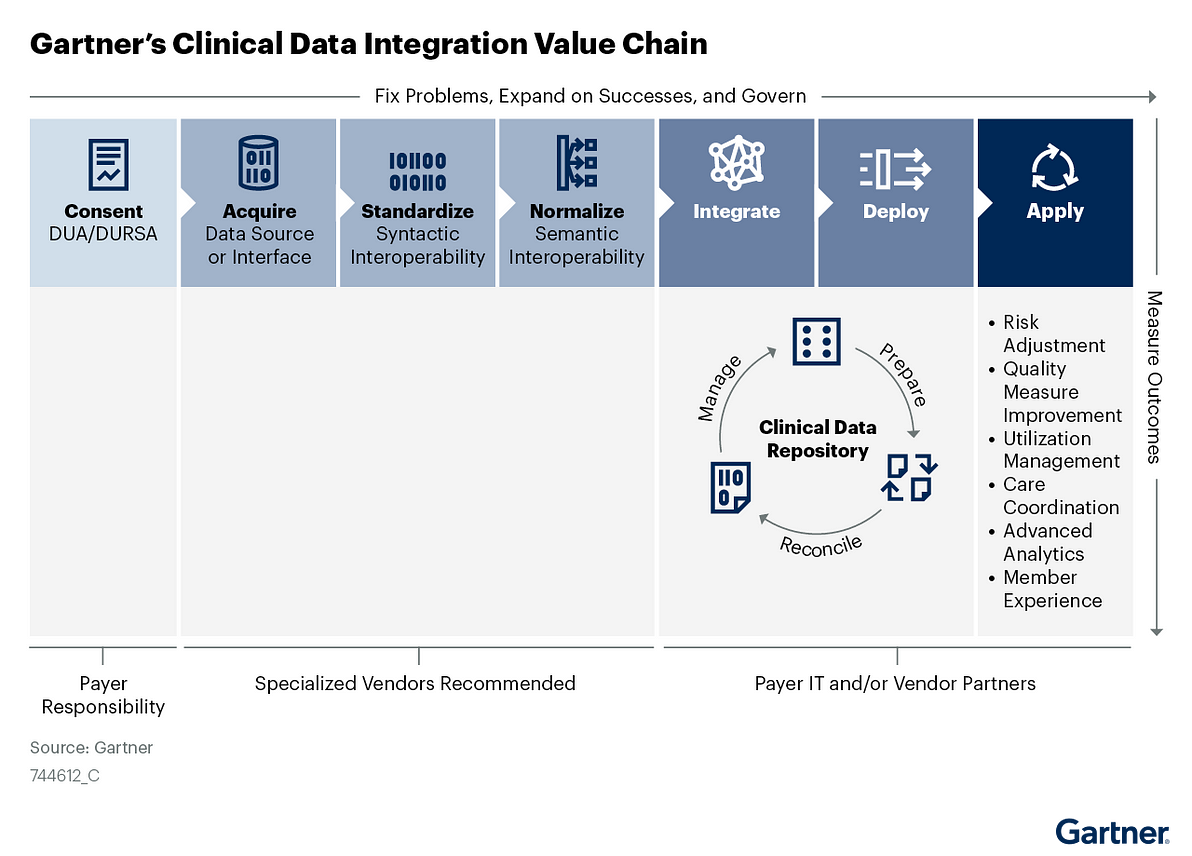

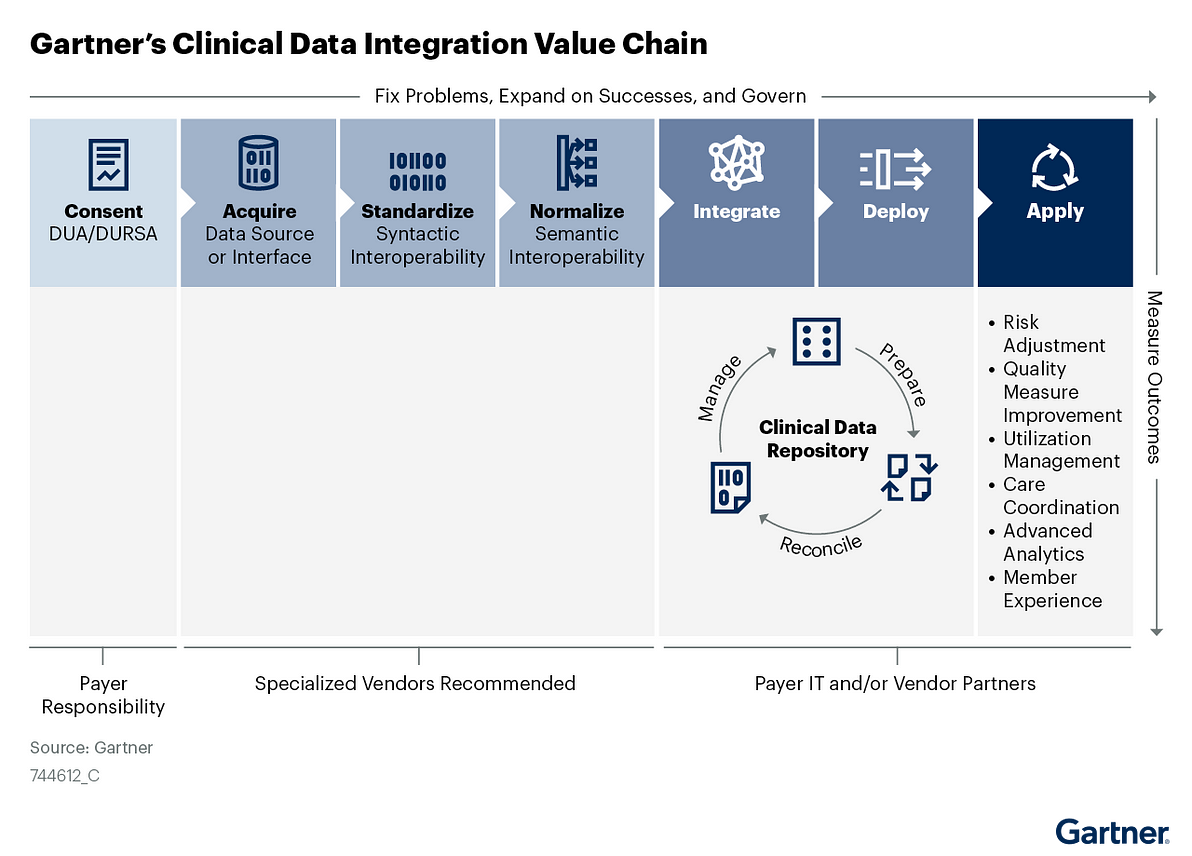

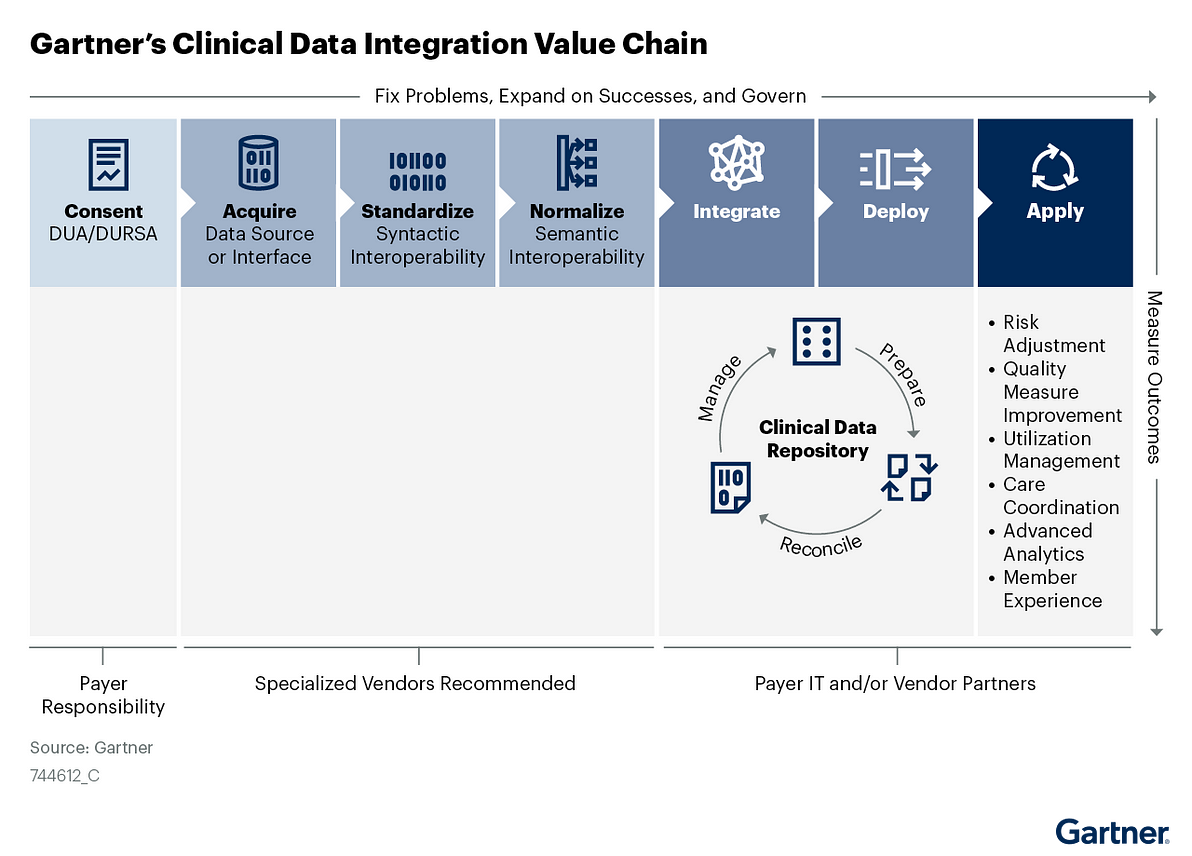

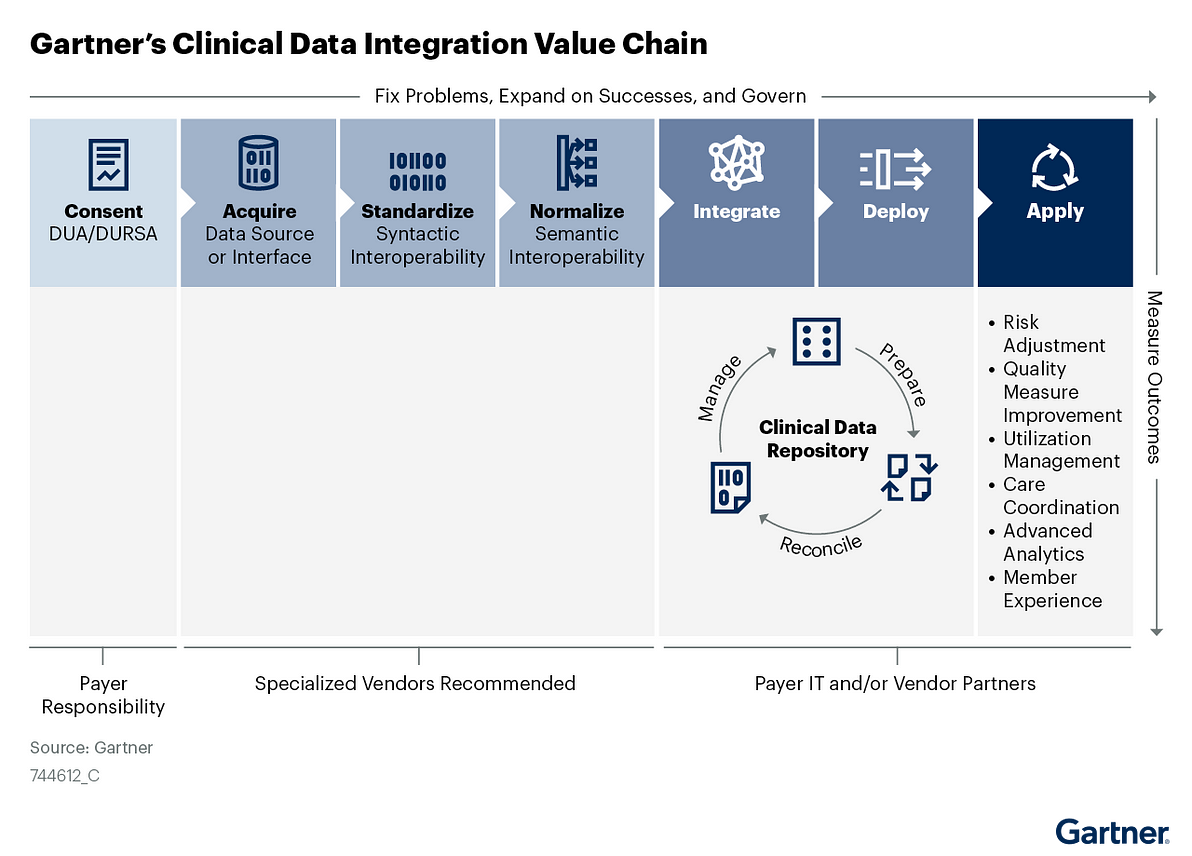

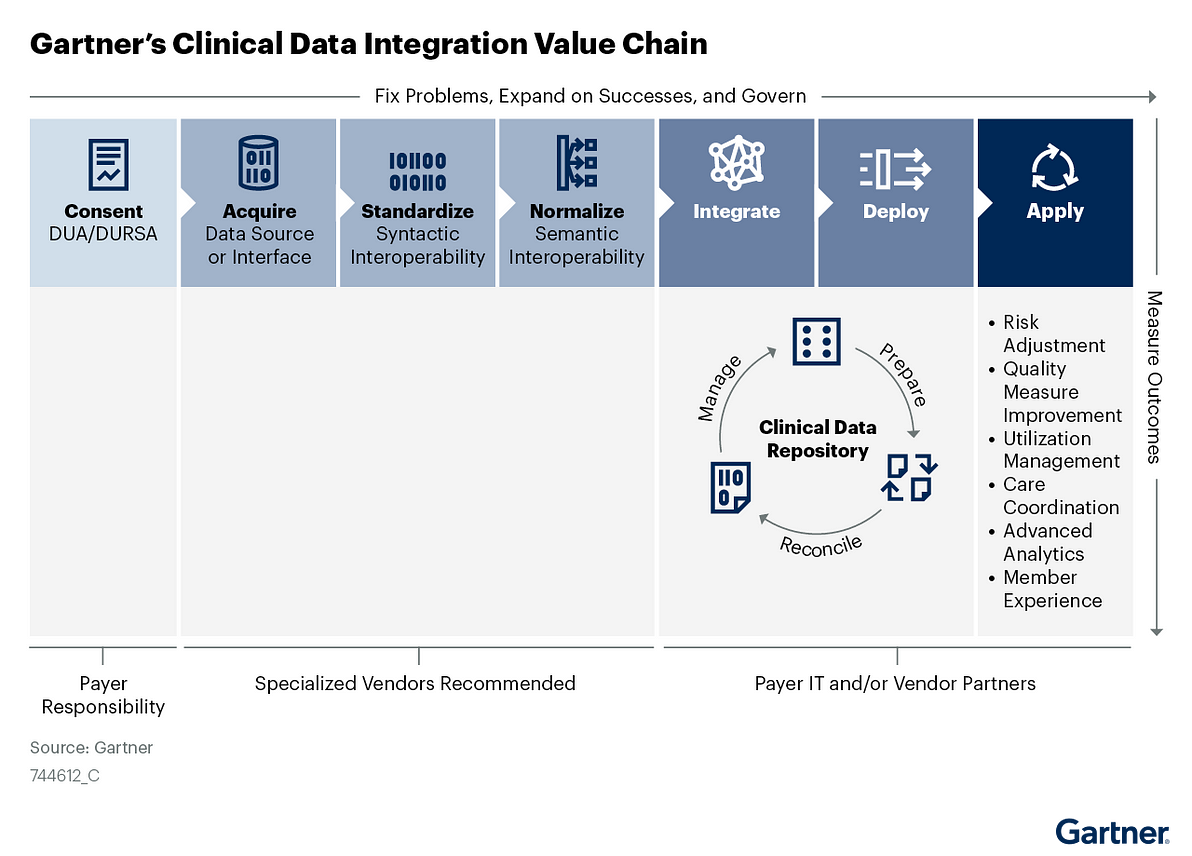

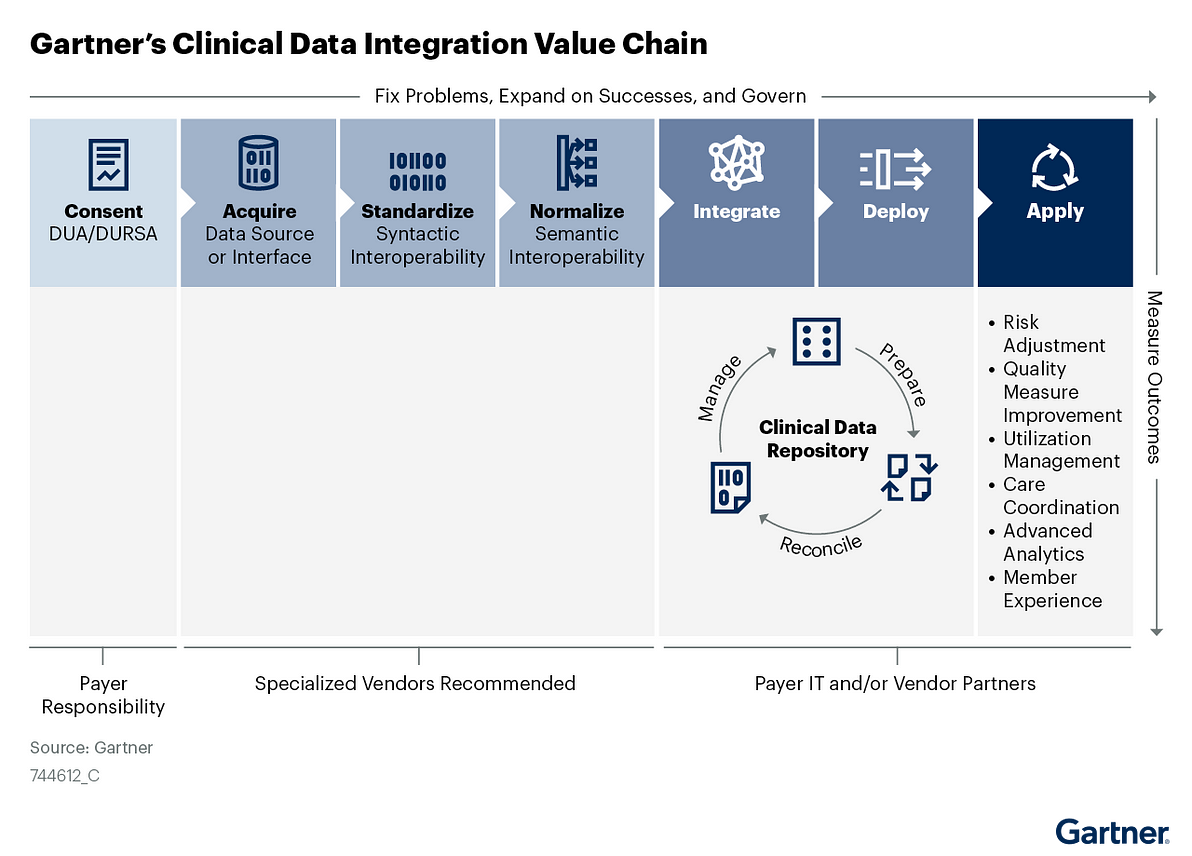

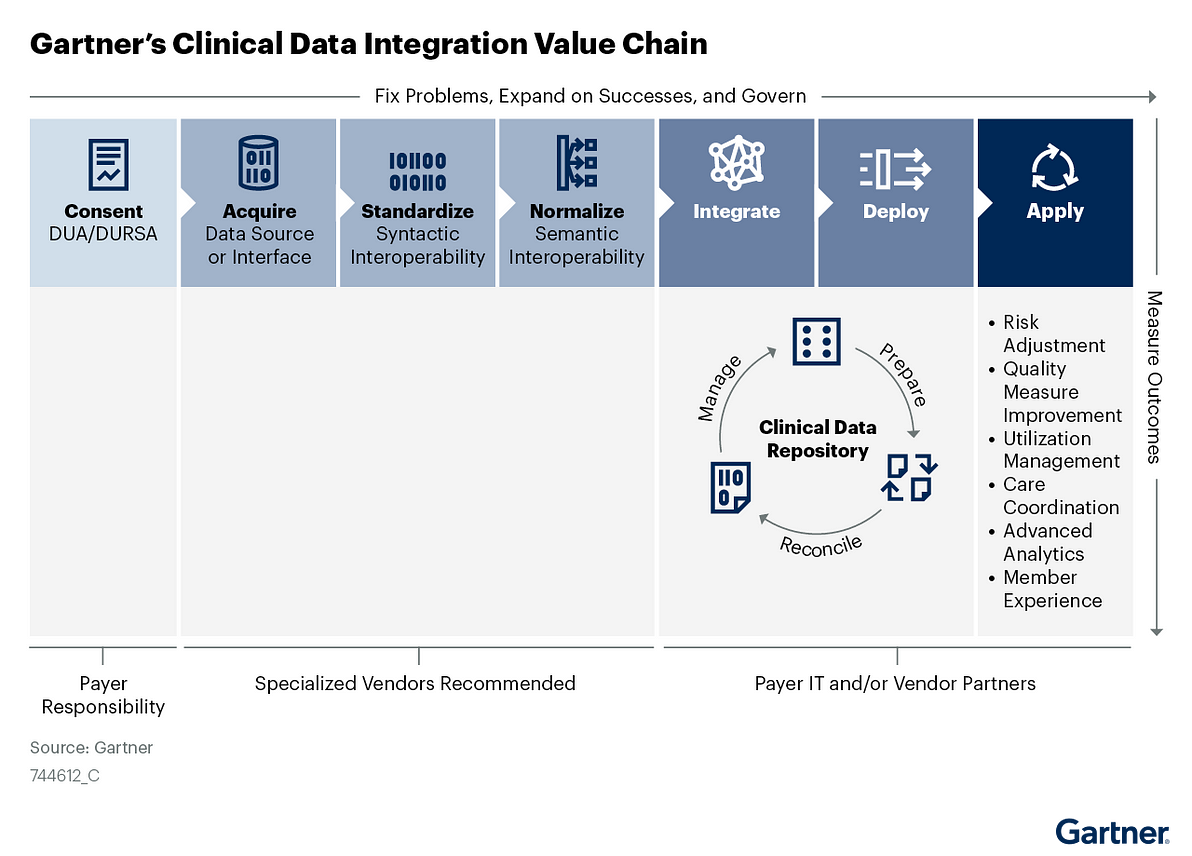

- CDI is a value chain, not a single process, and each step requires specialized skills and capabilities that many payers cannot support internally (see Figure 1).

CDI at scale (Clinical Data Integration) is elusive due to a number of factors:

Restrictive (or nonexistent) clinical data usage agreements that prohibit a single data exchange event from supporting multiple use cases.

Figure 1: Gartner’s Clinical Data Integration Value Chain

Use this research to identify and assess CDI knowledge or competency gaps and communicate CDI complexities to executives, business leaders and IT teams.

Armed with this information, you can then match internal capabilities and vendor solutions against each step in the CDI value chain to determine the optimal source to deliver value at scale.

ORIGINAL PUBLICATION (FULL VERSION)

Clinical Data Integration Capabilities and Sourcing — Recommendations for U.S. Healthcare Payers

Gartner

Mandi Bishop, Rohan Sinha,

26 April 2021

Healthcare payer CIOs and executives routinely underestimate the complexities involved in clinical data integration initiatives, leading to subpar business outcomes.

This research defines CDI processes and provides strategy and sourcing guidance to payer executives to achieve effective CDI at scale.

Key Findings

- Clinical data integration (CDI) is a complex value chain, not a single process. Each step in the value chain requires specialized skills that may not be accessible internally.

- Payer IT and business leaders underestimate the complexity of the CDI value chain, which leads to overpromising and failing to deliver target business outcomes.

- While there are an increasing number of CDI vendors offering solutions across the value chain, the vendor landscape is heavily specialized and requires nuanced evaluation.

Recommendations

U.S. healthcare payer CIOs accelerating healthcare and life science digital optimization and modernization should:

- Evaluate CDI requirements and capabilities by function to deconstruct the CDI value chain into seven discrete processes: usage consent, acquisition, standardization, normalization, ingestion, enterprise application deployment, and use-case application.

- Ensure your CDI strategy addresses compliance, privacy, security and governance considerations by aligning requirements to regulatory mandates and internal policies for consent, identity and access management as well as general information management.

- Future-proof your CDI strategy by incorporating Fast Healthcare Interoperability Resources (FHIR) API adoption and proliferation scenarios.

- Accelerate time-to-value for CDI initiatives by leveraging vendor solutions to support business capabilities on the value chain that are less feasible to deliver internally.

Introduction

CDI Is a Complex Value Chain, Not a Single Process — and Each Step Requires Specialized Skills

Interoperability and clinical data integration are top of mind for Gartner payer clients, as executives, care management, utilization management, quality and risk adjustment optimization leaders seek the richness and immediacy of data locked in providers’ electronic health records (EHRs).

CDI has been a high priority for payers since 2017, reaching a peak in 2020 with many pilot projects in play.

- Recent Gartner polling indicates that about half of all payers have implemented — or are in the process of implementing — one or more CDI use cases.

- However, few payers have achieved scale in their CDI efforts necessary to deliver the ROI business leaders expect.

- To that point, only 14% of respondents indicate that their CDI initiatives are ingesting data from more than 5% of their in-network providers.

To that point, only 14% of respondents indicate that their CDI initiatives are ingesting data from more than 5% of their in-network providers.

CDI at scale is elusive due to a number of factors:

Restrictive (or nonexistent) clinical data usage agreements that prohibit a single data exchange event from supporting multiple use cases.

- A lack of incentive alignment between payers and providers to encourage electronic data exchange, although value-based contract arrangements increase opportunities to address this barrier.

- A significant underestimation of CDI’s complexity and the required competencies as well as the level of effort needed to deliver value in alignment with business expectations.

- CDI is a value chain, not a single process, and each step requires specialized skills and capabilities that many payers cannot support internally (see Figure 1).

CDI at scale (Clinical Data Integration) is elusive due to a number of factors:

Restrictive (or nonexistent) clinical data usage agreements that prohibit a single data exchange event from supporting multiple use cases.

Figure 1: Gartner’s Clinical Data Integration Value Chain

Use this research to identify and assess CDI knowledge or competency gaps and communicate CDI complexities to executives, business leaders and IT teams.

Armed with this information, you can then match internal capabilities and vendor solutions against each step in the CDI value chain to determine the optimal source to deliver value at scale.

Analysis

Evaluate CDI Requirements and Capabilities by Function by Deconstructing the CDI Value Chain Into Processes

Interoperability Enables, But It Is Not CDI

Although they are closely related, Gartner defines interoperability and clinical data integration as separate and distinct capabilities:

- Interoperability is the capability to exchange data among healthcare organizations, inclusive of the standards, processes and technologies that support it.

- Clinical data integration (CDI) encompasses the ingestion and handling of interoperable clinical data into the payer environment. CDI consists of seven sequential processes forming a value chain: consent, acquisition, standardization, normalization, integration, enterprise application deployment and use-case application.

Effective CDI is a critical capability for building the data fabric that supports composable business. By understanding and using each process in the CDI value chain, CIOs can achieve effective CDI at scale for their organizations.

Process 1 — Gain Expanded Provider Consent for Clinical Data Integration and Comprehensive Use

To successfully scale CDI, payers must first collaborate with providers to align data-sharing priorities and enable trust. To facilitate this collaboration and make it mutually beneficial:

- Work with your network management business leadership to find common ground with provider partners. Identify (and be prepared to enable) potential CDI benefits, such as increased revenue from pay-for-performance, quality reporting, advanced quality or value-based contracts, and faster prior authorizations.

- Work with your legal and compliance teams to develop and execute meaningful data usage agreements (DUAs) between your organization and your provider partners. Seek to expand traditional DUAs that focus on attribute-level data use by developing use-case-specific language that allows your organization to use the data elements acquired in a single integration instance to support multiple high-value use cases.

- Ensure that use-case-based DUAs incorporate all data elements that could be helpful in achieving mutual objectives.

While putting together a DUA, pay close attention to details — CDI teams often perceive DUAs as perfunctory and easy to obtain. This is important because payers risk running afoul of state and federal data privacy and security laws, such as the Health Insurance Portability and Accountability Act (HIPAA), by integrating clinical data without the explicit consent of the submitting provider or the patient. 1

In conjunction with the DUA development, work with your legal and compliance departments to determine whether each provider connection additionally warrants a multiparty data usage reciprocal support agreement (DURSA). 2DURSAs define accountability and indemnity provisions between parties, and should apply to CDI initiatives that link payers, providers and vendors that act as data intermediaries.

Process 2 — Acquire Clinical Data From Provider EHRs

After a DUA/DURSA is in place, the next step is to acquire the clinical data from the provider-partner EHRs. Be sure that the CDI team has explicitly defined the scope of the data necessary to support the use case(s) the business is targeting before evaluating EHR connection opportunities. The nature of the data required and the use-case applicability will determine which of the various EHR data outputs best supports value realization.

Among various available EHR data formats and outputs, Health Level 7 (HL7) text files (version 2) and XML files (version 3) are most common. Since 2015, the Office of the National Coordinator for Healthcare IT (ONC) has required EHRs to support HL7 XML-based document exchange for providers to participate in the Meaningful Use EHR Incentive Program. New regulatory mandates from the ONC and the Centers for Medicare and Medicaid Services (CMS) require providers to notify a patient’s care team of admission, discharge and transfer (ADT) events using HL7 version 2 text files as a condition of participation in Medicare. These mandates also establish Fast Healthcare Interoperability Resources (FHIR) API standards for data exchange between payers, providers and patients that have long-term potential as an alternative to previous versions of HL7. 3

You can acquire clinical data several ways — and are likely to have to use more than one of these approaches to achieve scale, depending on your organization’s geographic reach:

- Establish a point-to-point integration with the provider EHR.

- Establish a one-to-many integration with a regional health information exchange (HIE).

- Purchase a vended clinical data platform solution that has existing integrations with your chosen providers.

- Partner with EHR companies directly.

- Implement an EHR (such as Health Care Service Corporation’s implementation of the Epic Payer Platform4).

Gartner recommends that you evaluate specialized vendors to support the acquisition step. It’s ideal to start with one data source at a time and avoid acquiring all available data types at once.

Process 3 — Standardize Clinical Data Output to Improve Data Quality and Usability

Standardizing clinical data refers to making it interoperable to populate downstream models and enable data interpretation once it is received. The first level of interoperability is syntactic interoperability that defines the syntax of data exchange. 5This ensures the data structure is interoperable from informational models (such as HL7’s Reference Information Model or openEHR) to schemas (such as XML) and terminology (such as naming conventions).

Standardization consists of the following actions:

- Develop a common data output specification to apply to each data source type (such as a FHIR resource) to minimize the target data model interface complexity. Although there are standard document types, each EHR implementation generates a different version of the document, and the differences between them can be considerable. Use standardized health data classes and elements from the United States Core Data for Interoperability (USCDI) as it is adopted as a standard in the ONC Cures Act Final Rule.

- Transform inbound data to the common data output specification for each data source type.

- Monitor and measure data quality to identify disparities in data source file structure or data element inclusion.

Do not mistake standardization for normalization (which is the next step), as standard data exchange formats do not ensure consistent content or the accurate representation of the clinical information contained in the data. We recommend evaluating specialized vendor partners to support the standardization step, as well as considering their ability to acquire and clinically normalize the data to achieve syntactic interoperability.

Process 4 — Normalize Clinical Data Semantically, Not Just Syntactically

To use clinical data effectively to inform processes such as care coordination and utilization management, it must be both syntactically interoperable (conforming structure) as well as semantically interoperable (conforming content). To achieve semantic interoperability, systems must be able to exchange data with unambiguous, shared meaning. For example, medication name, dosage and delivery modality must be consistent to support medical necessity decisions.

However, the nature of clinical data poses a significant challenge to semantic interoperability (see Clinical Data Integration: IT Readiness Assessment and RFP Questions for U.S. Healthcare Payer CIOs). Clinical data has a nearly infinite degree of variability. It is not rigidly structured with discrete data elements like HIPAA X12 administrative transactions are structured. Due to workflow differences between clinical practices or hospital departments, or even different documentation habits between clinicians operating within the same workflows, the data values will vary in both completeness and in how they are represented. For example, if the clinical workflow allows a codified entry or a free text entry for a particular field, one clinician may choose to use the code, and another may choose to enter text. Also, clinicians may only populate fields, such as diagnosis, to the extent that they are required for reimbursement — stopping at six values, for example, due to claim submission constraints from a payer.

Vexing as it is — not to mention being antithetical to traditional data management best practices — you must accept the reality of these irregularities to manage the normalization process effectively. As such, deriving meaning from clinical data can seem like an insurmountable challenge. To ensure the accurate interpretation of clinical findings from the data, you must, for example:

- Classify normalized data by relating it to clinical concepts in an ontology.

- Reconcile medications into a single value from hundreds of potential variations (codified as well as free text).

- Standardize units of measurement (such as thousand per microliter).

- Capture and standardize drug delivery methods.

- Deduplicate data while considering these variations.

- Account for scenarios in which the absence of a data value is clinically significant.

- Examine the data quality from each of the sources, and correct or exclude data that does not meet data quality thresholds.

Collaborate with provider partners to achieve the data quality needed to support your agreed-on use-case applications and address any gaps that the analysis attributes to clinical workflows.

Due to the clinical expertise this process demands, we strongly recommend that you seek expert assistance from a vendor to normalize clinical data.

Process 5 — Integrate Normalized Clinical Data Into a Repository

To create a longitudinal clinical record that can ultimately support a myriad of use cases, Gartner recommends integrating the normalized clinical data into a repository while preparing it for enterprise application consumption. Data updates, enrichment, and reconciliation processes occur in the repository, and this is where you would also enforce governance, access policies and controls. This repository makes data accessible to enterprise applications through some combination of batch export; extract, transform and load (ETL) processes; web services; and APIs. As such, this process ties into traditional data warehousing methodology, and follows standard data transfer and stable data model guidelines.

Within the repository, match the clinical data you have acquired, standardized and normalized with administrative data. To have a more comprehensive picture of your member’s health and utilization, you can expand your repository by including additional data types, such as claims and enrollment data as well as consumer insights, social determinants and patient-reported outcomes. In early CDI initiative phases you should narrowly focus data linkage on the bare minimum of fields or types required to execute simple use cases, such as using an ADT event to notify a care manager of a member’s hospital admission. In more complex use cases, like analytics, the linkages need to be quite robust and will be challenging to implement.

Process 6 — Deploy Clinical Data Into Enterprise Applications

To apply clinical data at scale and optimize value realization from CDI, you need to deploy it into enterprise applications and workflows, such as care and population health management. Deploy your clinical data via push or pull methods, meaning the repository can regularly export data to a receiving application, or the receiving application can request the data it needs to execute a process.

To establish a proper deployment plan, the CDI team must gather specific data requirements for the underlying applications that support the use cases agreed to in the DUA/DURSA. Each application and workflow may have different requirements for data elements, data transfer method and frequency, granularity, and access rights.

Payers adopting a composable approach to architecture should expose clinical data services as part of the data fabric that supports various application experiences. More restrictive technical environments are likely to pursue traditional ETL and data replication deployment approaches.

Use your deployment plan to evaluate internal IT capabilities and vendor solutions to determine whether the supported data access specifications meet your CDI needs.

Process 7 — Apply Clinical Data to High-Value Use Cases in Line With the DUA/DURSA

Gartner has identified six high-value use cases for clinical data integration that together form the basis for an enterprise approach:

- Risk adjustment optimization

- Quality measure improvement

- Utilization management

- Care coordination

- Advanced analytics

- Experience (member, provider and employee)

Be careful not to assume that data collected for one approved use case automatically applies to others under the terms of your DUA/DURSA.

Continue to revisit new use case applications with your legal and compliance peers, then discuss with your provider partners.

Alternative Process — Big-Data-Based Approaches to CDI May Require Value Chain Process Exceptions

When developing your CDI approach, it is important to note that big-data- or data-lake-based approaches to CDI value-chain processes may alter the execution sequence and minimize the value of the standardization process.

While several CDI vendors successfully employ this approach — often in conjunction with natural-language processing (NLP) and predictive modeling capabilities — we do not recommend that payers attempt it without vendor partners.

Ensure CDI Strategy Addresses Compliance as Well as Privacy, Security and Governance

To meet the new mandates and make smart strategic decisions to share clinical data with members, you must implement expanded privacy and security governance enabled by capabilities such as consent, identity and access management. These processes should align with your internal enterprise process frameworks, such as master data management and data quality. For consent, identity and access management, you may use internal capabilities or commercial enterprise tools.

Alternatively, you may choose to leverage a CDI vendor’s capabilities (although these tend to be rudimentary in comparison with purpose-built vended solutions). You must also address data security in your DUA and DURSA agreements. Information governance should align with your internal program requirements, although both internal and external stakeholders have responsibility and accountability for governance activities.

Future-Proof CDI Strategy by Incorporating FHIR Scenarios

The recent ONC and CMS regulatory mandates anoint FHIR as the cross-sector standard for interoperable healthcare data — but that doesn’t make FHIR a panacea for scaling CDI. Until FHIR is ubiquitously adopted for revenue-based practices (such as quality and risk reporting) as well as administrative processes (such as prior authorization submissions), CDI initiatives will continue to struggle with multi-format complexity.

Enterprise CDI strategy should consider two scenarios: FHIR becomes the lingua franca for healthcare or FHIR fizzles due to implementation challenges. Gartner believes FHIR will persist, expand and accelerate interoperability improvements across the ecosystem and we encourage scenario planning to prepare for any necessary pivot.

Accelerate Time-to-Value by Leveraging Vendor Solutions

Gartner recommends that payers contract with specialized vendor partners to deliver key business capabilities that are unlikely to align with internal core competencies.

In some cases, your organization will have an existing relationship with one or more of the vendors offering CDI solutions, and there may be an opportunity to simplify procurement and accelerate delivery.

The CDI solution provider landscape is evolving rapidly, and vendor offerings are nuanced.

Vendors have disparate approaches and capabilities, although all address at least one of the business capabilities in the CDI value chain.

We encourage you to speak with an analyst to align vendors to your specific needs and prepare to issue an RFI.

List of Representative (Not Exhaustive) CDI Vendors

Please note that the segments below are fluid — not mutually exclusive — and vendors flow across boundaries.

- Clinical data acquisition solutions include Apixio, Lyniate and Redox.

- ADT event, API and data exchange workflow-focused solutions include Collective Medical, Health Gorilla and PatientPing.

- Developer and partner-enabling solutions include: HealthLX, Onyx Technology and SmileCDR.

- Data curation and enrichment hub solutions that emphasize normalization include Diameter Health and Verinovum.

- Vendors addressing a majority of the CDI processes include 1upHealth, Arcadia, CitiusTech, Epic, IMAT Solutions, Innovaccer, InterSystems and Secure Exchange Solutions.

- Several cloud service providers, CRM solutions and master data management solutions offer CDI accelerators such as Amazon Web Services (AWS), IBM, Informatica, Microsoft Cloud for Healthcare, Google Apigee, Oracle and Salesforce Health Cloud with MuleSoft.

- Regional health information exchanges (HIEs) have an opportunity to be CDI partners. Unfortunately, few HIEs currently support the payment and operations use cases for HIPAA-compliant clinical data exchange between providers and payers. However, the National Committee for Quality Assurance (NCQA) recently certified three HIEs in New York state to provide supplemental data for quality measure reporting through its Data Aggregator Validation (DAV) pilot program. Manifest MedX (a CDI solution provider serving California) is the first organization to go through the DAV early adopter phase pursuing certification.

- Acquisition solutions that are working with the CommonWell Health Alliance to implement the payment and operations use cases for HIPAA-compliant health data exchange nationwide include Change Healthcare, Ciox, Inovalon and Moxe Health.

Source: Gartner Research Note G00744612, Mandi Bishop, Rohan Sinha, 26 April 2021

Originally published at https://www.gartner.com.