the health strategist

institute for strategic health transformation

& digital technology

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

October 27, 2023

What is the message?

The PwC Health Research Institute (HRI) has released its report on the projected medical cost trend for 2024, indicating that the cost of treating patients is expected to rise significantly.

This upward trend is primarily attributed to inflation, workforce shortages in healthcare, and the increasing cost of pharmaceuticals, notably new cell and gene therapies.

While some deflators, such as biosimilars and shifts in care settings, offer relief, the overall impact of inflators is expected to outweigh these positive factors.

Health plans need to navigate these challenges while continuing to address issues like health equity and behavioral health.

What are the key points?

Inflationary Pressures:

Inflation in the United States, coupled with clinical workforce shortages, is driving up healthcare costs. Hospitals and physicians are expected to seek higher reimbursement rates in contract negotiations. Provider burnout and increased patient demand further exacerbate these pressures.

Pharmacy Trends:

The rising median price of new drugs and the accelerated approvals of cell and gene therapies contribute to the inflationary pressure on pharmaceutical costs. This trend is expected to persist in 2024.

Deflators:

The introduction of biosimilars and shifts in the site of care offer some relief. Biosimilars, which are over 50% cheaper than reference products, are driving significant savings, and a shift towards outpatient care helps contain costs.

Other Factors to Watch:

Total cost of care management, the impact of COVID-19, health equity initiatives, behavioral health utilization, the CMS Price Transparency Rule, and Medicaid redetermination are factors that health plans consider when assessing the medical cost trend. These factors have varying impacts and may influence cost trends in different ways.

Market-Specific Considerations:

The report covers both small and large group plans as well as ACA marketplace plans. While the impact of major factors is similar across the two markets, some distinct considerations, such as Medicaid redetermination and network adequacy, apply specifically to the Individual market.

DEEP DIVE

Medical cost trend: Behind the numbers 2024 – Increased pressure in healthcare [excerpt]

PwC Health Research Institute

Heart of the matter: The cost of treating patients is on the rise

In 2022, inflation in the United States reached rates not seen since the 1980s. 1 With rising wages and expenses compounded by clinical workforce shortages, providers across the nation are fighting against declining profit margins. In turn, health plans are pressured to raise reimbursement levels in price negotiations with providers.

On May 11, 2023, the Public Health Emergency (PHE) officially ended, symbolizing a new stage in the pandemic. The past three years have seen not only a concerted effort to make available safe and effective COVID-19 diagnostics, therapies, and vaccines, but also shifts in how and where Americans gain access to care with an acceleration in technology and alternative sites of care.

While some of these changes are temporary, others will likely persist into the post-pandemic world and become a different future.

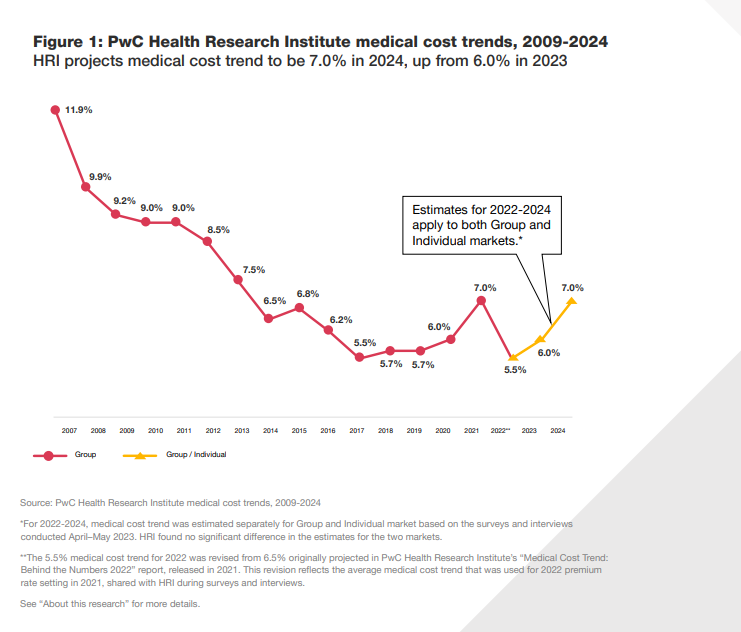

PwC’s Health Research Institute (HRI) surveyed and spoke with actuaries working at US health plans to generate an estimate of medical cost trend for the coming year. After considering various inflators and deflators of cost, HRI is projecting a 7.0% year-on-year medical cost trend in 2024 for both Individual and Group markets.

This trend is higher than the projected medical cost trends in 2022 and 2023, which were 5.5% and 6.0%, respectively (see Figure 1). The higher medical cost trend in 2024 reflects health plans’ modeling for inflationary unit cost impacts from their contracted healthcare providers, as well as persistent double-digit pharmacy trends driven by specialty drugs and the increasing use of the GLP-1 agonists for Type 2 Diabetes or weight loss.

PwC updated its 2022 medical cost projection for the Group market to 5.5%, 1.0% down from the initial projection in 2022, primarily driven by a shift in sites of care from inpatient hospital settings to less costly alternatives such as outpatient and ambulatory surgical centers.

The inflationary impact is further exacerbated by continued clinical workforce shortages in 2023-24, prompting hospitals to increase salaries and consequently seek higher reimbursement from payers. On the pharmacy side, the introduction of new cell and gene therapies (11 approved in the past three years) is a key inflator expected to increase the median price of treatment going into 2024.

Although health plans reported some deflationary relief through shifts in site of care and the introduction of biosimilars, the overall impact is muted by the various inflators.

1 The World Bank, “Inflation, consumer prices (annual %) – United States,” 2012-2023.

https://data.worldbank.org/indicator/FP.CPI.TOTL.ZGend=2022&locations=US&start=1960&view=chart

Inflators

Inflation and its ramifications across the healthcare landscape are the main factors driving spending in 2024.

- Inflationary impacts on healthcare providers. Hospitals and physicians are expected to seek higher rate increases (potentially also at a higher frequency) in contract negotiations. Workforce shortages and physician consolidation can further amplify the effect. Further, provider “burnout” and increased patient demand are expected to keep the pressure up on clinical workforces across the industry.

- Increasing cost of pharmaceuticals. Plans are experiencing inflationary pressure from the rising median price of new drugs, as well as the increasing price of existing drugs. Combined with the accelerated approvals of new cell and gene therapies, pharmacy trends are not expected to slow down in 2024.

Deflators

Some positive changes in the pharmaceutical market and care setting are expected to help counteract inflationary pressure, but their effect will be overshadowed by the inflators.

- Biosimilars coming to market. The prices of biosimilars are, on average, more than 50% lower than the reference products at the time of biosimilar launch. The launch of adalimumab biosimilars to Humira in 2023 is a new milestone in the market that is already driving significant savings.

- Shift in site of care. Plans reported a decrease in inpatient utilization as well as a shift towards outpatient care, allowing a two-pronged benefit to contain costs. Recent reports of increases in outpatient utilization among Medicare plans was not commented on during the research period for this report.

Trends to watch

In addition to the inflators and deflators summarized in this report, there were several other factors reported by health plans as being impactful for trend development, but were not considered a significant trend bender as an inflator or deflator.

- Total cost of care management. Many health plans continued to invest in total cost of care management initiatives such as value-based care that helped maintain year over year trend. National health plans generally demonstrated better cost management and subsequently achieved lower cost trends. As these national plans continue to grow, they will have a deflator effect overall on medical cost trends.

- COVID-19. Impacts of changes in federal and state policies and the need for vaccines, testing and treatment vary, with the net effect likely being neutral. Health plans did not report a causal relationship between pent-up demand for care during the pandemic and utilization of care. The consensus among health plans is that inflationary pressures continuing in 2023 and going into 2024 will be driven by provider unit cost increases and pharmacy trends rather than a recovery in surgery utilization post-pandemic.

- Health equity. Health equity is a focus of every health plan. The impact of related efforts to improve population health in the long term has not yet factored into plans’ cost of care models. Further, all plans are still working through CMS guidance on health equity.

- Behavioral health. While utilization of behavioral health grew during the pandemic and continues to grow, its cost remains relatively lower than other medical costs. Health plans did not account for behavioral health in their pricing and forecasting.

- Centers for Medicare and Medicaid Services (CMS) Price Transparency Rule. Health plans expect the impact of this rule on the 2024 trend will be neutral, given the immaturity of the data. In the long run, plans could see both upward and downward pressures.

- Medicaid redetermination. The impact is likely to be felt in the Individual market only, with magnitude and direction depending on the number of disenrollees who eventually purchase Individual plans and their risk profile.

This year, the scope of this report was broadened to include both small and large group (“Group”) 2 and ACA marketplace (“Individual) plans.

The Individual market has seen significant growth from 12 million in enrollment in 2021 to 16.4 million in 2023. In addition to Individual market-focused plans, all major health plans in the group market also offer plans in the Individual marketplace, where competition has intensified in recent years.

The impact of major factors driving medical cost is mostly felt in a similar way across the two markets. Meanwhile, there are distinct considerations that apply to one of the markets, most prominently Medicaid redetermination and network adequacy for the Individual market. This report does not focus on trends in Medicare and Medicaid.

2 Includes both self-insured and fully-insured plans.

What is medical cost trend?

Medical cost trend is defined as the projected percentage increase in the cost to treat patients from one year to the next, assuming benefits remain the same. While medical cost trends can be defined in several ways, this report estimates the projected increase in per capita costs of medical services and prescription medications that affect insurers’ Group and Individual plans.

Insurance companies use the projection to calculate health plan premiums for the coming year. For example, a 5.0% trend means that a plan that costs $10,000 per member this year would cost $10,500 next year. The medical cost trend, or growth rate, is influenced primarily by:

- Changes in the price of medical products and services and prescription medications, known as unit cost inflation.

- Changes in the number or intensity of services used or changes in per capita utilization.