Rich governments have pledged $100bn to help poorer countries reduce emissions. But there is no agreement on how to spend the funds

Financial Times

Leslie Hook; Joanna S Kao

November 2, 2021

On the Caribbean island of Antigua, builders will soon put hurricane reinforcements on hospital roofs and strengthen the windows on police stations. As climate change makes tropical storms more intense and more devastating, Antiguans are getting prepared.

This $46m storm-proofing project is just one part of a much bigger flow of money: a promised $100bn a year that rich countries pledged to spend helping poorer countries to cut their emissions and adapt to climate change.

The issue is shaping up to be a make or break issue at the COP26 climate summit under way in Glasgow right now.

The $100bn target is an “acid test” for whether rich countries are sincere about tackling climate change, says Molwyn Joseph, minister of the environment for Antigua and Barbuda.

“We are not asking for handouts, we are asking for compensation for damages, as a result of the profligacy of these developed countries,” he says. “Those that emit this carbon, that is causing climate events, should pay.”

Many countries say they need the money to reach their climate targets and invest in projects that lower emissions. When Indian prime minister Narendra Modi pledged on Monday to reach net zero emissions by 2070, there was a demand attached: $1tn in climate finance to developing countries.

“India expects developed countries to make $1 trillion available as climate finance as soon as possible,” he said. “As we are all increasing our ambitions with respect to climate action, the world’s ambitions with respect to climate finance cannot be [stay] at the same level.”

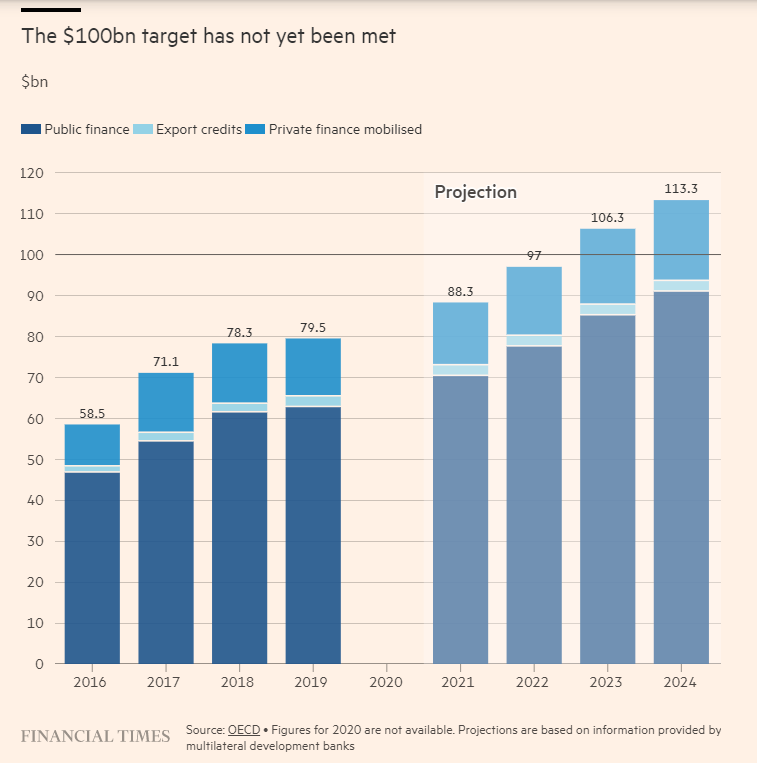

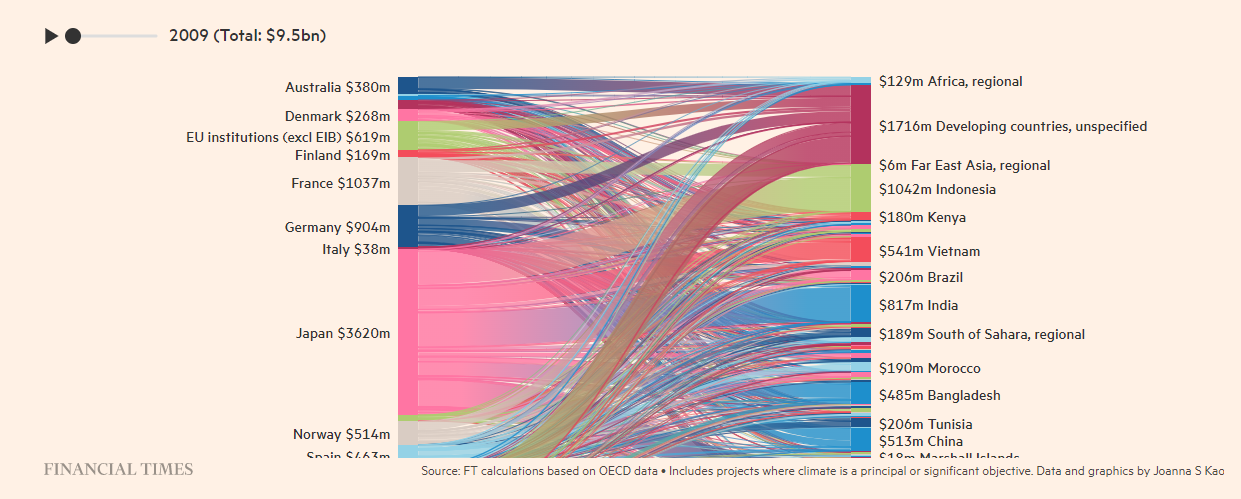

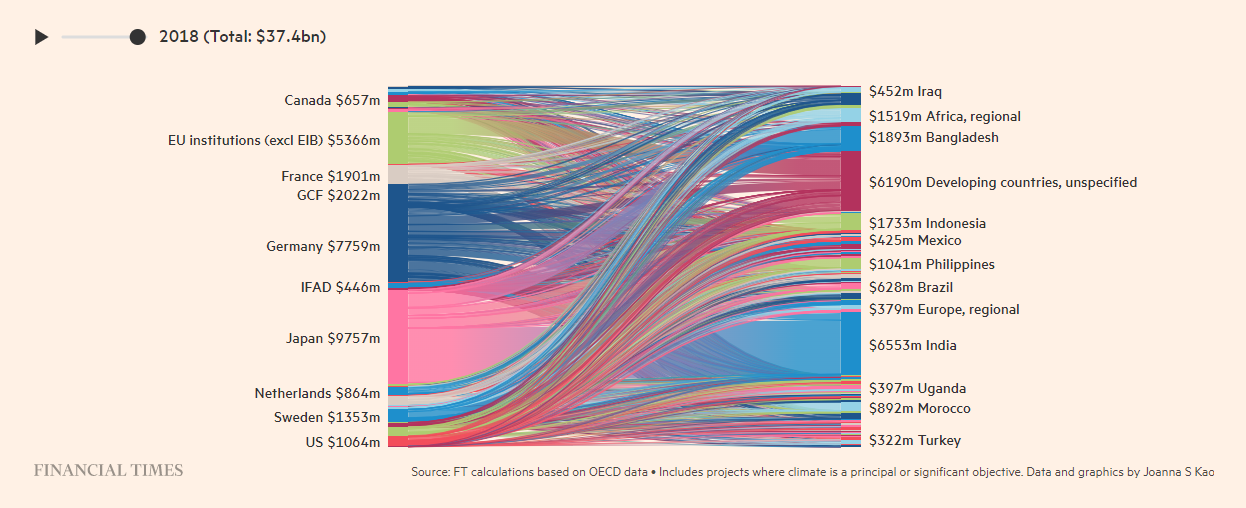

In 2009, rich nations promised they would send at least $100bn a year in climate finance to poorer countries by 2020. That understanding formed the basis of the 2015 Paris climate accord, which aims to limit global warming to well below 2C, ideally 1.5C.

“Suddenly you had this really emblematic ‘$100bn’ — where, unless you work this out, it is difficult to have the global agreement [at COP],” recalls Josué Tanaka, who helped launch the climate finance unit at the European Bank for Reconstruction and Development. “It became the signal, the base of trust, between developed and developing countries”

But last week, on the eve of COP26, donor countries admitted they missed that target in 2020. Now they expect to reach it in 2022 or 2023, years later than planned.

Everyone agrees there should be more money for climate finance. But that is where the consensus ends.

There is little agreement on how to spend the money, who should receive it, or how to make sure it is used effectively. There is even a dispute about how it should be measured, and what should be counted as climate finance.

While building storm shelters on hurricane-prone islands like Antigua and Barbuda might seem straightforward, the issue of who will pay the $100bn, when it will arrive, and how it will be distributed, has at times threatened to derail COP negotiations. Climate finance has had a very mixed record in terms of impact. Yet the $100bn-a-year target has also become a lightning rod for disagreement between rich and poor countries.

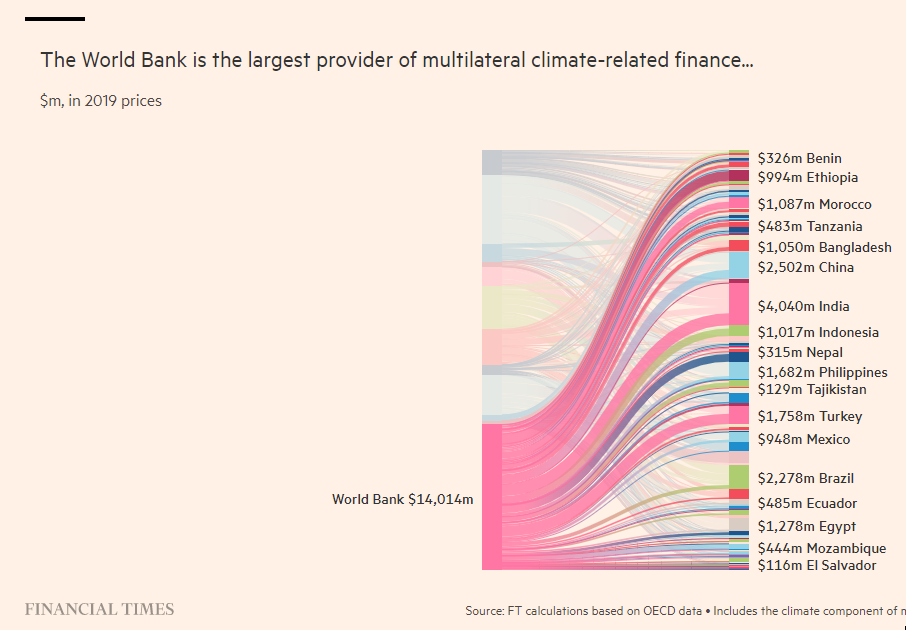

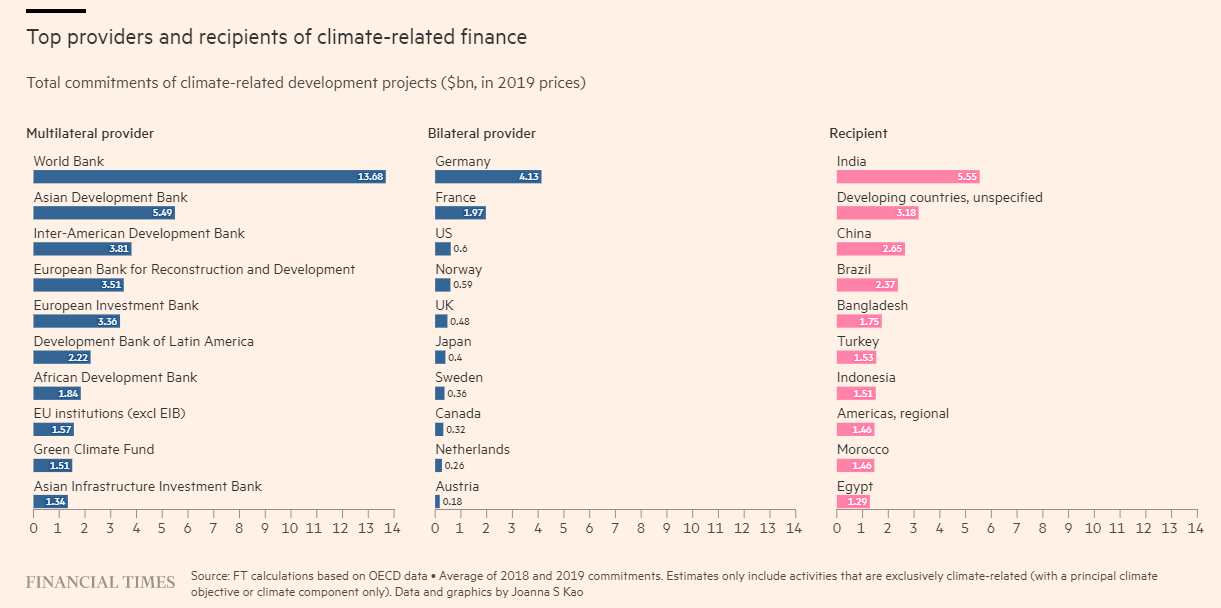

Much of the money that has been raised so far has gone to large international institutions that are already well-funded.

“Climate finance has been pivoting,” say Nick Mabey, head of E3G, a climate charity. “Everyone kind of points fingers, like ‘there aren’t enough projects’ or ‘there isn’t enough money’. But the system is broken, and how do you fix the system, that is the real question.”

Traditional development banks have not really risen to the challenge. “Just putting climate money through current development architecture will not get the impact that you need,” says Mabey. “This money needs to be used to help systemic reform, rather than just plugging a few gaps.”

These arguments over climate finance will provide the backdrop to COP26.

- Donor countries are making a major push at COP26 to boost the sums involved — Japan, Italy, the UK and Denmark have all raised their climate pledges in Glasgow.

- More private funding is coming to tie in with climate-related projects.

- And a new pool of tens of billions of dollars is being announced by multilateral development banks, with a special focus on helping countries quit coal.

A plan to redistribute special drawing rights to developing countries, to help fight climate change, is also under discussion. The IMF said last month that it would create a new trust for up to $50bn in reallocated SDRs.

“The climate finance will happen [eventually],” says Yannick Glemarec, head of the Green Climate Fund, which was set up by the UN to help distribute a portion of the $100bn. “The problem is, will it happen fast enough to avert catastrophic climate change?”

The origins of a target

One of the challenges with the $100bn target is simply how to define it, and who gets to decide what “counts” and what doesn’t.

“That’s the real $100bn question — what is climate finance? And no one has a real claim on that,” says Tracy Carty, climate change policy lead at Oxfam. She says that donor countries use this to their advantage.

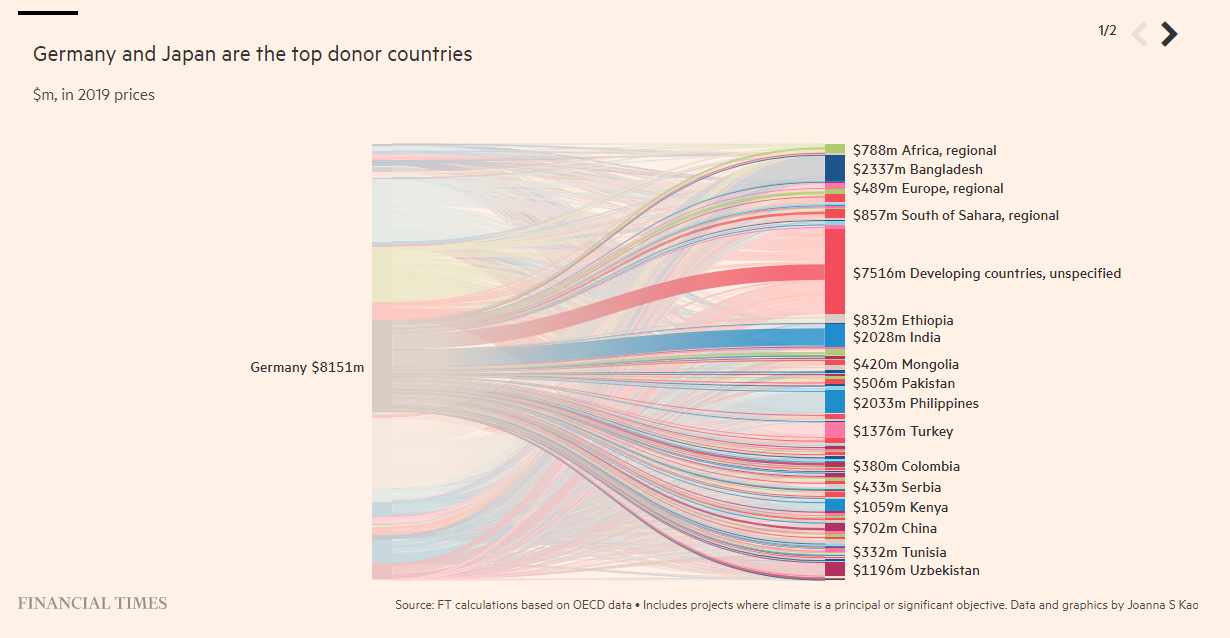

The OECD, a club of mostly rich countries, issues an annual report on climate finance that tallies what donor countries have “mobilised” — including grants, loans, and export finance credits — from both public and private sources.

Many developing countries think that definition is too generous, but it is still short of the $100bn goal: OECD figures showed that climate finance reached just $79.6bn in 2019.

Calculations from Oxfam suggest the true level of climate-specific grants is about one-fifth of the OECD “climate finance” numbers, once loans are taken out.

As the total level of climate finance has expanded in recent years “that increase has been on much harder terms for developing countries,” says Carty. The amount of grant funding has increased much more slowly than the amount of loan funding, she explains.

The origins of the $100bn target lie in the COP negotiations that took place in 2009 in Copenhagen.

The $100bn figure is also part of a much longer legacy, one that goes all the way back to the inception of the UN climate change framework, at the Rio Conference in 1992. The concept that rich polluting countries should pay to help developing countries fight climate change has been a core part of the grand bargain that lies behind every climate treaty.

That hasn’t always gone well though. In the Kyoto protocol, an elaborate system called the Clean Development Mechanism was introduced, which helped to channel hundreds of millions of dollars into climate-related projects in the developing world.

Abuses of the system, which was similar to a carbon offset market, were rampant.

A 2017 study by the EU found that 85 per cent of Clean Development Mechanism projects examined failed to have the expected emissions impact.

When climate projects go wrong, it’s doubly bad, because it is a waste of money and also bad for the planet, says Brice Böhmer, head of programmes at Transparency International, which recently launched a corruption tracker for climate and energy projects.

“We need to have much higher standards because if these investments are less, the consequences are terrible,” says Böhmer. “If it is a project that is supposed to reduce emissions, or a project that is supposed to help a population adapt, this is like penalising them twice.”

The $100bn goal took a slightly different approach: channelling funding through existing aid programmes and development banks, allowing donor countries to self-report to the UN each year on the funding they had mobilised.

The UN also launched a dedicated institution — the Green Climate Fund — to help distribute the $100bn. The GCF became the largest climate-specific fund in the world, having raised about $18bn since its inception in 2010.

But the GCF has had a chequered record. Beset by infighting on the board, and accusations of mismanagement and abuse from staff, it has been less effective than many of its early backers hoped.

And once funding from donor countries started coming in 2014 — the GCF raised $10bn in its first fundraising — the board decided not to hedge its exposure to the currency fluctuations between the currency that pledges were made in, and the US dollar (the currency for GCF operations). By 2018, $1bn had been wiped off the dollar value of the fund as a result.

One former board member, Tosi Mpanu-Mpanu, says the rich countries backing the GCF were “willing to turn a blind eye” to the mismanagement.

Access the original publication to read about the other indicators.

“If it was an African country, losing that much money would be a big deal,” he says. The slow pace at which funds are handed out is also to blame, he adds, echoing a complaint made by many developing countries. “If the money had been dispersed right away, maybe the loss would have been less.”

Glemarec says that the $1bn was not a “loss” and that currency fluctuations are normal. “By the time [the pledges] were translated into signed contributions, the dollar had significantly appreciated,” he explains. The GCF is considering whether to adopt a hedging policy next year.

The GCF has not achieved its goal of working with local institutions: its biggest grantees are the UN Development Programme, and the EBRD, both giant development organisations that are already well-funded. Two of the UNDP projects awarded by the GCF are under internal investigation after corruption allegations were raised.

“The way climate finance is being dispersed now is through huge institutions, and big red tape,” says Mpanu-Mpanu, who is a climate negotiator for the Democratic Republic of Congo. He points out the administrative overhead is also significant for these big multilateral institutions. “In the meantime, runaway climate change is happening.”

Is it working?

Climate finance has been beset by the same challenges of waste, corruption and inefficiency that have plagued traditional development aid.

In some ways, getting climate finance right is harder: people who work in the industry always say that the goal of climate finance is to be “transformative” and to trigger systemic changes, rather than just to build buildings and bridges.

But those goals are much harder to measure. Projects that aim to cut emissions — known as “mitigation” projects — typically compare their results against a hypothetical baseline of what emissions would have otherwise been. The results can often be subject to tricks of accounting: if $10m is invested in a better bus system in Hanoi, how do scientists measure how much emissions have been avoided?

When it comes to adapting to a warmer world, those projects can be even trickier to gauge, because they are based on projecting the likelihood of future events, which are highly uncertain.

Mushtaq Khan, professor of economics at Soas, says that because climate projects are often trying to prepare for risks that are in the distant future, or threats that are perceived to be very far away, it can be harder to monitor them.

His research found that one-third of the funding for climate adaptation projects in Bangladesh was lost to embezzlement. Countries with high levels of perceived corruption also tend to be among the most vulnerable to climate impacts, according to Transparency International.

“It is hugely politically incorrect to combine statements about climate change and corruption, because it looks like you are giving an excuse not to fund,” says Khan.

Khan thinks better monitoring by local communities can help, but acknowledges that this is not usually the way that big development banks design their programmes.

“To say that there is a lot of wastage and corruption, should not be an excuse for saying, oh well this is not going to work, let’s not do it,” Khan continues. “As the flows [of climate finance] are ramped up, a lot of it is likely to be wasted, if we don’t get our heads together and think of out-of-the-box ways to reduce leakage [from corruption].”

No one has tried to measure the total impact of the portion of the annual $100bn that has been spent so far.

Amar Bhattacharya, a researcher who chaired a recent UN report on the $100bn climate finance pledge, says this is an area where more research needs to be done.

“To date there has been very little impact measurement,” says Bhattacharya, a senior fellow at Brookings. “It is a very important issue.”

“People look at impact in terms of the composition of finance, things that relate to the financing side. But in terms of real impact of climate finance, and efficacy across different donors, there has been no development impact or climate impact study done to date,” says Bhattacharya.

The next round of funding

At COP26 a major topic of discussion is not only the $100bn — but also how to redirect financial flows from all sources and channel them toward cutting emissions.

“It is indisputable that there is capital out there, but is the capital going to where it needs to go? That is the problem, the capital is not going where it needs to go,” says Mafalda Duarte, chief executive of the Climate Investment Funds (CIFs).

A new wave of money is starting to head towards more climate projects. Some of this is starting to come from private sources — one example is a $600m BlackRock fund for climate projects, which is paired with government funds that take the risk out of the investment.

Public investors are starting to rethink their approaches: The CIFs is raising a $2bn fund from rich countries including Canada, Germany and the US, to help countries transition out of coal. Duarte says it will use this money to leverage funds from other public and private investors, so that every $1 from CIF brings in $10 from others.

Another potential big source of new funding could come from the “Article Six” negotiations at COP, which will iron out rules for global carbon markets.

That will put in place a system by which polluting countries transfer millions or billions of dollars for carbon-reducing projects in other countries. Done right, it could help lower emissions and send climate finance in the right direction.

But done wrong, it risks re-creating the same problems that plagued the earlier Clean Development Mechanism. If negotiators leave a lot of loopholes in the carbon market rules, such as allowing countries to double count their emissions, then the system could push emissions up rather than reducing them.

Still, developing countries warn that it may all be too little, too late. In Glasgow, negotiations will start over how to set a bigger climate finance target for 2025, even before the $100bn has been reached.

All this will come to a head in the next few days. As a political issue, the funding will be keenly debated. Even though there are questions about whether the money can be spent effectively, and how it should be distributed, politicians and activists admit that no one has found a better solution. However imperfect it is, climate finance is a central part of fighting climate change — and also the hardest to fix.

Originally published at https://www.ft.com on November 3, 2021.

Names cited:

Molwyn Joseph, minister of the environment for Antigua and Barbuda;

Narendra Modi, Indian prime minister;

Josué Tanaka, who helped launch the climate finance unit at the European Bank for Reconstruction and Development;

Nick Mabey, head of E3G, a climate charity;

Yannick Glemarec, head of the Green Climate Fund;

Tracy Carty, climate change policy lead at Oxfam;

Brice Böhmer, head of programmes at Transparency International;

Tosi Mpanu-Mpanu, One former board member,

Mpanu-Mpanu, who is a climate negotiator for the Democratic Republic of Congo;

Mushtaq Khan, professor of economics at Soas;

Amar Bhattacharya, a researcher who chaired a recent UN report on the $100bn climate finance pledge;

Mafalda Duarte, chief executive of the Climate Investment Funds (CIFs).