Investors expect the total dollars invested in digital health in 2023 will be between $15 billion and $25 billion

institute for health transformation

research, strategy and advisory

Joaquim Cardoso MSc

January 18, 2023

SOURCE:

PR News Wire

Dec 01, 2022

Investors in the healthcare technology space believe a measurable return on investment (ROI) and clinical validation of the technology’s platform …

… will be the greatest indicators of company success in 2023, according to a new survey of top digital health investors by GSR .

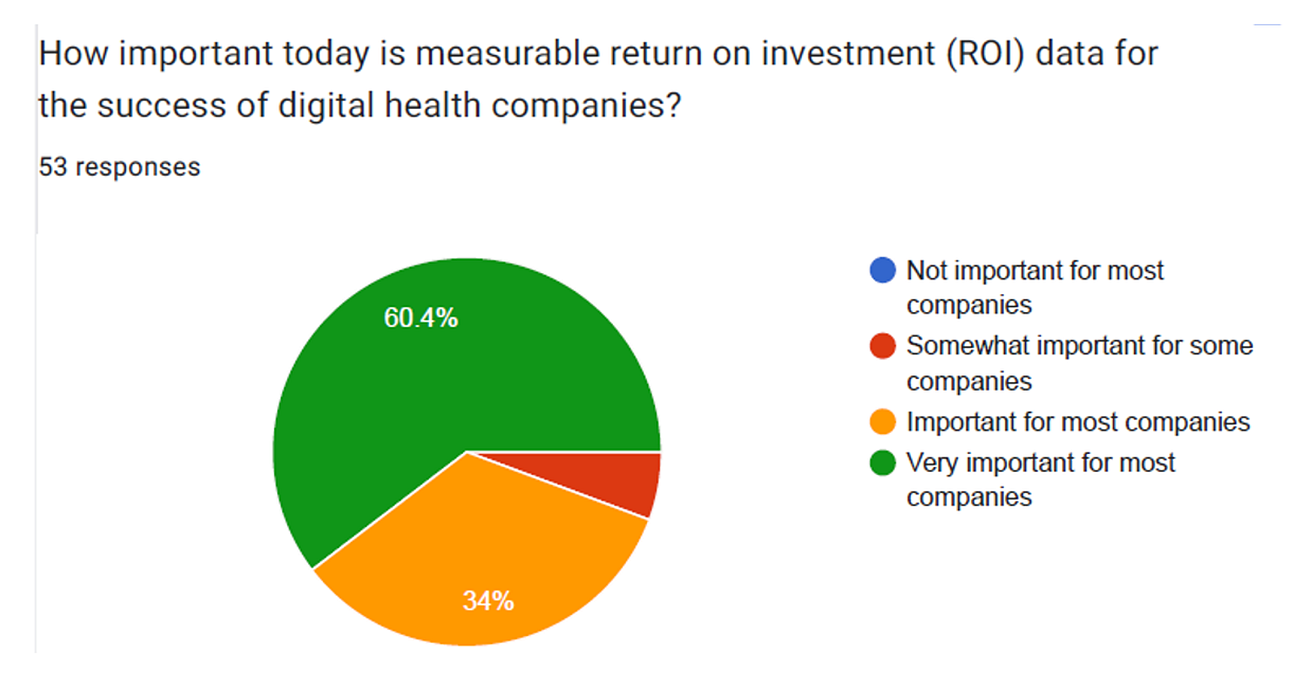

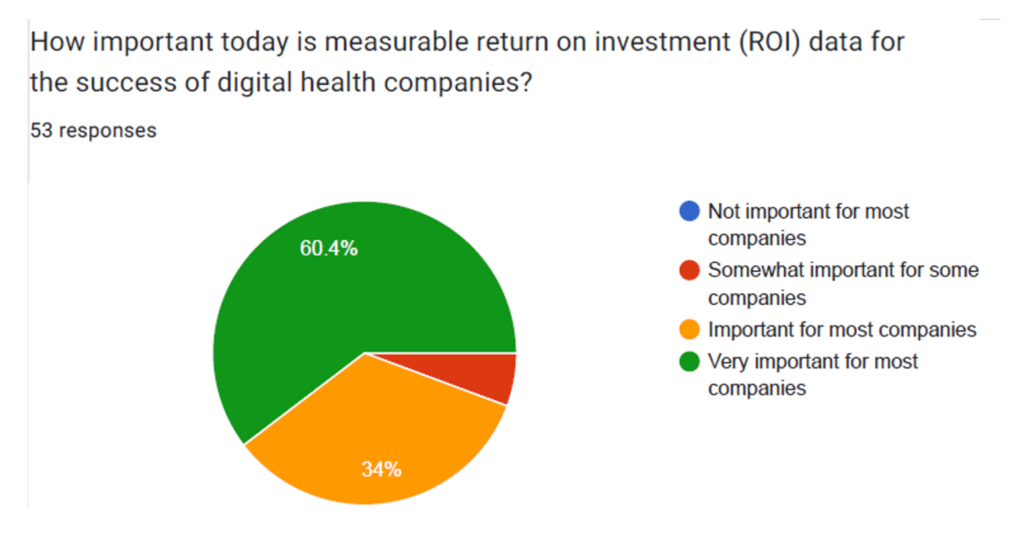

ROI was deemed “important” or “very important” to the success of digital health companies by more than 94% of investor respondents, and 79% for clinical evidence and trials.

“Generating a strong ROI has always been paramount for health tech startups and we’re seeing that even more emphasized in the current environment as purchasers prioritize their spending on solutions with the strongest value proposition,” said Dr. Sunny Kumar, a Partner with GSR Ventures.

“But we were most excited to see the vast majority of respondents also highly value clinical validation, which we believe is the best signal of patient value and historically has been under-captured in digital health,” he added.

More than 50 digital health venture capital investors responded to the survey from GSR Ventures, an early-stage digital health venture firm with over $3.5 billion under management.

Questions ranged from the volume and valuations of deals this year compared to previous years to industry opportunities and the sectors of most and least opportunity for startups.

Among the key responses:

- Investors expect the total dollars invested in digital health in 2023 will be between $15 billion and $25 billion

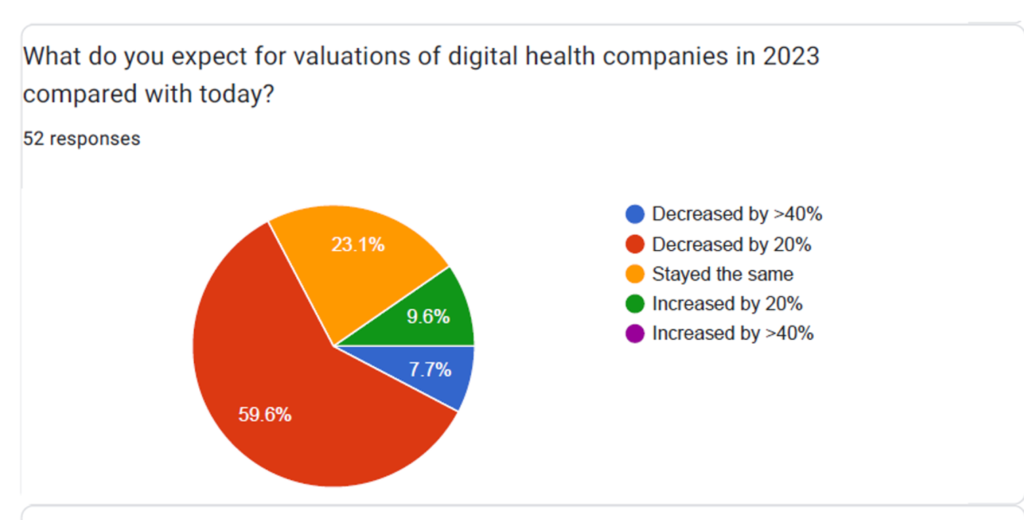

- The largest group of investors believe valuations will be down again next year by around 20% for seed stage investments and down by 20% to 40% for Series A and Series B+ investments

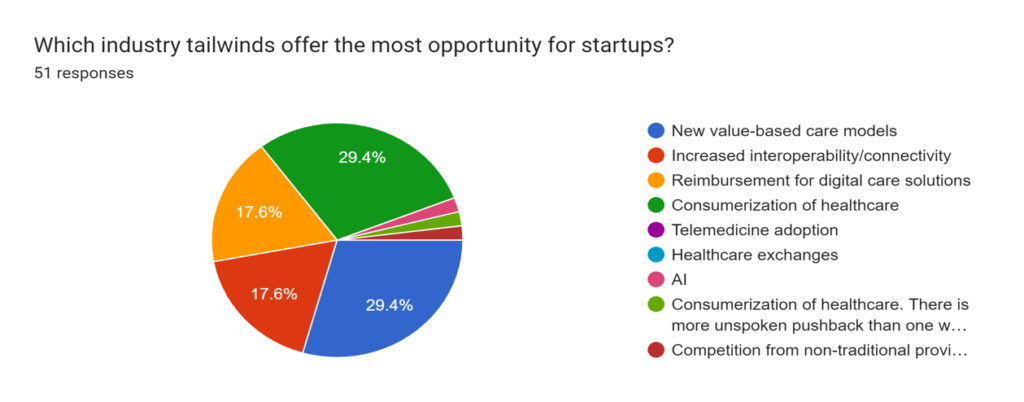

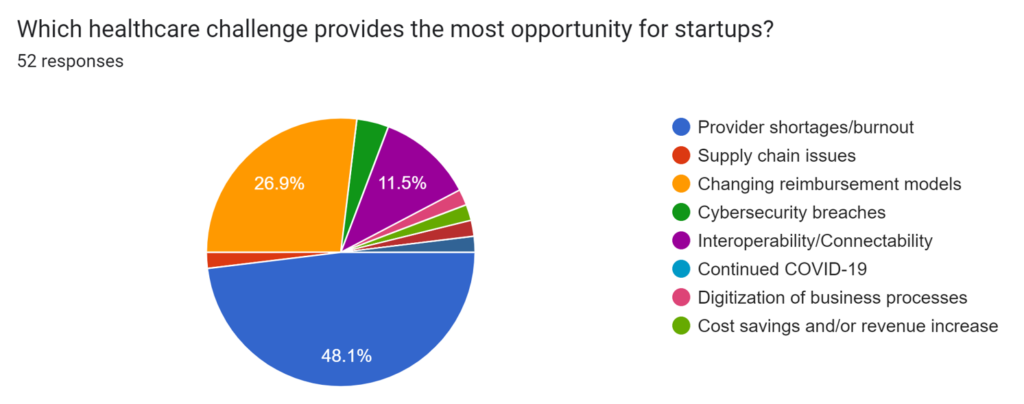

- Provider shortages/burnout were identified as the challenge providing the most opportunity for startups (48.1%), followed by changing reimbursement models (26.9%) and interoperability (11.5%)

- Investors overwhelmingly believe that oncology (51%) is the most promising clinical space for startups, followed by mental health (37.3%), neurology (27.5%), and primary care (23.5%)

“While digital health investors still believe valuations will drop in 2023, most still believe the overall ecosystem is quite healthy and investment levels will be comparable to the past few years at $15–25B” said Dr. Justin Norden, a Partner with GSR Ventures.

“Further, it’s great to see investors place increasing importance on clinical validation which is going to be essential as startups go after these areas of huge opportunity such as oncology and provider burnout.

Thanks to all of our digital health VC partners who contributed their time and opinion so we can better understand the field.”

“While digital health investors still believe valuations will drop in 2023, most still believe the overall ecosystem is quite healthy and investment levels will be comparable to the past few years at $15–25B”…

Originally published at https://www.prnewswire.com.

Names mentioned

Dr. Sunny Kumar, a Partner with GSR Ventures.

Dr. Justin Norden, a Partner with GSR Ventures.

INFOGRAPHIC

The investors also ranked sectors holding the most promise in digital health for 2023; these are expected to be:

- AI/machine learning (45%)

- Healthcare data and analytics (37%)

- Remote patient monitoring (29%)

- AI drug discovery and clinical trial technology (each at 27%), and,

- Interoperability (22%).