BCG – Boston Consulting Group

By Rahul Guha, Abhinav Verma and Natasha Prakash

BCG x IPA – Innovation, Quality and Global Reach

15 June 2020

Key Messages:

- Due to the unprecedented nature of the pandemic, traditional channels of interaction between patients, prescribers, healthcare companies and pharmacies have been disrupted, as depicted in Exhibit 1.

- While healthcare companies have successfully identified and responded to the immediate needs, they recognize the need to rethink and redesign their commercial operating model for the future.

- This article provides BCG’s view on the 4 key questions that companies need to answer in order to design their future commercial operating model.

- What are the elements that will ensure prescriber pull for digital engagement?

- How should the new sales call be designed?

- How should companies enhance their direct connect with patients?

- What will the commercial organization of the future look like?

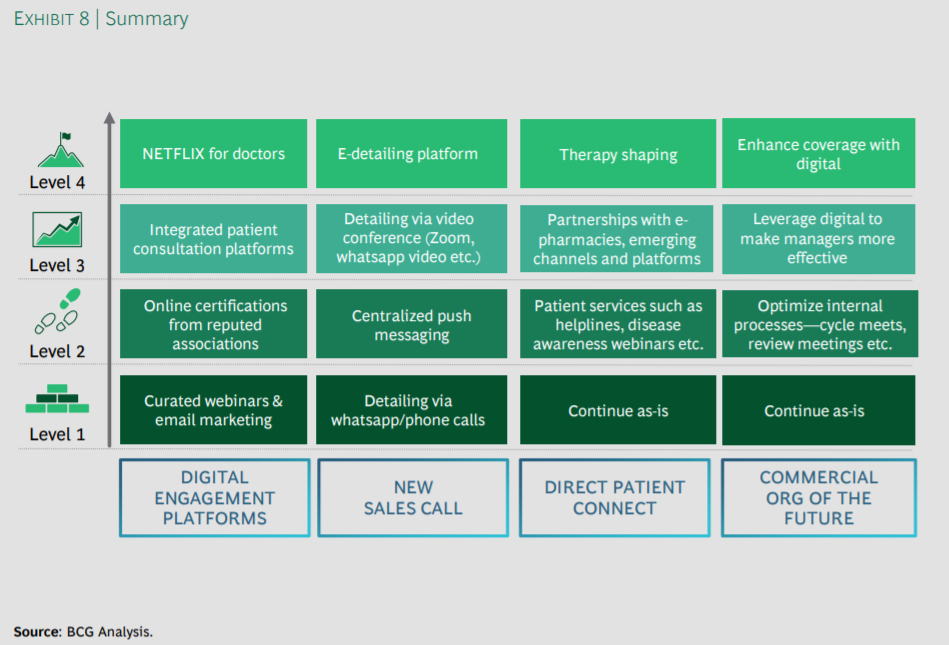

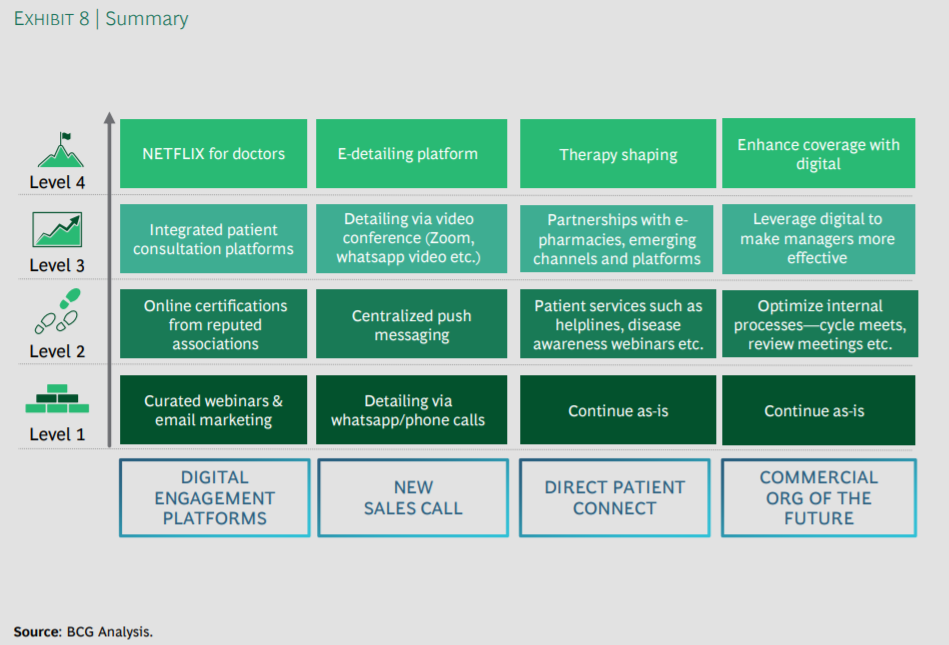

- The journey towards “Future of Work” is defined through a maturity model across the elements of digital engagement platforms, new sales call, direct patient connect and commercial organization of the future. A summary view has been depicted in Exhibit 8.

- Healthcare companies can view the above as a chessboard and decide where they want to play basis their strategy, prescriber preferences and investment willingness. For each choice, there are implications on the firm’s commercial operating model, with focus required on building new capabilities.

- Benefits will be visible through increased field force productivity and optimization of sales and marketing costs.

- Adoption of Level 4 across elements can result in an improvement of 5-6 percent in field force productivity, with a 4-5 percent optimization in S&M costs.

FULL REPORT

The healthcare eco-system today is navigating unchartered territory with COVID-19 impacting all major stakeholders.

Due to the unprecedented nature of the pandemic, traditional channels of interaction between patients, prescribers, healthcare companies and pharmacies have been disrupted, as depicted in Exhibit 1.

With no imminent respite, innovative and immediate measures have been taken across the eco-system to combat these new challenges.

The results of a BCG survey of 200 physicians across specialties in metro and tier 1 cities indicate that

- 84 percent respondents have moved to teleconsultations during the lockdown. This emerging trend has also benefited existing teleconsultation platforms such as Practo, Mfine and Lybrate.

- Patients too have moved online, with leading e-pharmacies witnessing a 100-200 percent growth in orders since the lockdown.

- Healthcare companies, meanwhile, have focused on supporting prescribers and patients in new ways, while safeguarding employees and upskilling them to operate in a changing environment.

- Results from the physician survey indicate that 98 percent prescribers spent time on digital mediums such as webinars organized by leading healthcare companies.

- Additionally, all prescribers that participated in our survey were contacted through phone / video by multiple healthcare companies.

- Firms have also embraced the digital way of executing internal processes and are focused on capability building of their field force.

While healthcare companies have successfully identified and responded to the immediate needs, they recognize the need to rethink and redesign their commercial operating model for the future.

This article provides BCG’s view on the 4 key questions that companies need to answer in order to design their future commercial operating model.

- What are the elements that will ensure prescriber pull for digital engagement?

- How should the new sales call be designed?

- How should companies enhance their direct connect with patients?

- What will the commercial organization of the future look like?

1.Digital Engagement Platforms

According to our physician survey, 61 percent prescribers found the various digital engagements conducted by healthcare companies during lockdown to be effective, and 70 percent indicated that they would like to continue the same going forward. 64 percent of this set intends to spend 30 mins-2 hours per day on these platforms.

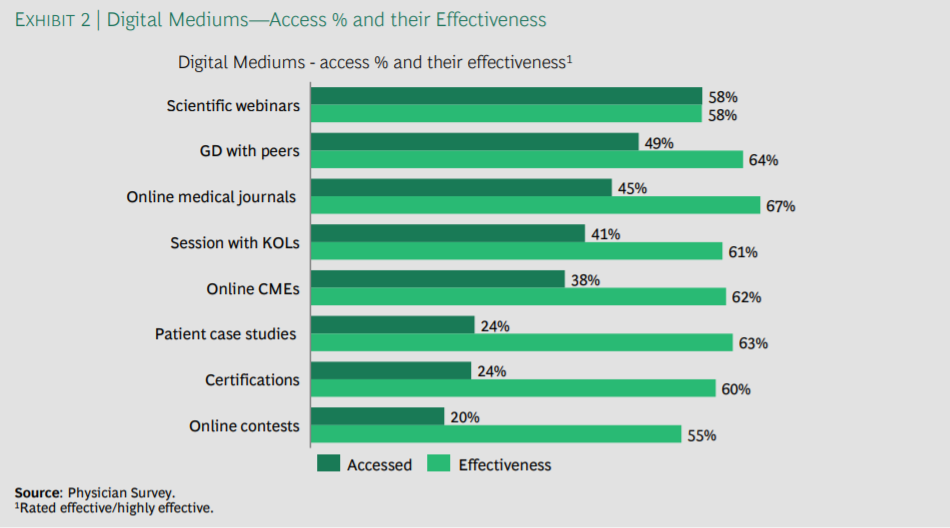

With restricted access becoming the new normal, it is imperative for healthcare companies to engage with prescribers through digital avenues. As displayed in Exhibit 2, apart from scientific webinars, prescribers find multiple other mediums effective for engagement. These include online group discussions, patient case studies, sessions with KOLs (Key opinion leaders) etc. Companies can explore these mediums going forward. However, in order to make the engagement effective and value accretive it is imperative that across each medium, companies develop high quality and differentiated content. Additionally, one should ensure that platforms are both easy to use and access.

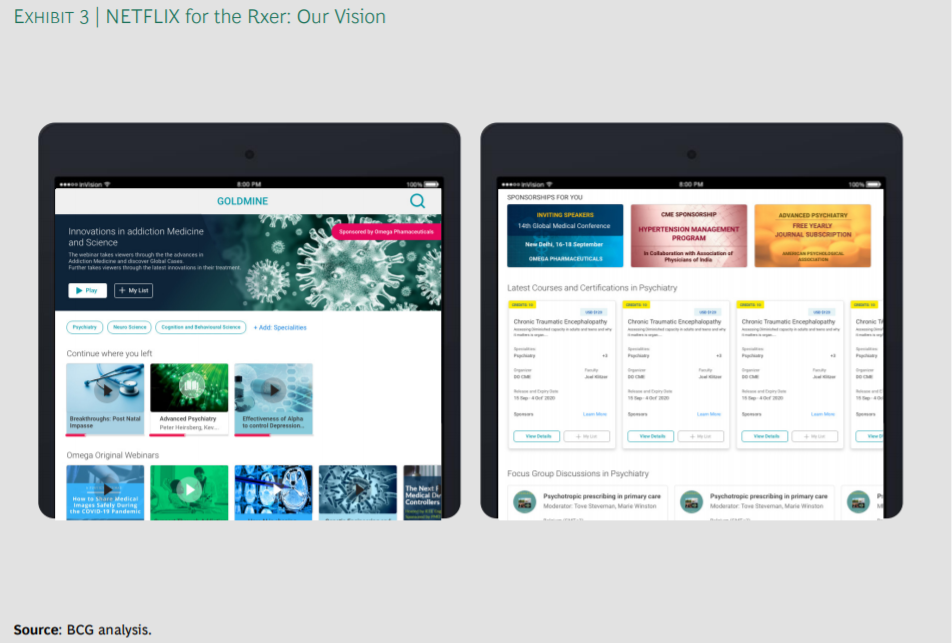

Healthcare companies, in our view, can potentially explore four different models as they pursue a sustainable digital engagement channel with prescribers. They can continue with the current model of curated webinars and e-mail marketing, or progress to a level which involves online certifications from reputed associations. Awarding of credit hours through these certifications / courses can be explored, thereby increasing user loyalty. Additionally, companies can explore engaging with prescribers through an integrated patient consultation platform. These platforms should aim to alleviate key issues faced by prescribers in diagnosing accurately and providing prescriptions to patients. The most comprehensive choice for companies is to offer prescribers a versatile platform offering variety of content and engagement across multiple channels (webinars, online CMEs, online group discussions etc.), something that can be referred to as NETFLIX for the Rxer (Exhibit 3).

There are certain implications for a firm across each choice / level of engagement. To set up and run NETFLIX for the Rxer, companies will first need to develop partnerships for content, which will require frequent refreshes. Firms will also need to enable personalized recommendations for prescribers basis platform usage to ensure good customer experience.

2.New Sales Call

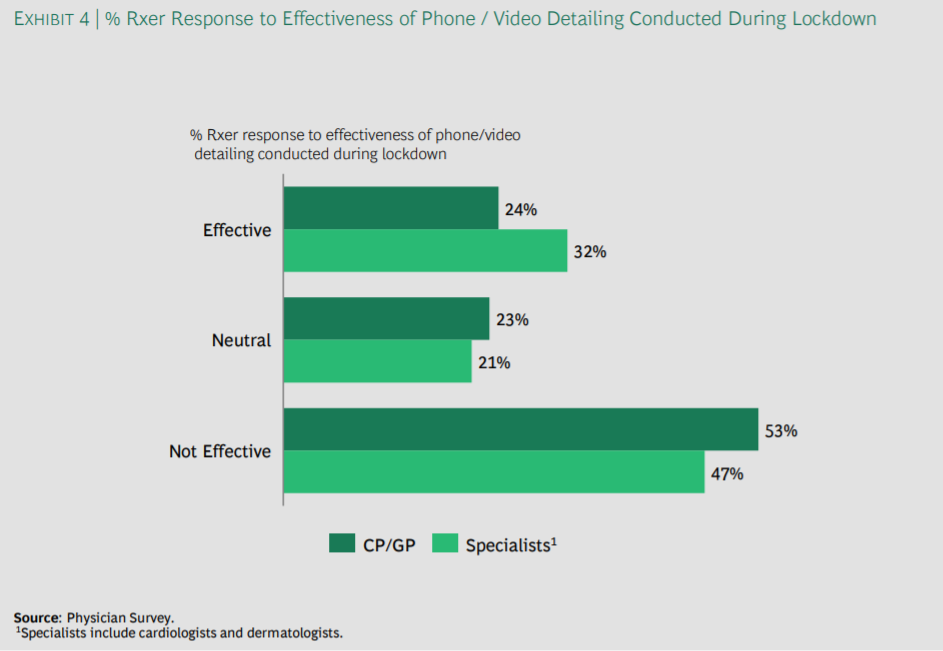

As mentioned earlier, sales teams have proactively maintained their relationships with prescribers through whatsapp / phone calls. Prescriber feedback on this mode of engagement, however, has been mixed (Exhibit 4). According to our survey, 50 percent prescribers (both GP / CP and specialists) currently don’t find this form of detailing effective. The major issues cited included a) poor field force communication during digital calls b) higher duration of phone calls and c) no scheduled time being set for digital calls. However, interestingly, 60 percent prescribers are likely to continue with virtual interactions.

In our view, it is imperative for firms to effectively adopt this model considering that the prevailing environment is unlikely to change in the near-term. ~68 percent prescribers are likely to curtail field force visits post the lockdown, with a majority restricting visits to once a month—a sharp decline from a frequency of 2 or more times in a month pre-COVID. Healthcare companies will now need to complement their physical reach models with virtual interactions to ensure that similar levels of engagement are maintained.

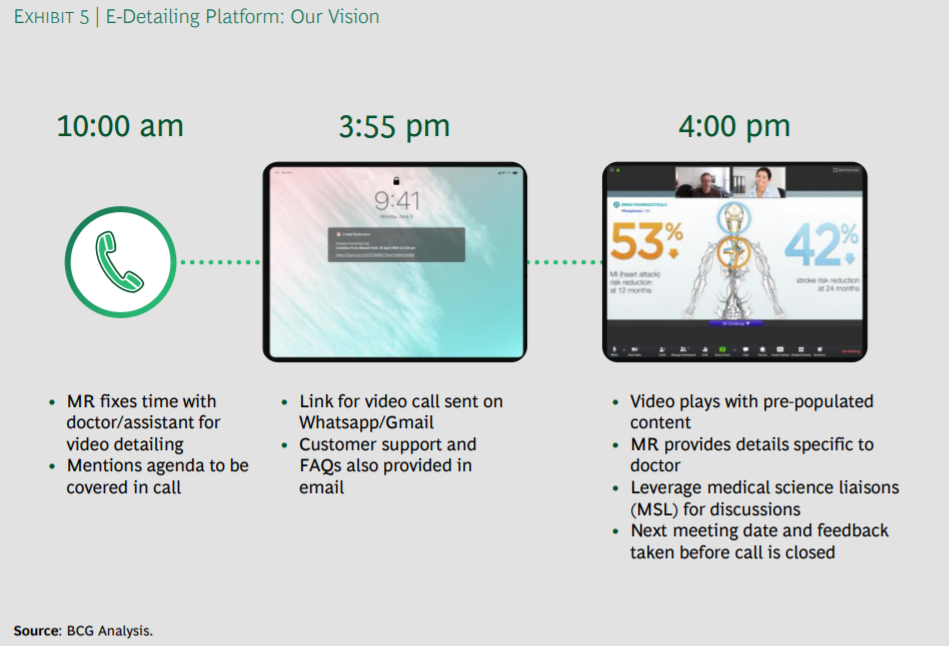

Companies can move from their current model of detailing via whatsapp / phone calls to centralized push messaging comprising consistent, repeated delivery of company / brand and scientific information. Alternatively, companies can progress to detailing via video conference—similar to an in-person call. An advanced level would be the adoption of an e-detailing platform. These platforms allow medical representatives to stream brand related content on a video call while being visible on the video link to respond to any questions. This can be executed at a time convenient to the physician. This has been depicted in Exhibit 5.

Achieving success in e-detailing will require differentiated content and delivery compared to in-person detailing. Scientific content interspersed with brand details can increase engagement. Training of field force on effective communication through digital channels will ensure consistent delivery and messaging.

Incorporation of this platform would require healthcare companies to develop partnerships and generate content specific to this medium, customized at a prescriber level. Once initial pilots have been completed, firms would need to embed these calls into the sales cycle, across planning, execution, review and coaching.

3.Direct Patient Connect

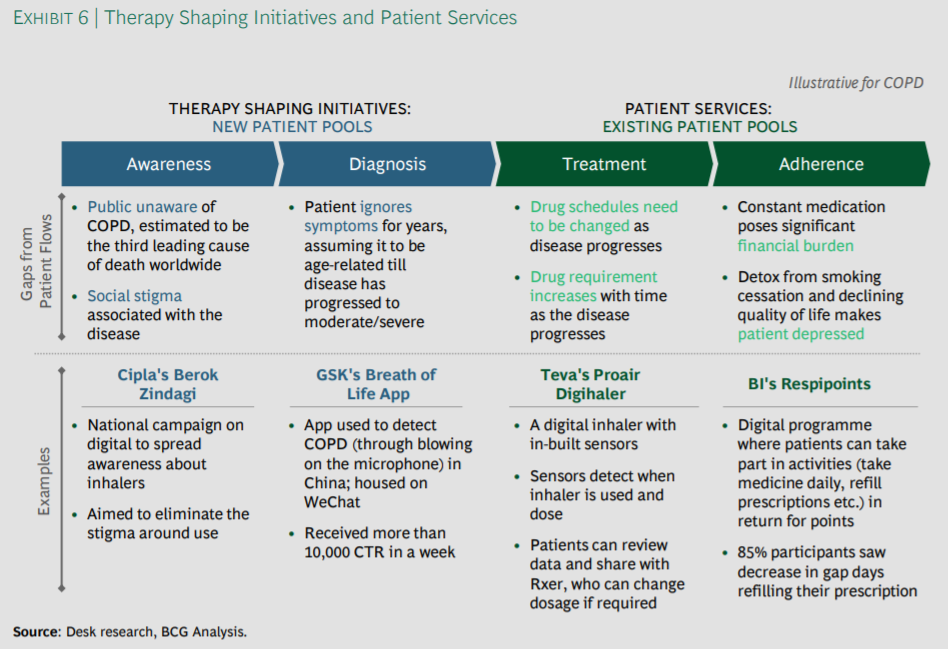

The rise of e-pharmacies and teleconsultations during COVID-19 has made it easier for healthcare companies to access patient pools. In our view, companies can engage directly with patients by enabling patient services for existing patients or developing therapy shaping initiatives for new patients.

Enabling patient services should be designed keeping in mind key patient pain points across treatment and adherence of therapy. Therapy shaping initiatives, on the other hand, are devised to drive mass scale awareness and improvements in diagnosis rate thereby facilitating access to new patients. Exhibit 6 below details the same for COPD (Chronic obstructive pulmonary disease)

To become a leader in therapy shaping, the selection of therapy plays a very important role. Healthcare companies that enjoy a leadership position in TAs (therapy areas) should prioritize diseases that have a low diagnosis rate. A separate marketing team may be established for this purpose.

4.Commercial Org of the Future

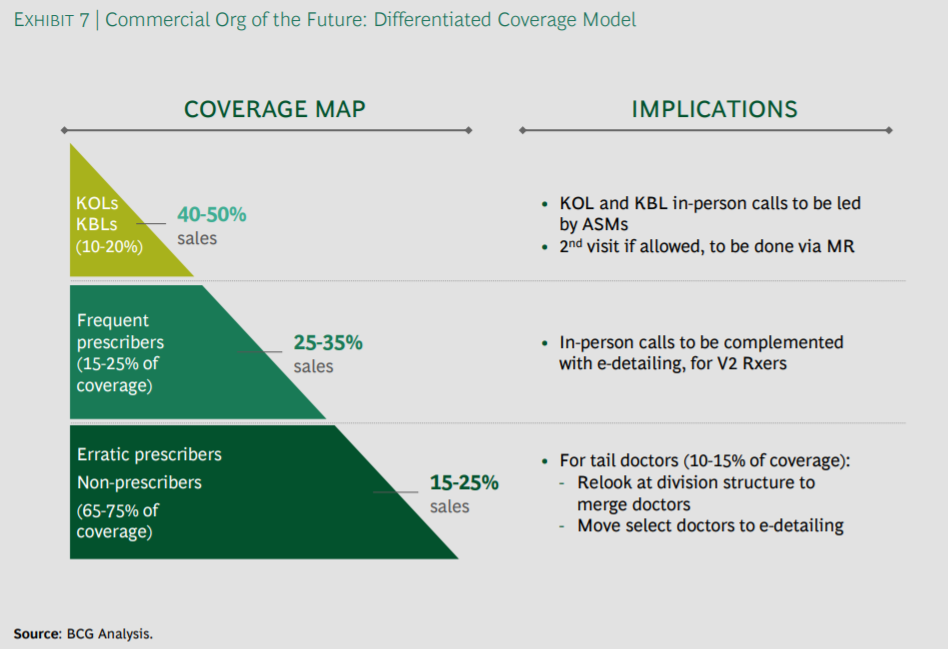

In our view, adoption of digital mediums by healthcare companies in internal meetings and reviews can be sustained even post the lockdown. In addition to current changes, firms can leverage digital to enhance the effectiveness of managers by using tools such as automated root cause analysis, execution alerts etc. Further, healthcare companies can develop a differentiated coverage model by doctor segment and contribution i.e. KOLs, frequent prescribers and erratic / non prescribers (Exhibit 7).

Adoption of such a coverage model will free up time available with the field force. This can be utilized to increase coverage amongst the non-prescribing doctors and strengthen relationships with channel partners.

At the same time, adoption will require an augmentation of current capabilities. Companies will need to focus on creating a digital COE (centre of excellence) that refreshes content. Apart from this, lead roles across E-SFE and digital marketing will need to be created. Firms can also consider establishing a team of medical liaisons to coordinate with partners and strengthen relationships with KOLs. Investments will need to be made in data and analytics, with initiatives towards data security and data management to protect privacy of all stakeholders as usage expands.

Summary

The journey towards “Future of Work” is defined through a maturity model across the elements of digital engagement platforms, new sales call, direct patient connect and commercial organization of the future.

A summary view has been depicted in Exhibit 8.

Healthcare companies can view the above as a chessboard and decide where they want to play basis their strategy, prescriber preferences and investment willingness. For each choice, there are implications on the firm’s commercial operating model, with focus required on building new capabilities.

Benefits will be visible through increased field force productivity and optimization of sales and marketing costs.

Adoption of Level 4 across elements can result in an improvement of 5-6 percent in field force productivity, with a 4-5 percent optimization in S&M costs.

About the Authors

Rahul Guha is a Managing Director and Partner at BCG, based at the Firm’s Mumbai office. He leads the healthcare practice in India.

Abhinav Verma is a Principal in the healthcare practice in India, based in Mumbai.

Natasha Prakash is a consultant in BCG’s New Delhi office.

Acknowledgements

The authors thank IPA Executive Council and all member companies for their valuable contributions. The authors thank Kanika Sanghi and Sidharth Kapil, from BCG’s Centre for Consumer Insight (CCI) for supporting design and execution of the physician survey. The authors thank Abhik Chatterjee, Amrita Chang and Shruti Sadani from the Platinion team for design of digital engagement and e-detailing prototypes. Jamshed Daruwalla, Pradeep Hire and Ratna Soni are also thanked for their support in the editing and formatting of the article.

Indian Pharmaceutical Alliance (IPA) represents 24 research based national pharmaceutical companies. Collectively, IPA companies account for over 85 percent of the private sector investment in pharmaceutical research and development. They contribute more than 80 percent of the country’s exports of drugs and pharmaceuticals and service over 57 percent of the domestic market. For more details please refer www.ipa-india.org

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we help clients with total transformation—inspiring complex change, enabling organizations to grow, building competitive advantage, and driving bottom-line impact.

To succeed, organizations must blend digital and human capabilities. Our diverse, global teams bring deep industry and functional expertise and a range of perspectives to spark change. BCG delivers solutions through leading-edge management consulting along with technology and design, corporate and digital ventures—and business purpose. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, generating results that allow our clients to thrive..

© Boston Consulting Group 2020. All rights reserved. 5/20