the health

transformation

knowledge portal

Joaquim Cardoso MSc

Founder and Chief Researcher, Editor & Strategist

April 2, 2024

What is the message?

The article explores the detrimental impact of for-profit investors, including private equity firms, on America’s hospitals, focusing on the practice of selling hospital land to real estate investors like Medical Properties Trust (MPT).

This financial maneuver has led to the closure or bankruptcy of numerous hospitals, exacerbating healthcare disparities and endangering the lives of vulnerable communities.

This summary is based on the article “The plundering of America’s hospitals”, published by Business Insider and written by Bethany McLean on March 11, 2024.

What are the key points?

Financial Exploitation: Hospitals serving low-income communities have been sold off to for-profit investors, who then sold the land beneath them to real estate investors like MPT. This resulted in hospitals paying rent on their own property, deepening their financial woes.

Private Equity Profiteering: Private equity firms like Cerberus, Leonard Green, and Apollo engaged in these transactions, extracting hefty dividends for themselves while leaving hospitals burdened with rent payments they couldn’t afford.

Systemic Impact: At least 13 hospitals have closed or gone bankrupt after their land was sold to MPT, with more closures looming. The practice has contributed to a decline in healthcare access and quality, particularly in underserved areas.

Ethical Concerns: While legal, these deals raise ethical questions about profiting from the suffering of patients and communities in need. Executives at MPT and private equity firms received substantial bonuses, further highlighting the moral ambiguity of their actions.

What are the key statistics?

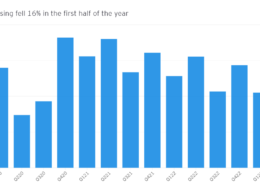

MPT acquired $16 billion worth of hospital real estate over two decades.

Steward, MPT’s biggest tenant, faced financial difficulties, unable to pay its rent, putting 2.2 million patients at risk.

MPT’s top three executives received $125 million in cash and equity grants from 2019 to 2022.

What are the key examples?

Cerberus profited from its investment in Steward, receiving a $484 million dividend while hospitals struggled and services were cut.

Prospect, owned by Leonard Green, faced financial losses despite MPT’s real estate deals, leading to unpaid bills and potential bankruptcy.

Conclusion

The article calls attention to the urgent need for accountability in healthcare financing, with Congress launching an investigation into private equity’s role in hospital closures.

While unlikely to recover lost funds, lawmakers aim to hold MPT and its partners responsible for the financial toll inflicted on patients and communities, potentially preventing future exploitation in the industry.

To read the original publication, click here.