This is an excerpt from the report “The State of Healthcare Report”, published by HIMSS @ 2021 Conference, with focus in “Digital Halth”

The State of Healthcare Report unveiled the disparities, challenges and opportunities of the healthcare industry and its stakeholders today. To gain such insight, HIMSS, along with its Trust partners surveyed more than 2,700 stakeholders, including patients, clinicians, health systems and payer organizations during March and April of 2021.

The report focuses on three main areas:

- digital health,

- financial health, and

- artificial intelligence (AI) and machine learning (ML).

Digital Health

The pandemic propelled digital health utilization to new heights, creating challenges throughout healthcare and promising lasting impacts.

By keeping close tabs on digital health trends, healthcare leaders can unearth future opportunities for innovation and proactively invest in the necessary tools and technology.

Health Systems

Health systems moved rapidly to establish telehealth offerings early in the pandemic and are now shifting focus to other use cases to gain a competitive advantage in this digitally advanced post-pandemic landscape.

- Most health systems offer digital programs,

- with nearly one-third having targeted, high-impact efforts that track key performance indicators and outcomes.

- However, 52% of providers have not progressed these initiatives beyond pilot stages.

The greatest barriers to adoption are not technology and patient demand; rather,

- 59% of respondents pointed to uncertainty over regulatory reimbursement issues and

- internal change management.

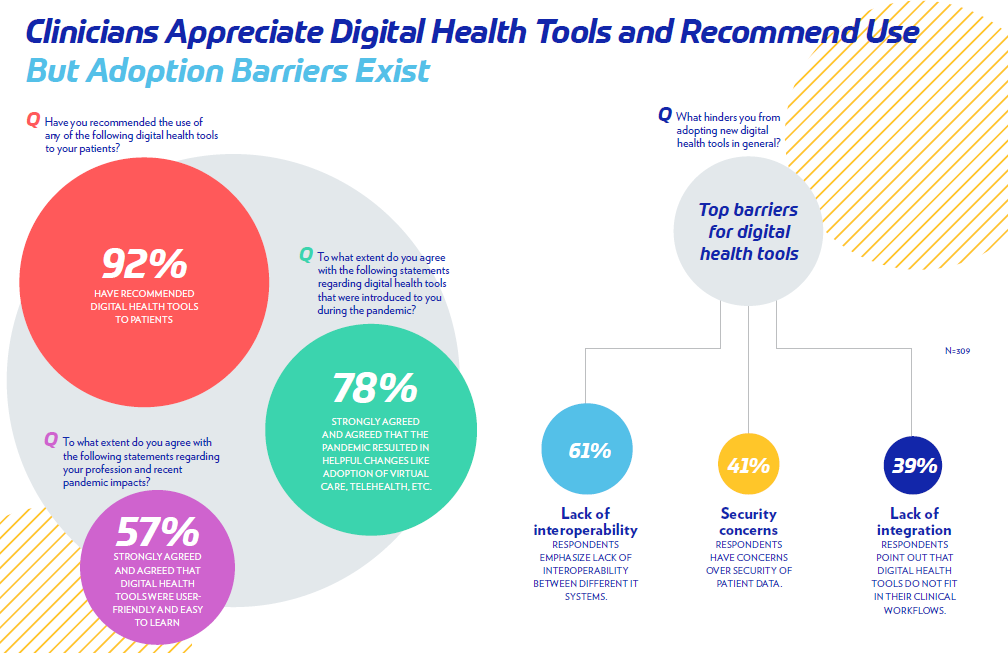

Clinicians

Clinicians adopted digital health tools at a faster pace during the pandemic, though more than 60% said the lack of interoperability between systems presents a hurdle.

- Amid security concerns surrounding digital health tools, more than eight in 10 clinicians trust their organization’s ability to protect patient health information, but this may be out of sync with the larger market as significant cybersecurity attacks continue.

- More than 90% said they have recommended digital health tools to patients and

- 78% agreed that the pandemic resulted in helpful changes like the adoption of virtual care, telehealth, and other tools.

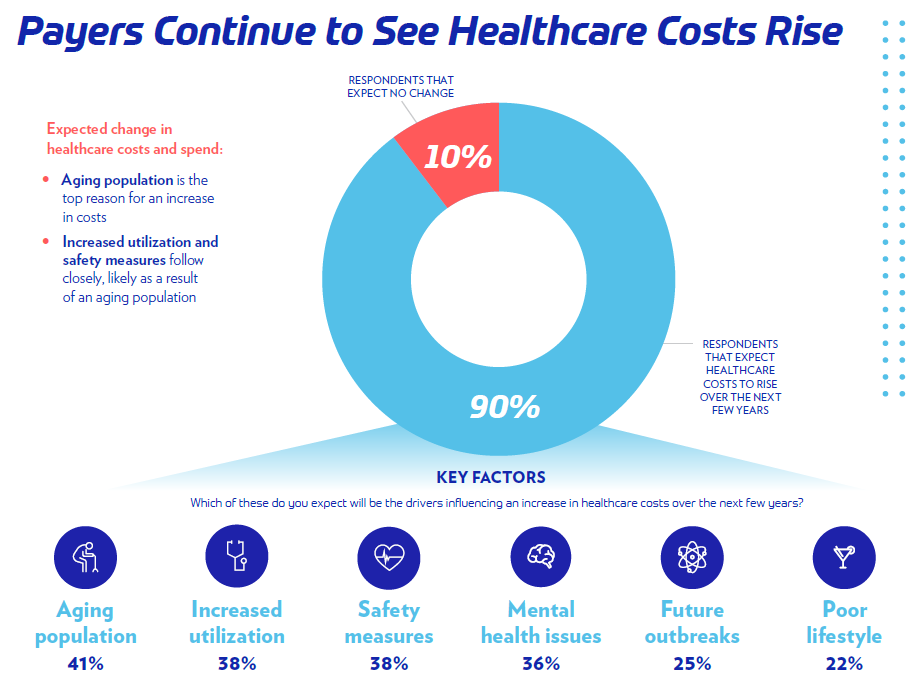

Payers

Payers shared that the future of digital health will greatly rely on government regulations and payment reform.

- More than 60% pointed to interoperability of telehealth platforms as a driver to enhance adoption,

- though 40% cited privacy and security concerns as the top barrier.

Patients

Patients were often split by generational lines in their perception of digital health but will likely demand better remote options post-pandemic, with

- 71% of younger generations (Gen Z, millennials and Gen X) saying one reason they prefer telehealth is because of convenience.

- Gen Z and millennials are resisting a return to in-person care, with 44% saying they may switch providers if telehealth options aren’t offered going forward.

1.Health Systems

Digital Health

Prior to 2020, digital health was gaining traction in the United States, but it wasn’t a primary focus for most health systems.

The COVID-19 pandemic, however, pushed the need for digital health options to the forefront.

“Now, there is broad recognition that digital is here to stay,” said Thomas Kiesau, director and digital leader for The Chartis Group, part of the HIMSS Trust partnership. “It was on everyone’s radar a couple years ago, but the pandemic really accelerated those programs.”

“It was on everyone’s radar a couple years ago, but the pandemic really accelerated those programs.”

In fact, the belief in digital is so strong that

- 70% of health system respondents said they have or are planning to establish a chief digital officer role.

- And eight in 10 providers (80%) currently have a patient portal in place — but not all are achieving the level of patient engagement that they desire.

What’s holding some systems back from adopting digital health is not technical issues — as many may think — but an overly complicated regulatory and reimbursement landscape.

“Regulatory questions aside, health system leaders are reasonably confident that technical and operational issues can be worked through,” Kiesau said.

2.Clinicians

Clinicians also showed a strong interest in digital health — so much so that 92% of those surveyed said they’ve recommended digital health tools to patients.

However, adoption barriers still exist.

“A lack of interoperability, security concerns and a lack of integration were all barriers,” Dr. Gibbings-Isaac said. “If it disturbs the way they do work or if there are issues accessing appropriate data, for example, clinicians aren’t going to use it.”

“If it disturbs the way they do work or if there are issues accessing appropriate data, for example, clinicians aren’t going to use it.”

3.Payers

Payers are focused on three main areas:

- reducing healthcare costs,

- improving care quality and

- being prepared for a future pandemic or breakouts,

according to Shreesh Tiwari, principal, ZS, part of the HIMSS Trust partnership.

In fact, most of payers’ barriers to innovation today are technological, rather than cultural, in nature.

“By now, the cultural and mental barriers to technology have been overcome,” Tiwari said. “Now, it’s about creating efficient processes in order to realize ROI.”

Interestingly, data suggests that payers will rely on health IT startups, and big tech to drive technology innovations going forward.

“Traditionally, payers and providers have been the ones to drive innovation,” Tiwari said. “But now most payers believe that innovation will come from outside the ecosystem.”

Considering that, during the pandemic, providers who operated under value-based care (VBC) arrangements have fared relatively better than others, it’s encouraging to see an overall increase in provider adoption of VBC arrangements, Tiwari said.

“There is a strong level of forward thinking and optimism in the industry across business and IT in terms of leveraging technology to improve care,” he said. “This is so heartening to see because this is where the real innovation happens.”

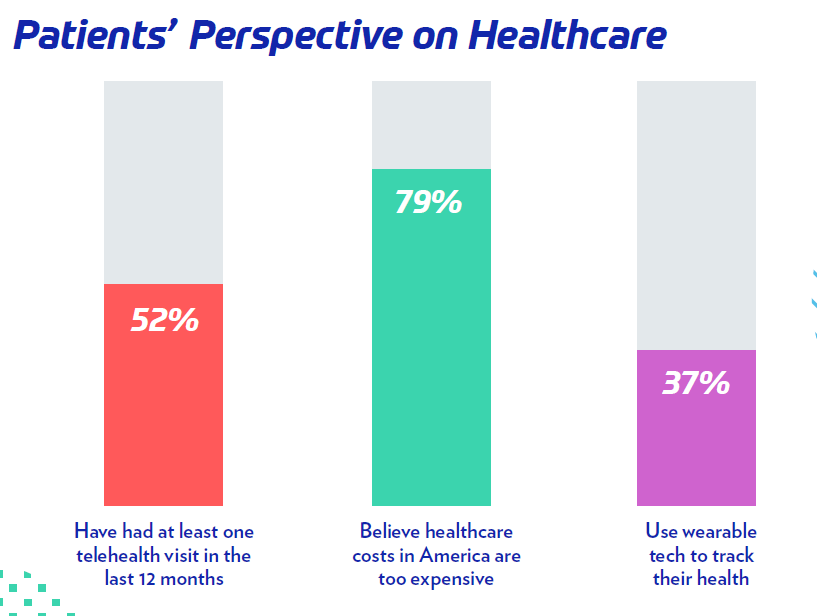

4.Patients

From January to March 2021, two-thirds of patients visited a healthcare provider, despite the pandemic.

“Overall, the sentiment is that patients want to go back to pre-COVID-19 times when it comes to their healthcare experience,” said Lauren Goodman, director of market intelligence at HIMSS. “But this feeling isn’t specific to healthcare, it’s general pandemic fatigue.”

Convenience is what it all comes down to — 65% of all patients surveyed said they prefer telehealth because of the convenience compared to in-office visits.

But how much that convenience truly matters in the long run is, unsurprisingly, split among generations.

- Nearly half of millennials said they will prefer tele-health appointments once the pandemic ends, but

- only a quarter of baby boomer patients said the same.

Interestingly, more than one in three patients currently use some form of wearable technology to track things like

- heartrate,

- pulse,

- blood pressure and

- oxygen saturation.

However, the adoption rate of wearable tech for those whose annual household income is less than $25,000 is considerably lower.

“Based on the data, there is evidence that there are some serious health disparities and real issues with health equity,” Goodman said.

While 79% of patients believe that healthcare costs in America are too expensive, 70% also say that their health insurance is a worthwhile investment.

“With the pandemic, insurance companies have flexed and accommodated for patients, including possibly not charging for COVID-19 tests or telehealth visits,” Goodman said. “Additionally, are patients grateful that, in present times, they have health insurance? Transparently, it could be a mix of things.”

Overall, the sentiment is that patients want to go back to preCOVID-19 times when it comes to their healthcare experience.

HIMSS Trust Partnership

The HIMSS Trust partnership is a consortium of leaders from across the healthcare and technology space who are collecting, analyzing and reporting on in-depth, data-driven market intelligence. Insights gathered by the Trust will unveil trends and challenges to help the industry prepare and predict for the next three to five years.

Originally published at https://www.himss.org on July 28, 2021.