Medium

Pranay Ahlawat

January 24, 2022

Today, as the speed of innovation accelerates, building market-winning products is no longer a function of adopting basic lean principles and agile development processes. Instead, companies that win and out-innovate are notable for their distinctive customer-centric strategies and product management capabilities that go well beyond just building software proficiently. With the growth of cloud and emergence of higher-level platforms, technology and engineering is table stakes for 90% of use cases, and no longer a competitive moat it once was. Best companies meet and anticipate customer needs and expectations and have coherent and purposeful processes to tightly manage product design, drive ruthless prioritization and team cross-functionally.

Only a handful of companies have consistently successful product track records because the required capabilities are wide-ranging and often difficult to build and scale. They deeply understand the customer needs, competitive dynamics and markets they are operating in. Their product management and innovation capabilities are data-driven, almost scientific. They have tight governance processes in place not just to identify attractive markets and double down on winning products, but more importantly to prioritize effectively, and pivot quickly when they’ve made the wrong move. Perhaps, most importantly, they have highly developed culture of innovation and work tireless to attract and retain difficult to find product talent.

While working closely with product and engineering executives at the software companies and interviewing more than a hundred of them, I have tried to identify the singular elements that enable the very best product organizations to excel. My conclusion is that these companies outclass their rivals because they do five things differently:

(1) They are customer obsessed and customer driven.

The notion of customer centricity is nothing new — Amazon, Apple are just two very public examples of companies that have built winning product strategies around transformative customer experiences. Simply put, the best software companies are customer obsessed. Everything they do — from innovation to strategy to operational processes — is informed by what customers want and need. Directly in the design of a product life cycle are mechanisms to take feedback from customers, including customer discovery processes aimed at surfacing unmet customer needs as well as multiple mechanisms to quickly get feedback from customers both during development and post-sales. Bill Gates famously said that the most unhappy customers are the biggest source of learning, and the best companies extend customer centricity to not just to existing, but to exited customers as well, through a mix of post-mortem surveys and focused interviews.

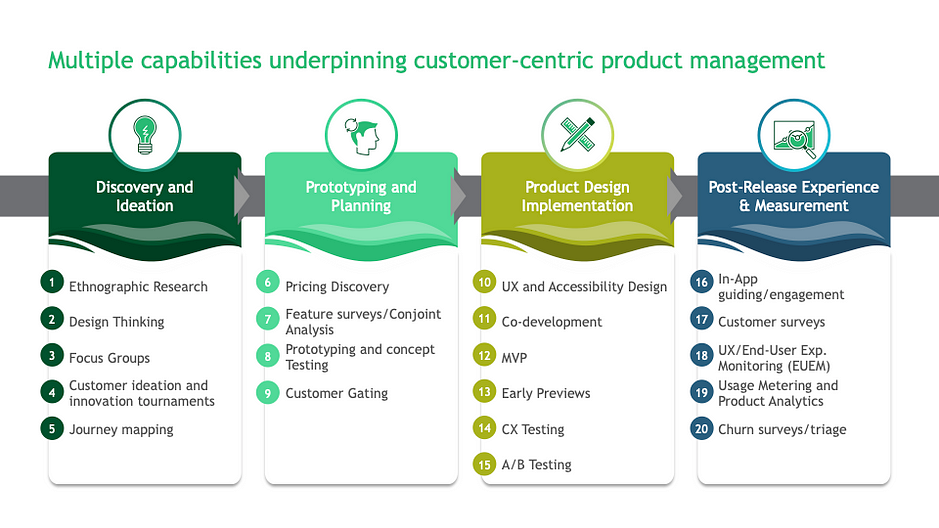

While customer centricity sounds simple in concept, its deeply rooted in the culture and backed by a sophisticated set of capabilities and process. On the broadest level, it is is a function of a well-articulated product management process. And more granularly, customer obsessed software companies invest in skillsets across the product lifecycle. They emphasize building creative design thinking, ethnographic and qualitative consumer research capabilities to drive innovation and boost customer experiences. They invest heavily in building product analytics and data science teams to measure product usage and run product experiments, including A/B testing, that can drive incremental product improvements. More importantly they track usage and have a tight post-sales feedback loop to drive continual improvement. The results of these disciplined efforts are well worth the time and capital: Gains in customer satisfaction and loyalty and better product economics as companies can take advantage of early warnings that they need to pivot rapidly by improving or shelving a product that isn’t getting traction.

(2) They are rigorous their product strategy and militant about prioritization

The best product teams are focused and this often means they say no more than they say yes. When companies enter unsuitable markets for their products or are unable to make a dent in competitor marketshare and enjoy timely returns, the culprit is often a basic lack of understanding about the market. This includes failure to adequately test customer interest in or willingness to pay for these products, poor estimates of required go-to-market investments and the time it will take to produce the product and too little clarity about competitor trends and plans. Perhaps the biggest mistake is failure to fully understand the opportunity costs to existing roadmap and product lines.

Focus is less about saying yes, it means saying no to a hundred good ideas that are there — Steve Jobs

These limitations may derive from weaknesses in a company’s market discovery frameworks, and product planning and prioritization processes. Another problem may be poor decision-making trees that give precedence to the “loudest voice” in the room or to the “highest paid” people, even if their points of view are misinformed. To make matters worse, some companies attribute poor product decisions to being “lean” and running “experiments” — to accepting some failure as the necessary precursor to success. This sentiment reflects a poor understanding of lean principles and has a very high opportunity cost. Experimentation cannot replace a coherent product strategy and well-founded product prioritization. When it comes to building winning products — looking before your leap, is often less costly and provides a better “hit rate” and consistency.

As a principle, product development should not put hands on keyboard until the company has completed a structured strategic assessment of the product and its potential. In this assessment, three actions are essential: First, be disciplined and objective in business case development. This means dispassionately evaluating the business opportunity — market size, the willingness of customers to pay, and the resources needed to build and bring a product to market. Second, take into account second order impacts beyond product development, which can include incremental marketing, sales and support costs e.g. new capability and team builds and enablement. Third, continually calibrate the market and adapt quickly as the market changes. Leverage internal and external research and a combination of usage, financial, market and operational metrics like RDI to support product prioritization, double down on winning products, and strip the portfolio of underperforming products.

(3) They understand, define and articulate the full scope of product roles and responsibilities.

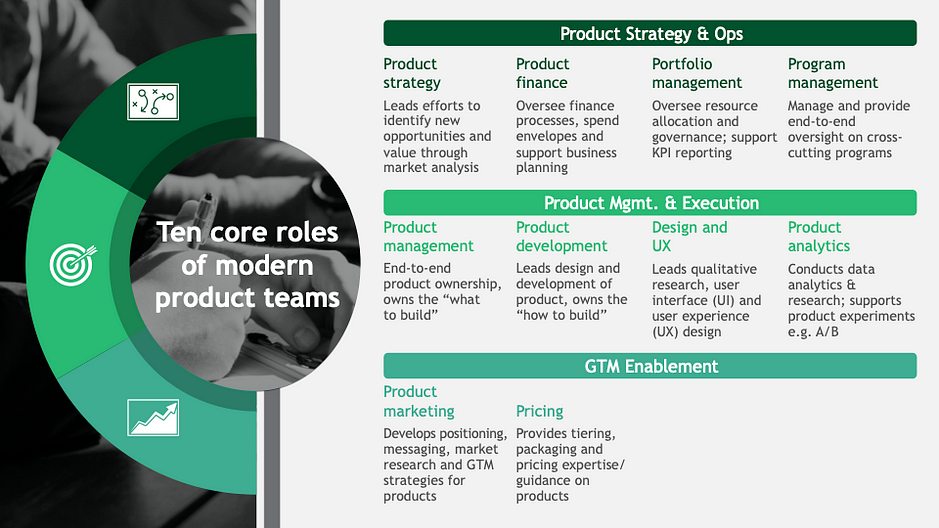

Launching a product is a complex undertaking with a hodgepodge of functions; among them, product strategy, analytics, design, development, pricing, marketing, and management. And undergirding these efforts is a complex array of processes involving strategy, discovery, planning, execution and governance. Faced with so many moving parts, most companies have permitted functions and responsibilities to overlap, particularly around product management. Generally, they have failed to establish unambiguous product roles, and clear teaming model between functions.While this approach works for early stage companies, the operating model breaks down as the company grows and scales. Without clear leadership and accountability for specific tasks, important activities and milestones are ignored or dropped completely. The outcome is a loss of product quality and delayed, unprofitable or flawed product rollouts, and worst of all a culture of finger pointing and lack of accountability.

To overcome these shortcomings, companies need to broaden the aperture of what is typically considered product management and clearly define the different product roles, responsibilities and handoffs from design to development, program to portfolio management, and from marketing to post-launch measurement. Broadly speaking, this holistic approach to a product operating model would define accountability as well as how the different teams and functions work together. The benefits can be noteworthy: an empowered product management team, improved performance, and better collaboration and teaming.

(4) They team effectively, and drive measurable product-strategy alignment

Getting product teams to stay aligned to strategy and work together at scale, is one of the biggest challenges in high growth software companies today. Often, a company’s strategic plans and its product roadmaps barely resemble each other. This is frequently because of overlapping product development and management responsibilities residing in numerous large teams, and sometimes business units that have disparate priorities and are moving in different directions. Or it could represent a leadership problem, in which top executives lack visibility into investments in new and existing products and are unaware of the how these products are impacting business results and perhaps hindering strategic goals. More often than not, poor alignment comes down to sub-optimal teaming and misaligned incentives.

In my experience, the best software companies have adopted a variety of ways to ensure strategy and product alignment. Perhaps the most the important step is to have a rigorous, annual integrated business planning process. This yearly meeting of all the relevant business units — including engineering, product management and sales — provides an opportunity to gain organizational consensus on priorities, tweak overall finance/budget envelopes, define overall business goals, and determine which new product lines could support these targets. Potential company investments for product development can be ironed out as well to link portfolio expansion to forecasted growth. Amazon with its OP meeting is a good example of a company that does this well.

Out of this, a series of measurable goals, or KPIs should be designed to drive alignment to business goals. Developed first at Intel and popularized by Google, OKRs (Objectives and Key Results) are widely accepted as the preferred mechanism to set goals and drive product governance.

While every company has a planning and some measurement process in place, the effectiveness varies significantly because of multiple reasons e.g. sub-optimal process design or implementation, lack of correct metrics and management system etc. Even so, a planning process and metrics are necessary but not sufficient. Companies need a structured way to collaborate — a teaming or interlock process must be designed to ensure that product teams are constantly communicating, not just with each other but across sales and support. Most importantly, the right incentive model is essential to drive the right organizational behavior.

(5) They are adept at attracting and retaining difficult to find product talent.

Like most things in business, success is dependent on the people in the organization. There is an adage in tech — “Average product and engineering talent is hard to find, great ones nearly impossible”. Across all roles, getting top-tier product managers is a bigger strategic stumbling block. Product managers require extensive skill sets. They must understand the product’s domain and its potential in a profound way; have engineering and technical skills to work effectively with product development; be proficient with analytics and metrics to gauge product performance and expectations; and have business skills to align the product with strategy and ensure that executives are deeply aware and support the product development effort. And they need soft skills to lead and influence colleagues in virtually all of the significant aspects of the business.

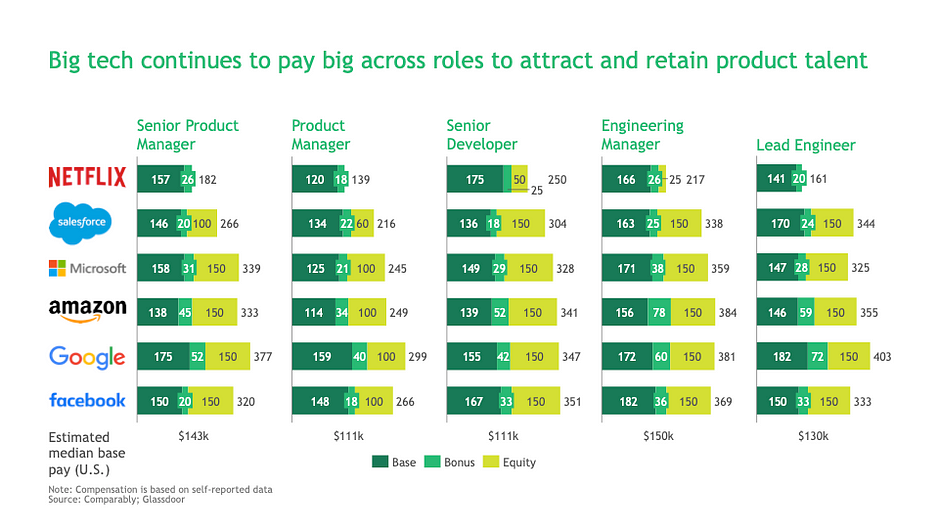

The best software companies view hiring the brightest product talent as an imperative, an essential marker of their success. As part of their approach, they are casting a wider net, and starting to recruit talent from non-traditional backgrounds — business consultants, MBA and product leaders from industries outside of the high-tech arena. Whichever capabilities these hires lack can be overcome with thoughtfully designed up-skilling and training programs. Moreover, these companies, particularly big-tech, are increasingly offering aggressive compensation and perks because retention is critical. In some cases, to overcome the inherent skill-set challenges, companies have re-designed roles e.g. dividing the product management position into two jobs — a Product Manager and Technical Product Manager. And when recruiting and up-skilling fails, companies may consider bringing in advisory and consulting help to get the project off the ground.

In the rapidly evolving world of software and tech, you innovate or die quickly. Customer centric innovation and bringing market-winning products to market does not happen by accident.

The culture of product excellence must be a constant thread that runs through everything the organization does. For the most innovative companies, product is a leadership priority and the tone of running a professional, customer-centric product organization is set from the very top. Counterintuitively, but not surprisingly, the best performing companies are often the most humble, self-critical, and most invested in continual improvement.

Killer products are rarely a result of individual brilliance, but an outcome of well-functioning, customer centric product teams, underpinned by rigorous processes, and a disciplined operating model. For the best companies innovation is highly strategic and an ever-evolving, repeatable science, which works at scale.

Originally published at