the health strategist

institute for strategic health transformation

& digital technology

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

October 11, 2023

What is the message?

A select group of intermediaries known as “big health” has become dominant and highly profitable within the American health-care system.

These intermediaries, including insurers, pharmacies, PBMs, and others, have significantly increased their presence and control in the industry over the past decade, accumulating substantial profits and market influence.

This concentration of power has raised concerns about transparency, pricing, and potential restrictions on patient access to treatments.

While some newcomers and tech giants aim to disrupt the health-care industry, they face substantial obstacles in challenging the established incumbents.

Examining America’s Health-Care System Profits and Challenges

In the United States, the health-care system is a behemoth, consuming a staggering $4.3 trillion annually, equivalent to 17% of the nation’s GDP.

However, despite this colossal expenditure, Americans face shorter lifespans and higher infant mortality rates compared to similarly affluent countries.

The most prominent beneficiaries of the America’s complex health-care system, are the intermediaries known as “big health.”

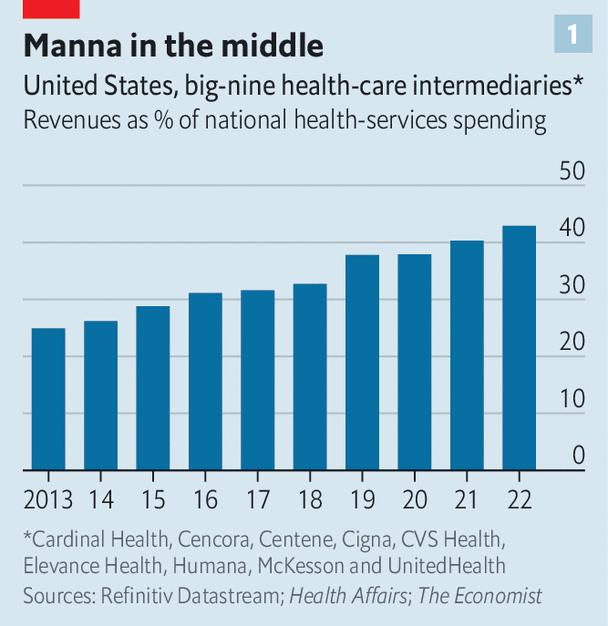

The rise of these middlemen, including insurers, pharmacies, drug distributors, and pharmacy-benefit managers (PBMs), has been significant, with their combined revenue in 2022 accounting for approximately 45% of the nation’s health-care spending, up from 25% in 2013.

Big health began as a constellation of oligopolies.

Four private health insurers account for 50% of all enrolments.

- The biggest, UnitedHealth Group, made $324bn in revenues last year, behind only Walmart, Amazon, Apple and ExxonMobil, and $25bn in pre-tax profit. Its 151m customers represent nearly half of all Americans.

- Its market capitalisation has doubled in the past five years, to $486bn, making it America’s 12th-most-valuable company.

Four pharmacy giants generate 60% of America’s drug-dispensing revenues.

- The mightiest of them, CVS Health, alone made up a quarter of all pharmacy sales.

- Just three PBM s handled 80% of all prescription claims.

- And a whopping 92% of all drugs flow through three wholesalers.

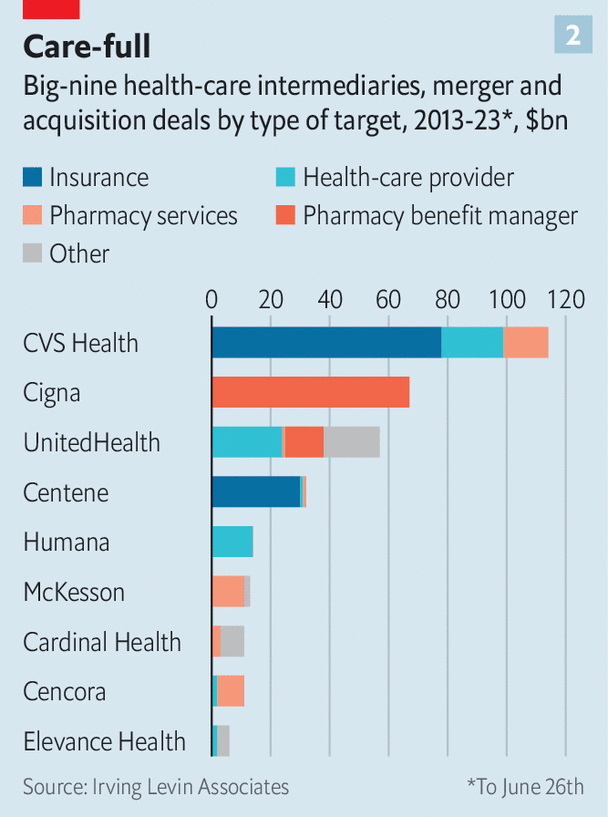

With little room left to grow in their core businesses, and trustbusters blocking attempts to buy direct rivals, the oligopolists have in recent years expanded into other bits of the health-care supply chain. Besides adding to the top line, such vertical integration is also juicing margins.

The Affordable Care Act of 2010 limited the profits of health insurers to between 15% and 20% of collected premiums, depending on the size of the health plan. But it imposed no restrictions on what physicians or other intermediaries can earn.

Examples of Big Health Impact:

- Market Dominance: The private health insurance sector is dominated by a few players, with the largest, UnitedHealth Group, generating $324 billion in revenue and covering nearly half of all Americans. This market power is reflected in the company’s $486 billion market capitalization, making it the 12th most valuable company in the U.S.

- Vertical Integration: In response to limited growth opportunities and antitrust regulations, big health intermediaries have expanded their operations by acquiring clinics, pharmacies, and other health-care providers. This vertical integration allows them to maximize their profits. For instance, the Affordable Care Act incentivized insurance companies to acquire clinics and pharmacies, potentially increasing costs for consumers.

- Oligopolistic Behavior: Big health companies have increasingly come under scrutiny for their practices, especially PBMs. Their opaque pricing structures have raised concerns, with critics arguing that they don’t pass on savings to health plans and restrict access to less profitable treatments.

- Profitability: Research indicates that health-care intermediaries have enjoyed excess returns, with annualized excess returns of 5.9 percentage points between 2013 and 2018, compared to 3.6 percentage points for the S&P 500 as a whole.

Challenges and Potential Disruption:

- New Entrants: Upstart health insurers like Bright Health Group and Oscar Health aim to offer transparent and consumer-friendly alternatives to the established players. Mark Cuban’s Cost Plus Drug Company offers an online pharmacy model that bypasses intermediaries to reduce costs for consumers.

- Amazon’s Ambitions: Amazon has ventured into health care with initiatives like Amazon Clinic, an online service for virtual consultations, and the acquisition of One Medical. With its vast logistics network and focus on customer experience, Amazon has the potential to disrupt the industry further.

However, the impact of these newcomers has been somewhat muted due to the complexity and scale of the health-care industry, coupled with the incumbents’ extensive networks and regulatory advantages.

In conclusion, America’s health-care system is characterized by significant profits generated by big health intermediaries.

While challenges and regulatory scrutiny are mounting, the entrenched players’ market power and complexities within the industry make it a formidable environment for disruption.

Newcomers face substantial hurdles in their quest to reshape the landscape of American health care.

This is an Executive Summary of the Article “Who profits most from America’s baffling health-care system?”, published by The Economist”

Infographic

Originally published at https://www.economist.com on October 8, 2023.