Christian Weiß

Heal Capital

Dec 7, 2020

Telemedicine 1.0

Telemedicine remains one of the fastest growing sectors in healthcare. With digital native patients who are comfortable in seeing their doctors online and the addition of the global COVID-19 pandemic, telemedicine’s adoption has skyrocketed. Telemedicine started out as a pure service business, offering video-conferencing tools tweaked to medical use-cases but fundamentally comparable to existing, generic video conferencing tools packaged together with integrated electronic patient reports.

Nevertheless, at Heal Capital we believe that such platforms cannot be competitive in the long run — here’s why:

On the one hand, ‘technology-only’ telemedicine providers cannot compete with the big, existing video-conferencing platforms such as Skype, Zoom, WebEx or the likes. On the other hand, they do not sufficiently differentiate from these either.

Thus, the next logical step is the integration of a curated team of doctors that offer consultations directly through telemedicine platforms. Several difficulties arise for these business models: Due to a lack of possible differentiation, no clear USP can be offered vis-à-vis existing providers. What is more, competition makes the business model questionable margin-wise, and risks resulting in a race to the bottom. Finally, the medical value of being randomly connected with unknown medical professionals is limited and only presents a good use case for a small range of patient issues.

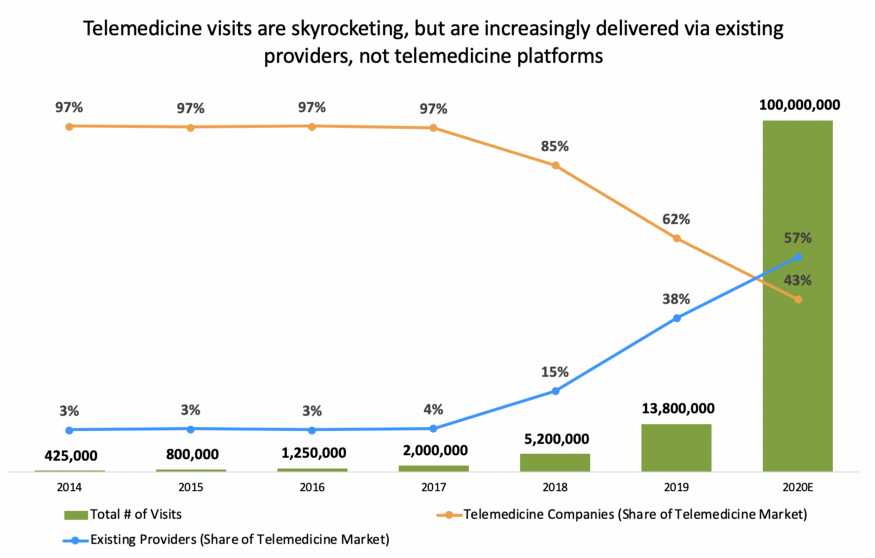

This insightful graph from Healthy Ventures clearly underlines our observations:

While the number of telemedicine visits is increasing significantly, incumbent players in the medicine market are seemingly winning the race. At the same time, there are hints that the COVID-19 based telemedicine-hype might not turn out to be as sustainable as telemedicine providers would wish: we talked to several players who indicated that the development of telemedicine visits take the form of an “inverted v-shape” — i.e. a strong increase in telemedicine-visits during the first wave of COVID-19, followed by a relatively steep decline in the last months.

Nevertheless, we are convinced that the floodgates have been opened and telemedicine is here to stay — the question is, in what form?

What’s next in Telemedicine?

We see this development being centered around technologies that are used to vertically integrate the value chain. Lately, we have been observing a number of telemedicine players that are vertically integrated from the very beginning, providing end-to-end solutions in a specific patient indication or for a specific patient issue. The latter is what we describe as Vertically Integrated Micro- PROviders, or short:. The advantage of these players lies in leveraging the strengths of classic telemedicine, while addressing telemedicine’s weaknesses through successfully adding in features like digital therapeutics (DTx) or prescription medicine (Rx) — a great example of synergies that follow the principle where “the whole is more than the sum of its parts”.

A pioneer in the VIMPROs space is HIMS, an end-to-end provider in the men’s health space. Their proposed IPO through a merger with blank-check company Oaktree with an initial valuation of about $1.6bn once more underlines the massive potential of this development. Meanwhile, we are seeing more and more VIMPROs emerge and expand into all areas of healthcare, with common treatment areas ranging from dermatology to the cardiovascular space.

How VIMPROs beat DTx and Telemedicine

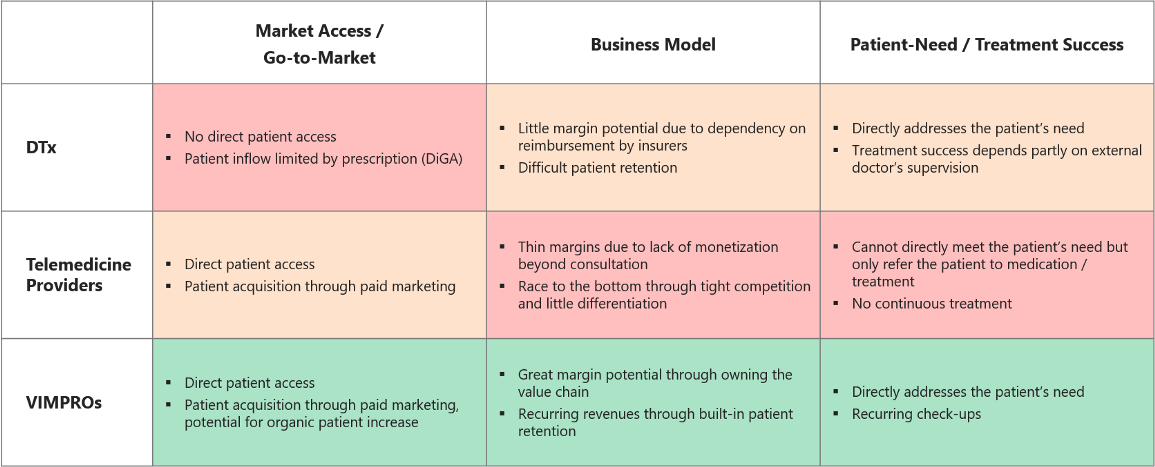

We are convinced that VIMPROs beat both digital therapeutics (DTx) and Telemedicine. Here are the three aspects that underline how:

Market access and go-to-market strategy

VIMPROs outperform both pure DTx and telemedicine companies regarding market access: DTXs’ access to patients is directly dependent on the prescription by a doctor, as there is usually no element of direct-to-patient contact involved. Telemedicine providers do have direct patient access and can increase their patient inflow through paid marketing campaigns. However, VIMPROs take this one step further: Patient inflow is not only a response to successful paid marketing, but VIMPROs can generate patients also through organic marketing by creating a strong customer brand through social media and content marketing, blog posts, customer reviews and recommendations and SEO-activities.

Business model

VIMPROs are clearly winning in terms of their superior business model: Telemedicine providers face paper thin margins that are caused by a difficult to optimize, face-to-face service component and a lack of monetization of their service beyond the consultation, after which a patient is usually lost. Additionally, the structure of the telemedicine market is characterized by high fragmentation and low differentiation, resulting in a race to the bottom. For DTx, the margin potential is better, as automation and technology can be leveraged and competitive differentiation can be achieved through product development and branding. Still, this margin is subject to the reimbursement by payers and DTx can have difficulties with patient retention, due to low patient engagement and the lack of involvement of a physician or specialist doctor. VIMPROs have great margin potential as a result of owning the whole value chain, where they can influence and optimize margins at each step. What is more, built-in patient retention mechanisms, such as regular doctors’ check-ups with continuous adjustment of patient treatments or subscription-based services regarding the delivery of products result in recurring revenues and multiplied patient lifetime values.

Patient needs and treatment success

VIMPROs outperform DTx and Telemedicine in how well they meet their patients’ needs and achieve successful patient outcomes: Telemedicine providers themselves cannot alone meet their patients’ needs — they can only prescribe the medication or treatment that they think will work best for their patient out of the existing solutions on the market. In theory, DTx are prescribed to directly address patients’ needs. However they cannot control prescription behaviour to ensure this is always the case, which makes the success of the treatment partly dependent on an external doctor’s supervision of the process and, if required, adaptation of the treatment. When it comes to addressing patients’ needs and achieving treatment success, VIMPROs tick all boxes: They directly address their patients’ needs by accompanying them through the whole process, starting with the consultation and ending at the specially developed products that they control themselves. Through recurring check-ups, they have the possibility to check in on patients’ adoption of the prescribed treatment and adapt it if needed.

How can we identify the most promising VIMPROs out there?

As we are clearly convinced of the business model of VIMPROs, how can we now find the best out of all of them? We identified five factors to assess VIMPROs:

- Is the patient’s pain point higher than the provider’s pain point?

- Is the VIMPRO operating in an indication characterized by poor patient access in the traditional system, such as waiting lists for appointments or gate-keeping through mandatory referrals?

- Is the solution offered by the VIMPRO medicalized and clinically effective?

- Is the treatment patient-centric, with the patient-doctor interaction being characterized by multiple check-ins and potential treatment adaptations?

- Is there a technological edge that increases patient empowerment and control over their disease, compared to the existing available treatment solutions?

To sum, we are convinced that in indications where the existing solutions and treatment do not meet patients’ needs, VIMPROs are the superior solution to traditional medicine, telemedicine, and DTx. Through their focus on the whole patient journey and their vertical integration of the entire value chain, they are one step ahead of everyone else. Recently, we have seen rapid development in the VIMPRO space and are excited to see what’s next. We believe that telemedicine’s development towards VIMPROs has the potential to initiate a shift towards sustainably meeting patients’ needs, and could give rise to the next unicorn in the digital health space.

Written by Dr. Christian Weiß

Managing Partner

Heal Capital

Originally published at https://medium.com on December 11, 2020.