health transformation institute

research, strategy and advisory

Joaquim Cardoso MSc

January 17, 2023

EXECUTIVE SUMMARY

Health systems are facing significant financial pressure due to dried up federal public health emergency funding, costlier inpatient stays, decreasing outpatient revenue, and decreased demand for care.

Hospitals, in particular, have taken the biggest financial hit.

- However, health systems are faring better, with operating margins for the three largest US health systems being positive for most of the pandemic, and exceeding pre-pandemic levels during the majority of that time.

- However, they are not immune to financial challenges and pressures, with rising costs, interest rates and planned cuts to Medicare payments impacting their financial outlooks.

- Health systems are also facing competition from burgeoning retail and ambulatory care centers, …

- … as well as big tech companies and virtual-first companies, who have the existing tech infrastructure and capabilities to provide patients with a more digital, consumer-friendly experience.

- This puts even more pressure on health systems to digitize healthcare delivery and invest in digital health capabilities.

Outline of the publication

- Financial Pressures Abound

- More Options, More Competition

- Steward Health Care System: Innovating around Challenges

- CommonSpirit Health: At An Inflection Point For Digital Health

- Geisinger: Prioritizing The Patient Experience

- Accelerate On The Curve

INFOGRAPHIC

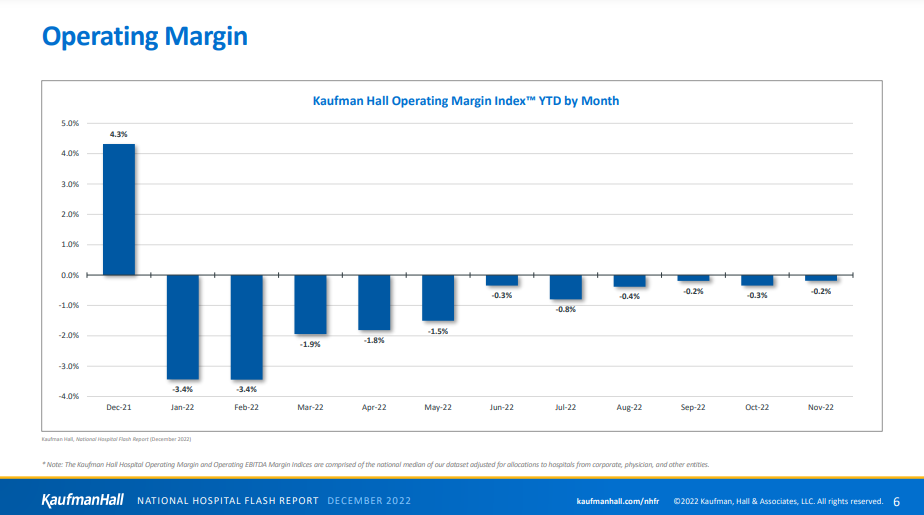

- The Median Kaufman Hall Year-To-Date (YTD) Operating Margin Index, which reflects actual margins for 900 U.S. hospitals, was -0.2% through November 2022, according to the company’s National Hospital Flash Report, with more negative months following.

DEEP DIVE

Under Financial Pressure, How Are Health Systems Prioritizing Digital Health Investments?

Forbes

Set Joseph

January 11, 2023

As big tech and retailers continue wading into the care delivery waters, it puts even more pressure on hospitals and health systems to “accelerate on the curve,” and prioritize digital health investments capable of delivering value.

In 2022, U.S. hospitals and health systems were up against some of the toughest financial headwinds since the pandemic began.

Dried up federal public health emergency (PHE) funding, costlier inpatient stays, decreasing outpatient revenue, and decreased demand for care, still hovering below pre-pandemic levels, are among the financial challenges hospitals and health systems face this year, and will continue to face into the next.

Financial Pressures Abound

Hospitals, in particular, have taken the biggest financial hit.

The Median Kaufman Hall Year-To-Date (YTD) Operating Margin Index, which reflects actual margins for 900 U.S. hospitals, was -0.2% through November 2022, according to the company’s National Hospital Flash Report, with more negative months following.

“Labor shortages, high prices for supplies, and cost increases to treat sicker patients over longer stays are ballooning hospital expenses,” said Erik Swanson, senior vice president of data and analytics for Kaufman Hall, to Fierce Healthcare.

Health systems, on the other hand, are faring better.

A recent Kaiser Family Foundation analysis found that operating margins for the three largest U.S. health systems — HCA Healthcare (HCA), Tenet Healthcare Corporation (Tenet), and Community Health Systems (CHS) — were not only positive for most of the pandemic, but exceeded pre-pandemic levels during the majority of that time, including the third quarter of 2022.

Health systems are certainly not immune to financial challenges and pressures, though.

The current economic climate, rising costs and interest rates, and planned cuts to Medicare payments are all impacting organizations’ financial outlooks — issues only compounded by having to take care of sicker patients, while dealing with the fallout from patients delaying care during the pandemic.

“There are multiple forces at work colluding to erode profitability,” says Ed Marx, CEO of healthcare consulting firm Divurgent.

Marx, a veteran health IT leader and former chief information officer (CIO) at Cleveland Clinic, sees the nursing shortage, “generally-modest reimbursement rates,” and the shift to outpatient and hospital-at-home models as adding to the “bearish reality” that hospitals and health systems have faced in recent years.

More Options, More Competition

Both hospitals and health systems continue to face competition from burgeoning retail and ambulatory care centers as well, where even traditional players are exploring new models of care.

“New entrants in the marketplace are disintermediating traditional care models, including high-tech companies such as Amazon, an explosion in street-corner retail converting to care centers, virtual-first companies such as AmWell, and finally, payers as providers,” said Marx.

Moreover, many of these newer care entrants have the existing tech infrastructure and capabilities to provide patients with a more digital, consumer-friendly experience.

And as big tech and retailers continue wading into the care delivery waters, it puts even more pressure on hospitals and health systems to up the ante when it comes to digitizing healthcare delivery and investing in digital health capabilities.

With all of these factors at play, how are health systems considering future investments in digital health?

Are health systems pulling back the throttle? And, what should digital health companies be doing to be the most attractive option?

Steward Health Care System: Innovating around Challenges

Hospitals and health systems are no strangers to small margins, but the current economic climate means there is an even greater need to be efficient operators, regardless of any payer negotiated payment rate increases, says Steward Health Care System chairman and CEO Ralph de la Torre.

Steward is the largest physician-owned private for-profit healthcare network in the country, with more than 5,500 providers and 43,000 health care professionals caring for 12.3 million patients a year.

Based in Dallas, Steward provides care globally and nationally, including across Arizona, Arkansas, Florida, Louisiana, Massachusetts, Ohio, Pennsylvania, Texas, and Utah.

Having been at the helm of Steward as CEO since 2008, de la Torre has weathered tough times before, but sees a bright spot ahead for digital health and innovation within hospitals and health systems.

“The way I see it, this environment provides young health tech companies and digital health with tremendous opportunities,” said de la Torre.

“Pressure on traditional health systems provides great opportunity for both digital health companies and organizations like Steward to digitize themselves, or in some cases, cannibalize themselves.”

“Pressure on traditional health systems provides great opportunity for both digital health companies and organizations like Steward to digitize themselves, or in some cases, cannibalize themselves.”

Regarding the latter point, de la Torre referenced Steward’s recent deal with CareMax, the now-exclusive value-based management services organization for Steward’s Medicare network, which moves care from the hospital to a lower cost, more coordinated model.

Regarding the latter point, de la Torre referenced Steward’s recent deal with CareMax, the now-exclusive value-based management services organization for Steward’s Medicare network, which moves care from the hospital to a lower cost, more coordinated model.

Says de la Torre, “That’s a patient and physician focused move that is a bet on the future of care — one we are most definitely a part of, but not in the same owned, four-walls way we had historically operated.”

Says de la Torre, “That’s a patient and physician focused move that is a bet on the future of care — one we are most definitely a part of, but not in the same owned, four-walls way we had historically operated.”

De la Torre is also encouraged by the increase in venture capital (VC) and health system partnerships, whereby health systems become the “test beds” for VC firms’ digital health portfolio companies’ offerings.

In November, VC firm General Catalyst announced a number of new health system partners, bringing its roster to 14 system collaborators.

Also in November, VC firm Andreessen Horowitz announced its partnership with rural health system Bassett Healthcare Network.

The partnership, through a16z ‘s Bio+Health Fund, creates a formal process for getting a16z-backed offerings to Bassett for consideration.

In November, VC firm General Catalyst announced a number of new health system partners, bringing its roster to 14 system collaborators.

Also in November, VC firm Andreessen Horowitz announced its partnership with rural health system Bassett Healthcare Network.

While Steward continues to invest in innovation, including new technologies like AI, much of the health system’s investment is in support of value-based care and the tenet of “right care, right time, right place,” says de la Torre.

While Steward continues to invest in innovation, including new technologies like AI, much of the health system’s investment is in support of value-based care and the tenet of “right care, right time, right place,” …

CommonSpirit Health: At An Inflection Point For Digital Health

For CommonSpirit Health — the result of a 2019 merger between Catholic Health Initiatives and Dignity Health, and the fourth largest healthcare system in the U.S. by bed size — despite reporting a $23 million operating gain in the first quarter of its fiscal year, the system ultimately had a $397 million net loss for the quarter ending on September 30.

Per the company’s Q3 earnings, persistent labor shortages and other “revenue challenges” contributed to its razor-thin 0.3% margin for the first quarter, all on the heels of a fiscal year in which the system had a nearly $1.3 billion operating loss and a $1.85 billion net loss.

Per the company’s Q3 earnings, persistent labor shortages and other “revenue challenges” contributed to its razor-thin 0.3% margin for the first quarter, all on the heels of a fiscal year in which the system had a nearly $1.3 billion operating loss and a $1.85 billion net loss.

Rich Roth, SVP and chief strategic innovation officer at CommonSpirit, sees these challenges as an inflection point.

“In many ways, today’s financial challenges necessitate the need for strategic innovation, partnerships and revenue diversification, and are a test to every system’s innovation and investment thesis,” he said.

“In many ways, today’s financial challenges necessitate the need for strategic innovation, partnerships and revenue diversification, and are a test to every system’s innovation and investment thesis,” he said.

Roth also notes the renewed urgency he sees to design innovations that can meet provider and organizational needs, while demonstrating fast impact and ROI to augment recovery efforts.

“Our strategy has always been to align deeply with operations, and thus many of the innovations we seek are in support of the problems they identify.”

Roth also notes the renewed urgency he sees to design innovations that can meet provider and organizational needs, while demonstrating fast impact and ROI to augment recovery efforts [aligned with operations]

But it’s the innovations that focus on holistically and equitably supporting patients that present the biggest opportunities for health systems.

As Roth explains, CommonSpirit’s investment in Concert Health is one way the health system is “helping reduce barriers to care access for behavioral health to better support the community need.”

Geisinger: Prioritizing The Patient Experience

“At Geisinger, our priority is patient experience,” says Karen Murphy, PhD, RN, executive vice president and chief innovation and digital transformation officer of the health system.

Geisinger is a fully integrated health system that serves central, south central and northeast Pennsylvania, as well as seven counties in southern New Jersey, to provide care to over 4 million residents.

Geisinger is a fully integrated health system that serves central, south central and northeast Pennsylvania, as well as seven counties in southern New Jersey, to provide care to over 4 million residents.

As Murphy notes, making digital health tools easy to use and helping patients navigate the healthcare environment efficiently is the main focus for the health system.

“This strategy allows patients to be seen sooner and have their medications refilled faster, and provides for easier engagement between providers and patients,” said Murphy.

As Murphy notes, making digital health tools easy to use and helping patients navigate the healthcare environment efficiently is the main focus for the health system.

“This strategy allows patients to be seen sooner and have their medications refilled faster, and provides for easier engagement between providers and patients,” said Murphy.

And the strategy seems to be working, as the number of patients using certain digital health tools at the organization is growing.

Data provided by Geisinger for the past year (ending 9/30/22) shows:

- 1.2 million Geisinger patients sought healthcare provider information online.

- 829,000 people used our patient portal (MyChart), a 12% increase year over year, submitting a total of 1.68 million requests/messages through the portal.

- Nearly 352,000 appointments were scheduled online.

- More than 368,000 prescription renewals and refills were completed online.

- $48 million in revenue was collected through online bill pay options.

Murphy says that Geisinger also continues to invest in chronic care management solutions, …

… “to leverage technology to connect with patients where they are and help them manage chronic conditions more easily.”

One example is Gesinger’s ConnectedCare365 app, which Murphy says uses remote patient monitoring, AI and patient-reported outcomes to manage chronic conditions for patients at home.

Murphy also pointed to increases in virtual care utilization since the beginning of the pandemic.

“In 2022, Geisinger providers conducted an average of 340,000 virtual visits per month in primary care and across dozens of specialties,” she explained.

Accelerate On The Curve

For digital health developers, which are seeing investment interest plummet compared to years prior, this means there is even more pressure to get things right and ultimately deliver value for their provider customers.

“The challenge for digital health companies remains the same:

If you are a single-solution provider (focused/narrow by design), you must be obviously better and more impactful in an area that really matters, than something a health system could build itself,” said de la Torre.

He also flagged that best in suite applications are usually cheaper and much easier to implement than best in breed applications.

Digital health developers are also up against an overall ebbing of interest from the all-digital, all-virtual heyday of the pandemic.

“During the pandemic, there was an insatiable appetite for any digital tool that helped to provide care in a covid friendly manner,” said Marx of Divurgent.

But in a largely post-pandemic world, these exuberant purchases are now taking a toll and executives are taking notice, he says.

During the pandemic, there was an insatiable appetite for any digital tool that helped to provide care in a covid friendly manner,” said Marx of Divurgent.

But in a largely post-pandemic world, these exuberant purchases are now taking a toll and executives are taking notice,

Marx does note that while there remains interest in digital tools that can help pull costs out of the system, and for those that directly improve clinician and consumer experiences, that’s about where it ends.

“You can see the retreat happening in previous excessive valuations and uncontested hospital purchases,” says Marx.

At the same time, hospitals that neglect to continue to invest in digital transformation may find themselves targets for acquisition.

At the same time, hospitals that neglect to continue to invest in digital transformation may find themselves targets for acquisition.

With this in mind, hospitals need to accelerate on the curve, says Marx.

“While competitors may slow down or pump the breaks, this is not a time to be timid. New entrants have the pedal to the metal, and they will continue to gain ground.”

For de la Torre, innovation is key to sustainable growth for both healthcare technology companies and hospitals and health systems.

“With the outsized impact new technology can make on hospital and health systems’ success (or failure), digital health companies need to be more agile and sharper than ever before.”

The same goes for hospitals and health systems looking to make an impact through digital health.

There are many ways to cut corners for quarterly results or short-term gains, and that’s not a winning strategy, says de la Torre.

“In healthcare, if you put your patent and employees first, and keep your eyes cast on the horizon, you will make better decisions.”

There are many ways to cut corners for quarterly results or short-term gains, and that’s not a winning strategy, says de la Torre.

“In healthcare, if you put your patent and employees first, and keep your eyes cast on the horizon, you will make better decisions.”

Originally published at https://www.forbes.com.

NAMES MENTIONED

Steward Health Care System chairman and CEO Ralph de la Torre.

Rich Roth, SVP and chief strategic innovation officer at CommonSpirit, sees these challenges as an inflection point.

Karen Murphy, PhD, RN, executive vice president and chief innovation and digital transformation officer of the health system.