The Health Strategy Blog

Joaquim Cardoso MSc.

April 8, 2022

In Q1 2022, UnitedHealth Group’s Optum division announced its plan to acquire home-based health operator LHC Group, which has a presence in 37 states and the District of Columbia.

The extent to which Optum has moved into delivery of healthcare services was evident in the statement by Optum Health CEO Wyatt Decker announcing the planned acquisition.

Decker said that the transaction “will greatly enhance the reach of Optum’s value-based capabilities along the full continuum of care, including primary care, home and community care, virtual care, behavioral health and ambulatory surgery”[2] -which includes almost everything except acute inpatient care.

Below you find two articles that give more details about Optums Strategy and History.

ARTICLE 1

What’s Next for Unitedhealth and Optum after $5.4 Billion Acquisition of Home Care Provider? | AHA

American Hospital Association

March,2022

UnitedHealth Group’s Optum is making another significant push into care delivery after its recent $5.4 billion merger agreement with home care company LHC Group. The question now is: What’s next for Optum?

The LHC Group merger, if approved by regulators, would give UnitedHealth a huge footprint in home care. To date, Humana has been the only other payer to make a significant investment in this sector. LHC, which operates 964 locations in 37 states and has 32,000 employees, says it reaches 60% of the U.S. population 65 and older with home health, hospice and home- and community-based services.

The move would complement Optum Health’s existing primary care and ambulatory surgery center operations.

But the LHC deal is just the latest in a series of huge investments UnitedHealth and Optum have made to continue their expansion into care delivery.

Late last month Optum acquired Refresh Mental Health from private equity firm Kelso & Company, roughly 15 months after the private equity firm bought the behavioral health network for more than $700 million.

Refresh has since been valued at $1.2 billion, according to an Axios report.

Meanwhile, Optum is preparing to defend its $13 billion deal for the health technology company Change Healthcare at an August trial after a legal challenge from the Justice Department over the deal.

Optum announced the planned acquisition in January 2021. Critics of the merger, including the AHA, have warned that the deal could lead to massive consolidation in health care data. The AHA in a letter to the DOJ raised concerns that Optum and Change Healthcare’s plan to divest assets that generate hundreds of millions of dollars in revenue as a way to gain DOJ approval doesn’t go far enough to resolve substantial competitive challenges.

Originally published at https://www.aha.org.

ARTICLE 2

Optum a step ahead in vertical integration frenzy

april 12, 2018

By Jeff Byers Associate Editor

Getty / Edited by Healthcare Dive

Vertical integration is all the rage in healthcare these days, with Aetna, Cigna and Humana making notable plays.

If the proposed CVS-Aetna, Cigna-Express Scripts and Humana-Kindred deals are cleared by regulators, the tie-ups will have to immediately face UnitedHealth Group’s Optum, which has been ahead of the curve for years and built out a robust pharmacy benefit manager (PBM) business already along with a care services unit, employing about 30,000 physicians and counting.

UnitedHealth formed Optum by combining existing pharmacy and care delivery services within the company in 2011. Michael Weissel, Group EVP at Optum, told Healthcare Dive the company began by focusing on three core trends in the industry: data analytics, value-based care and consumerism.

Since then, the company has been on an acquisition spree to position itself as a leader in integrated services.

“For the longest time, the market assumed that they were building the Optum business [to spin it out] and what is interesting in the evolution of the industry is that that combination has now set a trend,” Dave Windley, managing director at Jefferies, told Healthcare Dive.

“United has now set the industry standard or trend … to be more vertically integrated and it seems less likely now that United would spin this out … because many of their competitors are now mimicking their strategy by trying to buy into some of the same capabilities,” he said.

Weissel said Optum will continue to push on the three identified trends in the next three to five years, with plans to invest heavily in machine learning, AI and natural language processing.

The question will be whether and how the company can keep its edge.

What Optum is

Optum is a company within UnitedHealth Group, a parent of UnitedHealthcare. Optum’s sister company UnitedHealthcare is perhaps more well known within the industry and with consumers.

However, Optum, a venture that encompasses data analytics, a PBM and doctors, has been gradually building its clout at UnitedHealth Group.

In 2017, the unit accounted for 44% of UnitedHealth Group’s profits.

In 2011, UnitedHealth Group brought together three existing service lines under one master brand. Services are delivered through three main businesses within a business within a business:

- OptumHealth — the care delivery and ambulatory care capabilities of OptumCare, as well as the care management, behavioral health, and consumer offerings of Optum;

- OptumInsight — the data and analytics, technology services and health care operations business; and

- OptumRx — its pharmacy benefit service.

The company focuses on five core capabilities, including data and analytics, pharmacy care services, population health, healthcare delivery and healthcare operations. Services include but are certainly not limited to OptumLabs (research), OptumIQ (data analytics), Optum360 (revenue cycle management), OptumBank (health savings account) and OptumCare (care delivery services).

The Eden Prairie, MN-headquartered company has recently expanded its care delivery services, with much of the growth coming from acquisitions. The past two years have seen Optum expand its footprint into surgical care (Surgical Care Affiliates), urgent care (MedExpress) and primary care (DaVita Medical Group).

Timeline of Optum Acquisitions

1998

- UnitedHealth Group forms health IT arm Ingenix (now OptumInsight) and Specialized Care Services (now OptumHealth)

2002

- UnitedHealth Group charters Exante Financial Services and Exante Bank, a health banking platform.

2005

- UnitedHealth buys PacifiCare, a health plan which had a pharmacy benefit manager. The PBM is separated within the company and named Prescription Solutions (now OptumRx).

Feb. 2008

- OptumCare begins with Sierra Health Services, a multi-specialty clinic, acquisition.

July 2010

- Ingenix acquires Picis, a health information company.

Aug. 2010

- Ingenix acquires Axolotl, a health information exchange services company.

- Ingenix acquires Executive Health Resources.

2011

- WellMed Medical Group, a network of clinicians in Texas and Florida, joins Optum.

April 2011

- UnitedHealth Group announces Optum master brand, bringing together pharmacy services, data & analytics tools, and care delivery services under one roof.

Jan. 2013

- Partnering with Mayo Clinic, Optum unveils OptumLabs, a health data initiative.

Oct. 2013

- Optum, partnering with Dignity Health, launches Optum360, a revenue cycle management venture.

Feb. 2014

- Optum purchases a majority stake in Audax Health Solutions, a patient engagement company. Audax is later rebranded as Rally Health.

April 2015

- Optum acquires MedExpress, an urgent care and preventative care services company.

July 2015

- Catamaran, a pharmacy benefit manager, joins OptumRx.

Jan. 2017

- Optum acquires Surgical Care Affiliates, an ambulatory surgery center and surgical hospital provider.

Aug. 2017

- Optum announces it will acquire Advisory Board Company’s healthcare business.

Dec. 2017

- Optum announces DaVita Medical Group acquisition, expected to close in 2018.

It’s a wide pool, but the strategy affords UnitedHealth the opportunity to grab more revenue by expanding its market presence. For example, the DaVita acquisition, which is still pending, allows OptumCare to operate in 35 of 75 local care delivery markets the company has targeted for development, Andrew Hayek, OptumHealth CEO, said on an earnings call in January.

Optum’s strategy of meeting patients where they are and deploying more ambulatory, preventative care services works in concert with its sister company UnitedHealthcare’s goal of reducing high-cost, unnecessary care services, when applicable. If Optum succeeds in creating healthier populations that use lower levels of care more often, that benefits the parent company UnitedHealth Group as UnitedHealthcare spends less money and time on claims processing/payout.

The strategy has been paying off so far.

Three charts that show UnitedHealth’s financial health as it relates to Optum

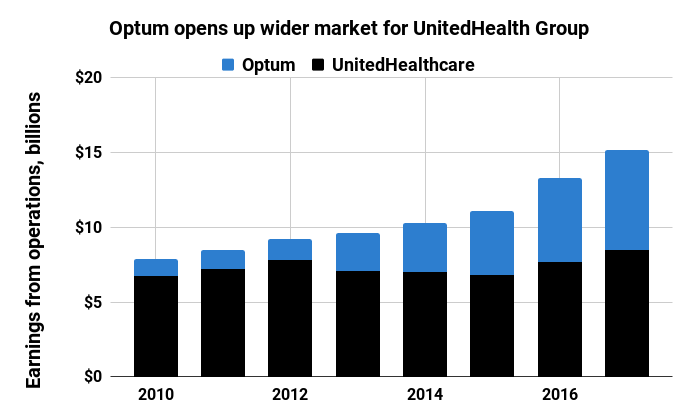

Optum’s presence has grown as it has steadily increased its percentage of profits for UnitedHealth Group.

Healthcare Dive / Jeff Byers

In 2011, the first year Optum was configured as it looks today, the company contributed 14.8% of total earnings through operations to UnitedHealth Group with $1.26 billion. That’s about 29 percentage points lower than in 2017, when Optum brought in $6.7 billion in profits on $83.6 billion in revenue.

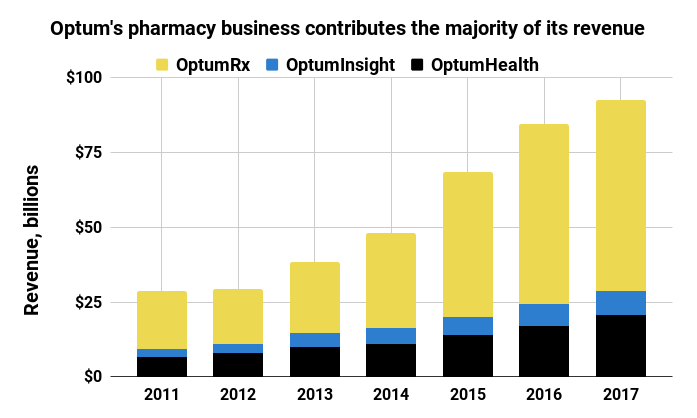

Broken down, it’s clear that pharmacy services make up the lion’s share of the company’s revenue. In 2017, OptumRx earned $63.8 billion in revenue, fulfilling 1.3 billion prescriptions. OptumRx’s contributions to the company took off in 2015 when Optum acquired pharmacy benefit manager Catamaran.

Healthcare Dive / Jeff Byers

In recent years, OptumHealth has grown due to expansion in care delivery services, including consumer engagement and behavioral and population health management. The care delivery arm served 91 million people last year, up from 60 million in 2011.

OptumInsight has grown largely due to an increase in revenue cycle management and operations services in recent years.

On Wall Street, UnitedHealth Group is performing well and has seen healthy growth since 2008. The stock peaked in January and took a dive when Amazon, J.P. Morgan and Berkshire Hathaway — industry outsiders yet financial giants — announced they would create a healthcare company.

Healthcare Dive / Jeff Byers

While these charts suggest a dominant force, the stock activity shows that investors believe there’s still more room for competition, if the new entrants play their cards right.

Where Optum could lock out and rivals could cut in on competition

UnitedHealth started down this strategic path many years ago and the rest of the industry just now seems to be catching up.

“Optum’s been the leader in showing how a managed care organization with an ambulatory care delivery platform and a pharmacy benefit manager all in house can lower or maintain and bend cost trend and then drive better market share gains in their health insurance business,” Ana Gupte, managing director of healthcare services at Leerink, told Healthcare Dive. “I think they have been the impetus in the large space for the Aetna-CVS deal.”

Optum’s competitive advantage in the PBM space is driven largely by already realized integration. Merging data across IT systems is no easy task, and Optum has spent years harmonizing pharmacy data across platforms to assist care managers in OptumCare to see medical records for United members.

Anyone with experience implementing EHR systems can tell you such integration doesn’t happen over night.

If the Cigna-Express Scripts deal closes, the equity can compete with OptumRx, but the technology investment needed to harmonize data and embed Cigna’s service and pharmacy information into Express Scripts servers will take time, Windley said. Optum, on the other hand, has invested in the effort and integration for years.

Gupte says the encroaching organizations in the PBM space have the ability to realize the efficiencies and savings and the integrated medical that Optum has been realizing across OptumRx and the managed care organization.

Optum’s leg up in PBM space could last two to three years over the competition, she said.

On the care delivery side, OptumHealth has been purchasing large physician groups for a variety of services. There are only so many large physician groups putting themselves on the market, and Optum has been making bids for them.

There’s still a bit of white space to fill in its 75 target markets, but analysts note Optum may have the competition on lock in this space.

Even if CVS-Aetna closes, OptumCare is a $12 billion business with many urgent and surgery care access points. If CVS-Aetna is finalized, the company will have about 1,100 MinuteClinics capable of realizing efficiencies with Aetna, but, as Windley notes, they likely won’t have primary care or surgery care elements.

There’s also a lot of time and capital needed for building out and retrofitting retail space to medical areas.

On the surgical care services, “I don’t see either Cigna, Aetna or Humana getting into that business,” Gupte said. “That will be one element of their footprint on care delivery that will be unique and differentiated for them.”

Urgent care has the potential for outsider competition, she added. However, Optum is using its MedExpress business to treat higher acuity conditions and have an ER doctor on staff in each center. Compared to the typical types of conditions treated in retail clinics or those that would be feasible over time, Gupte believes services that could be seen in CVS or Walmart would be lower acuity, chronic care management services.

“[Optum has] been so proactive and so strategic I don’t think there’s going to be a lot of reactive catchup they have to do,” Gupte said. “I think it’s going to be hard for the other entities to play catch up, outside of the PBM.”

One potential issue will be harmonizing the disparate businesses so patients can be effectively managed across the various organizations, Trevor Price, founder and CEO of Oxean Partners, told Healthcare Dive.

“I think the biggest challenge for Optum is operationalizing the combined platform,” Price said. “The biggest question is do they continue to operate as individual businesses or do they merge into one.”

What’s next?

Optum will continue to explore ground in the three core trends it has identified.

Out of the three, consumerism has the longest path to maturity in healthcare, Weissel said, adding he believes consumerism is going to change healthcare more than any other trend over the next decade.

“There is a wave coming, and this expectation that we will move there,” he said. “Increasingly, this aging of people who become very comfortable in a different modality is going to tip the balance with how people will want to interact with healthcare. I know there’s pent up demand already.”

That means the company is putting bets into the marketplace around consumer building and segmentation models as well as thinking about how to connect data to allow patients to schedule appointments, view health records, sign up for insurance, search for providers or renew prescriptions online.

Consumer-centric projects currently underway include digital weight loss programs — including streaming fitness classes — and maternity programs to track pregnancy. The company is also experimenting with remote patient monitoring to understand the impacts on those with heart disease or asthma and to search for service opportunities.

Optum will pursue investments as well as acquisitions to push into the consumer space.

“When it comes to acquisitions to Optum overall, we’re always in the marketplace looking to extend our capabilities, to extend our reach in the care management space to fill in holes or gaps that we have,” Weissel said. “That’s a constant process in our enterprise.”

– Jeff Byers