the health strategist

institute for strategic health transformation

& digital technology

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

October 27, 2023

One page summary

What is the message?

The rapid uptake of high-price weight loss drugs, including Ozempic, presents a unique challenge and opportunity for health insurers in the United States.

While these medications are expensive and initially seem like a burden for insurers, they are, in fact, creating opportunities for certain players in the healthcare industry, particularly pharmacy-benefit managers (PBMs).

This complexity arises from the nuances of drug pricing, competition, and insurance dynamics.

What are the key points?

Challenges for Health Insurers:

The high costs of GLP-1 drugs, used for both diabetes and obesity, place a financial burden on health insurers. Medicare and Medicaid don’t cover these drugs for obesity, and the self-insured commercial market means that employers bear the risk of these escalating costs.

Pharmacy-Benefit Managers (PBMs):

Large health insurers, such as Cigna, UnitedHealth, and CVS Health, own PBMs that negotiate drug prices and influence the inclusion of drugs in health plans. Higher drug volumes translate to more revenue for PBMs, making them significant players in managing drug costs.

Complexity of Drug Coverage:

The pricing and coverage of GLP-1 drugs create complexities for employers and health insurers. Employers may become increasingly dependent on PBMs to navigate these complexities and control costs.

Net Prices Lower Than Sticker Prices:

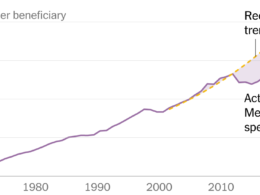

An analysis by the American Enterprise Institute reveals that the net price, what manufacturers receive, is significantly lower than the sticker price. Discounts for GLP-1 drugs range from 48% to 79%, which can be crucial in managing overall drug costs.

Impact on Healthcare Costs:

While the high price of obesity drugs concerns many, it’s essential to consider the net prices that insurers pay. This has implications for healthcare premiums and the financial well-being of Americans.

Strategies

- Leveraging Pharmacy-Benefit Managers: Health insurers with PBMs should focus on leveraging the capabilities of these middlemen to negotiate better drug prices, manage drug volumes, and optimize formulary placement.

- Educating Employers: Health insurers can educate employers about the complexities of drug coverage and the role of PBMs in managing these complexities, helping employers make informed decisions.

- Promoting Competition: Increasing competition within the GLP-1 space can benefit PBMs and health insurers by driving higher rebates and mitigating the rising cost trend.

- Advocating for Affordable Innovation: Health insurers can advocate for more affordable pricing and innovative solutions in the pharmaceutical industry to ensure that innovation is accessible to all without breaking the bank.

Examples

- Role of PBMs: Health insurers like UnitedHealth leverage their PBMs to offset some of the higher costs associated with high-priced drugs. Optum RX, UnitedHealth’s PBM, saw substantial revenue growth, emphasizing the role of PBMs in cost management.

- Net Pricing: Health insurers can use the insights from the American Enterprise Institute’s analysis to communicate the significance of net prices versus sticker prices to both employers and policy-makers.

- Competition and Rebates: Health insurers can work with PBMs to encourage competition in the GLP-1 drug space, potentially resulting in higher rebates and better cost management.

Conclusion

While the surge in high-price weight loss drugs initially appears to be a challenge for health insurers, it presents opportunities for those who can navigate the complexities of drug pricing and coverage.

Leveraging PBMs, promoting competition, and advocating for affordable innovation are strategies that health insurers can employ to benefit from this evolving landscape.

DEEP DIVE

This summary was written based on the article “Ozempic Boom Is an Opportunity for Health Insurers”, published by The Wall Street Journal and written by David Wainer, on October 21, 2023.

To read the original publication, click here.