How healthcare stakeholders can win within evolving healthcare ecosystems.

June 23, 2020 | Article

June 23, 2020 | Article

By Shubham Singhal, Basel Kayyali, Rob Levin, and Zachary Greenberg

Author’s Note: This paper was originally completed for publishing in early 2020 prior to the major outbreak of the COVID-19 pandemic in the United States.

We believe that the COVID-19 pandemic, and economic downturn, has only accelerated the evolution of healthcare ecosystems.

As we move forward, organizations can consider ways to use healthcare ecosystems to improve patient experience and health, while reducing total costs.

Ecosystems create powerful forces that can reshape and disrupt industries.

In healthcare, they have the potential to deliver a personalized and integrated experience to consumers, enhance provider productivity, engage formal and informal caregivers, and improve outcomes and affordability. We define an ecosystem as a set of capabilities and services that integrate value chain participants (customers, suppliers, and platform and service providers) through a common commercial model and virtual data backbone (enabled by seamless data capture, management, and exchange) to create improved and efficient consumer and stakeholder experiences, and to solve significant pain points or inefficiencies.

Healthcare has shifted away from its post-World War II focus on contagious disease and workplace accidents, which necessitated episodic interventions.

Today, the primary goal is preventing and effectively managing chronic conditions. However, as we have shown, productivity in healthcare is lagging other services industries as these goals shift. New technologies promise care that is available nearby or at home, supports continuous self and autonomous care, and reduces friction costs between supporting stakeholders.

These shifts create an imperative for stakeholders to move toward an ecosystem-based model of care enabled by five key industry forces driving technological innovation:

- Longstanding industry inefficiencies are leading to affordability, outcome, and quality challenges, and poor consumer experience.

These inefficiencies are not new and provide the fertile ground for innovation to deliver high returns.

2. High rates of healthcare technology investment are being realized.

From 2014 to 2018, there have been more than 580 healthcare technology deals in the United States, each more than $10 million, for a total of more than $83 billion in value. They have been disproportionately focused on three main categories: patient engagement, data and analytics, and new care models.

3.Technology giants are locked in a trillion-dollar battle to win share in the public cloud and to retain consumer “mindshare” and engagement.

As a result, they are investing billions of R&D dollars into their platforms to create services easily usable by a range of customers and for a range of applications (for example, predictive analytics) that accelerate innovation. Additionally, certain partnerships or acquisitions, whether between pharmacy providers or health systems and technology companies, reflect increased integration, as well as rising concerns around patient privacy. Healthcare incumbents and new entrants have a huge opportunity to tap into this innovation to gain market share while improving the cost and quality of healthcare.

4.Proposed regulatory changes offer the potential for more integrated data sharing, and greater transparency for consumers.

The Centers for Medicare & Medicaid Services (CMS) and the Office of the National Coordinator for Health Information Technology (ONC) are making changes to promote data sharing between healthcare organizations. These regulatory changes include interoperability of electronic health record (EHR) data and increased rate transparency for consumers and may help eliminate the data silos that have historically prevented end-to-end care analytics.

5.Healthcare industry incumbents increasingly are making large bets in acquiring capabilities that could advance their ecosystems.

Payers, providers, healthcare services, and technology firms are acquiring assets to extend their data and analytics capabilities and engage with patients longitudinally, driving almost $40 billion in healthcare technology deals from 2014 to 2018.

This white paper explores three main questions in further detail.

TABLE OF CONTENTS

- What could the healthcare ecosystems of the future look like?

- What are the component layers that will form future healthcare ecosystems?

- Conclusion

What could the healthcare ecosystems of the future look like?

Ecosystems have emerged across industries because they do the following:

- address industry inefficiencies, often by optimizing underutilized assets/resources or eliminating friction in consumer experience

- benefit from network effects, because as they grow, they create more value for suppliers (for example, gig drivers or app developers) and consumers alike

- own something in scarce supply that provides strategic leverage to the ecosystem operator

- use the data generated in the ecosystem (for example, purchase patterns or viewing behaviors) to tailor solutions for suppliers and consumers

- reduce likelihood to switching due to ease of use or structural advantages gained or generated in the ecosystem

Mature ecosystems exist across industries, with both technological disruptors and incumbents deriving value from these ecosystems.

One example is Disney. Its robust ecosystem allows each component to positively reinforce the other. Disney launched its first movie in 1937, its first television series in 1954, and, by 2019, the streaming service Disney+. Its theme parks, such as Disney World, reinforce the brands of characters, allowing children and families to have engaging in-person experiences. Those children also ask for Disney toys, Disney apparel, and Disney games, creating a self-reinforcing experience within the ecosystem enabled by the control of a scarce resource-content-and the underlying data and analytics to best deliver it.

The healthcare ecosystems of the future, like other ecosystems, will be centered on the consumer, in this case the patient.

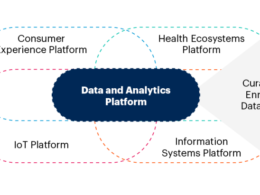

The capabilities and services that form the healthcare ecosystems of the future (illustrated in Exhibit 1) will include, but are not limited to:

- modalities of traditional care: direct care and pharmaceuticals administered by providers, across traditional sites of care

- home and self-care: patient engagement, self- and virtual care, remote monitoring, and traditional care that can increasingly be delivered near or in the home

- social care: social and community networks related to a patient’s holistic health focused on community elements of unmet social needs

- daily life activities: patient actions and habits enabling wellness and health, including fitness and nutrition

- financing support: operations and financial infrastructure supporting industry care events, including payment and financing solutions

Healthcare ecosystems of the future will be centered on the patient.

Each of these capabilities and services contribute to the underlying data backbone and advanced analytics technologies.

These capabilities maintain data integrity and enable insights from the ecosystem. These layers are further outlined in section 2.

The healthcare ecosystems of the future will likely be defined by the needs of different patient populations and their associated effective care journeys (including beyond care itself).

The consumer-oriented nature of these ecosystems also will increase the number of healthcare touchpoints, with the goal of modifying patient behavior and improving outcomes.

On one end of the spectrum, healthcare ecosystems will emerge to address the needs of healthy patients, who have less consistent medical challenges, but often set personal wellness goals.

These patients will likely experience a more digital ecosystem, where patient data and insights are consumed in a highly personalized and meaningful way, such as with wearable devices.

Only a small percentage of the touchpoints would be in modalities of traditional care.

At the other end of the spectrum, healthcare ecosystems will emerge to address the needs of patients who have multiple complex chronic conditions.

For these patients, especially the Medicare and Medicaid dually eligible population, coordination between providers and services delivered virtually and in-person at or near the home becomes critical to the end-to-end experience. Technology components of these ecosystems will often be leveraged to enhance the in-person experience and support the care team. This team includes informal caregivers, such as the adult children of elderly patients who may play an increasingly important (and technology-enabled) role. Healthcare startups are already experimenting with this model in a targeted way.

Although patient segments help organize how we think about care journeys and the ecosystems required to support them, the services provided along these journeys will be tailored to the specific needs of each patient.

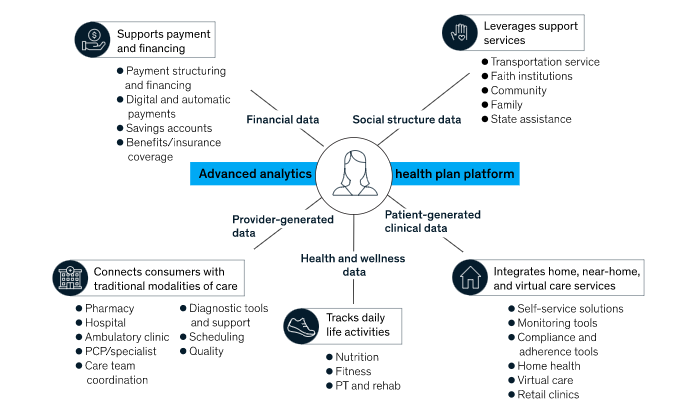

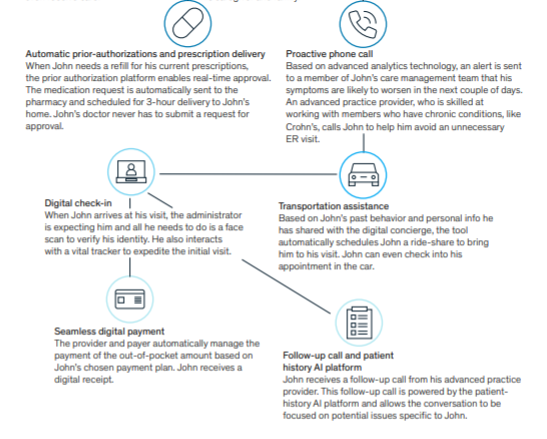

Below we imagine a tailored patient journey for John, a financially constrained patient with multiple chronic conditions, and the healthcare ecosystem that supports him.

Exhibit 2 Meet John.

In a patient-centric ecosystem orchestrated by an incumbent payer, John — a nancially constrained patient with multiple chronic conditions — will have a personalized frictionless experience

What are the component layers that will form future healthcare ecosystems?

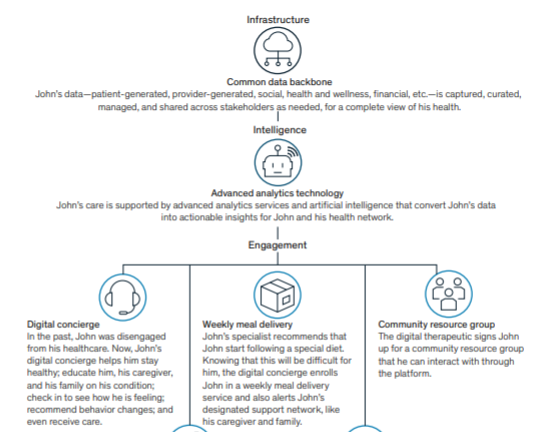

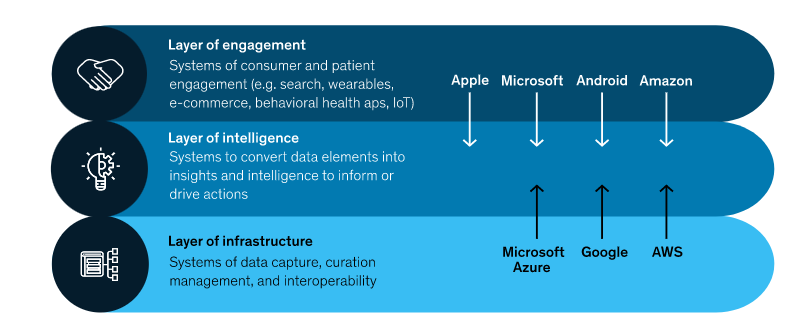

Ecosystems are built on three layers:

- infrastructure,

- intelligence, and

- engagement.

Exhibit 3

Technology giants are investing in capabilities across the layers of healthcare ecosystems.

The infrastructure layer is foundational, composed of effective data capture, curation, management, storage, and interoperability to create a common data set upon which the ecosystem can operate. Built on top of the infrastructure layer is the intelligence layer, which converts data elements to consumable and actionable insights. Finally, bringing an ecosystem to life also requires a robust engagement layer, enabled by the infrastructure and intelligence layers, to effectively curate an end-to-end experience for suppliers who provide services and offerings to patients. Components of these layers can be built, bought, partnered, or vended by ecosystem curators and participants.

The infrastructure layer requires data liquidity

Data liquidity-the ability to access, ingest, and manipulate standardized data sets-is required for the infrastructure layer to serve as the foundation for all insights and decisions made in the ecosystem. This data liquidity enables the ecosystem to create value and removes silos by allowing stakeholders to operate off the same data sets with increased coordination.

Similar increases in data liquidity in other industries, specifically consumer banking, have altered competitive landscapes. The Society for Worldwide Interbank Financial Telecommunications (SWIFT) messaging system, created in 1973 to transmit financial data, was a game-changer in introducing industry-wide standards. The result is an improved customer experience and added consumer choice.

Increased data liquidity enables stakeholders to access a complete longitudinal patient record, consisting of patient-generated data, provider-generated data, health and wellness data, financial data, and social data. As standards are established and cloud services continue to proliferate, this data will be easier to access, consume, and integrate. Patients will still be owners of this data and will be required to grant stakeholders permission. While balancing privacy, stakeholders will have to ensure that they are building in the appropriate safeguards and that the ecosystem will provide clear value-added benefits before patients are willing to make the trade-off.

In healthcare, data liquidity will likely enable more coordinated care and accelerate innovation. Open application programming interfaces (APIs) built for liquid data can provide access to patient records, support electronic data exchange for care transitions, and enable the integration of new data sets, including and beyond claims, clinical, pharmacy, financial, and social data. For example, Medicare-participating hospitals could automatically send HIPAA-compliant electronic notifications to in-network post-acute care providers and other stakeholders when a patient’s status is updated. As ecosystems evolve, tangible concerns and risks about the manipulation and ownership of patient, consumer, and provider data will arise for participants. Preserving individual privacy and trust is critical to the functioning of ecosystems. Reforms and regulations are beginning to address this challenge, with likely more to come.

Although the Department of Health and Human Services appears to be advancing data interoperability, evidenced by the CMS and ONC proposed rules around data interoperability, standard data formats, and APIs, the regulatory framework and mechanism of implementation of increased data liquidity will continue to evolve, because stakeholders, including patients, will demand it.

The intelligence layer requires advanced analytics

Successfully converting data from the infrastructure layer into insights in the intelligence layer requires advanced analytics. Advanced analytics-including machine learning, natural language processing, artificial intelligence, and big data analytics-is critical to gain actionable insights to guide stakeholders across ecosystems. Data liquidity will enable advanced analytics in the intelligence layer and lead to more robust patient risk identification, clinical pathway development, and personalized and precision medicine.

In healthcare, advanced analytics allows stakeholders to use personalized and predictive insights to more effectively manage population health. Our 2011 research identified a $300 billion opportunity from data and analytics in US healthcare, yet only 10 to 20 percent of that was captured as of 2016. Despite this lag, advanced analytics is being applied to healthcare problems (for example, PathAI is leveraging machine learning to improve cancer diagnoses, Babylon Health is using AI to improve remote monitoring, and various pharmaceutical companies are developing breakthrough therapies enabled by AI).

Much of the innovation in this space could be driven by technology giants. Seventy percent of AI experts in the United States work for Google, Facebook, Microsoft, and Amazon, with 30 percent of all US AI patents related to healthcare. Google, for example, is developing its own AI/machine learning capabilities for disease detection. These capabilities will help healthcare incumbents and new entrants leverage robust healthcare-specific services that can be built, partnered for, or acquired.

The engagement layer requires shared digital platforms, compelling consumer experiences, and new payment models

The engagement layer of the ecosystem is where end users interact with services that are in turn supported by underlying data sets from the infrastructure layer and insights from the intelligence layer. The engagement layer requires a shared digital platform where end users can access, through one principal channel, the curated set of services and offerings. Amazon is an example of a non-healthcare ecosystem that has enabled consumers to leverage a single digital platform for an entire spectrum of needs. In healthcare, these engagement offerings might include appointment scheduling, transportation assistance, daily health monitoring, and financial assistance.

In this layer, data liquidity and infrastructure will support advanced digital therapeutics and coordinated care across traditional and innovative care models that rely on up-to-date and comprehensive patient information.

To fully take advantage of this model in healthcare, industry behaviors will need to change. For example, provider practice changes include using the layer of intelligence to inform care decisions, leveraging innovative care delivery models and working across a care team at distributed sites, and capturing data from all relevant healthcare-related encounters. These changes will require payment model innovation to align provider and healthcare stakeholder incentives to change provider, payer, and patient behaviors.

The role of technology giants across healthcare ecosystems

Technology giants-and the billions of R&D dollars they are investing to create cross-industry capabilities-will influence the evolution of the healthcare ecosystem. The only question that remains is in what role.

At a minimum, they will supply the underlying capabilities across layers. In this world, healthcare incumbents would curate ecosystems and build on top of the big tech players’ capabilities through industry-specific services augmenting their horizontal/cross-industry infrastructure, intelligence, and engagement capabilities. For example, technology giants are locked in a battle to win share in the public cloud, creating infrastructure that could give healthcare players massive computing power. Furthermore, as data becomes more liquid, these technology giants will be able to continue to scale this infrastructure, supplying the foundation healthcare stakeholders can build on to realize value through healthcare ecosystems, and win market share against traditional competitors. At the same time, healthcare stakeholders who partner with these technology giants will need to address key risks associated with these arrangements, including those related to privacy, security, and internet protocol (IP) management.

The largest technology players might build and curate their own ecosystems. They could go to market either directly to consumers or through a select set of industry-incumbent partnerships. In this world, healthcare profit pools would likely be disrupted, as these large technology giants disintermediate existing healthcare incumbents’ relationships with their patients or empower incumbents who are partnering with them to gain share. For this scenario to emerge, the large technology players would likely need a series of regulatory changes (for example, increasing data interoperability) and be reasonably confident that the economics of disrupting the industry make more sense than enabling innovation within it, which typically involves lower risk.

Finally, although the battle for share between technology giants in the infrastructure and engagement layers is fairly mature, the intelligence layer is much less developed, leading to heightened competition for talent and investment in these cross-industry oriented capabilities. An illustration of the competitive dynamics between technology giants is provided in Exhibit 3.

How can healthcare stakeholders prepare for and act within healthcare ecosystems?

Despite the movement from some of healthcare’s major players, many have not yet clearly articulated their ecosystem strategy.

Nor are they set up with talent, operations, and technology that can fully realize value from either curating or participating in integrated, omni-site, patient-centered ecosystems.

Strategically, stakeholders need to decide whether they will act as curators or participants across the ecosystems that they touch. Stakeholders who wish to curate an ecosystem will need to ensure meaningful improvement in outcomes for a specific set of patients. This approach will require being clear on which industry-agnostic services they leverage and how they augment those services with healthcare-specific capabilities to create a differentiated ecosystem. Other stakeholders who want to provide point-solutions will need to ensure their value proposition is both competitively distinctive and compatible with a variety of ecosystems.

In addition, most stakeholders will need to make foundational upgrades across ecosystem layers, including:

- Technology upgrades to leverage increasing data liquidity. Stakeholders must ensure that all created data is stored in a standard format and easily accessible. For many organizations, this upgrade will be accomplished by a transition to the cloud and the development and curation of data lakes. This approach also will enable the reconciliation of broader sets of data, including, for example, patient-generated and social/demographic data.

- Operating model upgrades to drive insights through data and analytics. By building and integrating APIs and services that increase data availability, stakeholders will enable advanced analytics and automation techniques, such as predictive models and decision engines. Increasing the types and quantities of data that can be used to drive decisions is critical for a robust healthcare intelligence layer.

- Data-first talent model upgrades to capture value. To effectively capture the value from the improved infrastructure and intelligence layers, organizations and participants can adopt new technologies that generate insights and change stakeholder behaviors based on these insights. These talent upgrades include, for example, teaching stakeholders how to use these insights to make decisions, and require change management and targeted re- or up-skilling.

- External and partner services upgrades to expand engagement. Enabling provider, patient, and other stakeholder engagement across the ecosystem will likely require an external-facing orientation focused on collaborations and partnerships in line with stakeholder needs, particularly in the engagement layer, but also to optimize infrastructure and intelligence.

Additionally, healthcare stakeholders will need to shift behaviors of healthcare participants across patients, providers, and other healthcare stakeholders to realize value from ecosystems.

This shift requires curators and stakeholders to ensure adoption of new technologies, services, and capabilities in an already crowded space. Ecosystem curators and stakeholders offering point solutions therefore need to consider not only which technology and services they will provide, but also how those capabilities will sit within workflows and journeys, build on existing behaviors, and are linked to incentives.

Payers

Payers, who have access to members and claims data and a core competency in understanding, adjusting to, and shaping regulation in a highly regulated industry, are well-positioned to act as curators of specific healthcare ecosystems. That said, payers likely have to actively position themselves for this role by curating an end-to-end experience for members and providers that can be improved upon over time, especially as the payer core value proposition begins to be “unbundled.” This would include individual point solutions that begin displacing core payer functions. Some payers are already integrating with pre- and post-acute care delivery systems and finding higher returns.

Curating an ecosystem requires a few steps:

- Determine which ecosystem or sub-ecosystem to curate.

Given the range of member needs and the ways in which patients engage with healthcare stakeholders, ecosystems must be customized to different types of care needs and journeys (for example, healthy individuals versus dual-eligible patients with multiple chronic conditions). Payers should decide which ecosystems they want to curate rather than simply participate in.

2. Build partnerships that will allow stakeholders to create a seamless experience for patients.

Effectively curating an ecosystem requires the ability to create a seamless experience for patients. This requires an underlying data infrastructure that follows patients throughout their healthcare journey and enables interoperable transfer of data across healthcare stakeholders. It involves intelligence that turns that data into insights, and engagement capabilities that lead to stakeholder action. In many cases, the underlying technology required for each layer of future healthcare ecosystems already exists and is relatively mature. Therefore, payers may be able to curate ecosystems most efficiently if they partner with existing technology players and apply healthcare-specific talent and operating models to orient that technology. In this context, payers will need to effectively manage the risks of partnership, including security and privacy concerns.

3. Integrate patient and provider services into the ecosystem through contract, partnership, or acquisition on a use-case basis and with incentives in mind.

Curating a successful ecosystem requires operating in an agile, patient-oriented way. Building the ecosystem on a use-case basis allows payers to gradually transition to these new ways of operating, while also ensuring a robust set of services that focus on the patient/patient-profile selected. For example, if a payer decides to focus on simple chronic patients, they may first decide to integrate services that enable remote monitoring for providers treating patients with diabetes. Additionally, payers can weigh investing in the capabilities required to build new payment models in order to best enable ecosystems. Given the increasing complexity of ecosystems and the requirement for stakeholders to work together to optimize the quality of care for patients, payers are likely to focus on payment models that effectively align incentives across ecosystem stakeholders.

Providers

While provider systems have made significant capital investments, to date these investments have not delivered their expected productivity improvements. The evolution toward ecosystems presents an opportunity for these providers to increase their return on this invested capital. Leveraging historical-and potential future-investments to create a more longitudinal and personalized care experience could be a potential “unlock” for productivity. Additionally, the emergence of ecosystems may drive care delivery innovation as it enables providers to leverage a broader array of services for patients beyond responding to acute needs.

In an ecosystem-driven world, providers can either participate in an ecosystem curated by another stakeholder, as a professionalized deliverer of episodic or acute care, or they can curate a care-oriented ecosystem for certain populations across the care continuum. Providers are most likely to act as ecosystem curators for subsets of the population with intense, chronic needs; lower-need, healthier populations have less interaction with providers and are not likely to participate in an ecosystem curated by a provider.

The goal for providers who choose to curate ecosystems would be to deliver a fully integrated experience, centered around the patient, and incorporating informal caregiver engagement. These care-oriented ecosystems will need to extend throughout the entire care continuum. Providers who wish to pursue this strategic path will need to do the following:

- Develop a strategy for bringing together care experiences across the entire continuum (that is, seamlessly linking pre-acute, acute, and post-acute care).

This kind of integrated network integrity likely requires deployment of a few critical enablers:

- Mechanisms that make scheduling and referrals processes more seamless and proactive. These mechanisms could include open scheduling, centralized referral recommendation tools, or care navigators who schedule follow-up appointments with emergency department patients upon discharge.

- Integrated network strategy across all provider types and locations. This strategy ensures that affiliated physicians are able to practice at the facility that makes the most sense to the patient.

- Creation of a network for high-needs patients. This network will fulfill all of the clinical needs of the selected patient segment, for example, focusing physician outreach/recruitment on specialties where patients are most likely to see an out-of-network provider.

- Aligned provider incentives. Providers within the ecosystem of care must realize ecosystem-oriented payment arrangements or joint incentives, such as through joint venture arrangements.

2. Re-work the traditional concept of organization via “service lines.” A truly integrated experience will revolve around a patient’s holistic needs.

In the current system, patients transfer from one service line to another (for example, from radiology to oncology, to surgery, back to oncology, to social services).

A team-based approach centered around the patient (for example, someone with a complex cancer diagnosis) will be more in line with an ecosystem view, but requires organizational, financial, and operational changes.

3.Integrate tools and care approaches that address non-clinical behaviors that influence health status, potentially through partnerships with other organizations (clinical care explains only about 15 percent of overall health outcomes).

4.Deploy tools that help personalize the ecosystem experience for each individual patient.

Data liquidity in the infrastructure layer and innovation in the engagement layer (for example, deployment of digital tools) will be particularly important to enable this personalized experience.

For providers that make a strategic choice to be a participant in an ecosystem, it will be important to have a distinctive value proposition. This means, at minimum, providing high-value care for specific patient needs. To maintain this value proposition, providers may choose to act as specialty aggregators that bring together distinctive services for a specific specialty (for example, orthopedics) to support an ecosystem.

Providers who pursue this strategic path will need to do the following:

- carefully consider which specialties or practice areas they will offer (for example, based on competition trends in those areas, long-term economic sustainability)

- ensure that there is a clear quality and affordability value proposition so that they have a “right to play” in various ecosystems curated by others

- ensure that the infrastructure, intelligence, and engagement capabilities they have in place can easily integrate into others’ ecosystems

Healthcare services and technology players

Healthcare systems and technology players vary widely in terms of services and offerings. These players vary both across function (providing services, data and analytics, consulting, and software and platforms) and topical domain (for example, payment integrity, revenue cycle management, care management). As we’ve noted in previous work, amid wide diversity of players in this segment, large-scale platform players could evolve to create frictionless markets for healthcare products and services.

This wide variation means that healthcare services and technology players are naturally positioned to participate in emerging healthcare ecosystems across different ecosystem layers:

- At the infrastructure layer: healthcare services and technology players (for example, health information exchanges and clinical information systems) currently provide data collection, transfer, and management capabilities. As the layer of infrastructure underpinning healthcare ecosystems matures-including through the entry of large technology giants-these healthcare services and technology players can realize value by building capabilities that require healthcare-specific expertise and domain knowledge to serve critical functions in enabling data sets.

- At the intelligence layer: healthcare services and technology players (payment integrity, revenue cycle management, population health, clinical decision support) currently play a critical role in converting underlying data to actionable insights for a variety of customers. With the evolution of healthcare ecosystems, the opportunities for intelligence functions will likely expand materially. As advanced analytics capabilities mature-including through healthcare agnostic technologies-healthcare services and technology players can build off these capabilities and data to develop healthcare-specific insights. These insights can be provided to the patient in an efficient and actionable way, while also improving the quality of care.

- At the engagement layer: healthcare services and technology players, including patient engagement, care and disease management, utilization management, and provider enablement, currently play a critical role in providing information to and changing behavior of healthcare stakeholders. As healthcare ecosystems evolve, the number and complexity of points of engagement will continue to expand. This expansion presents an opportunity for engagement organizations to leverage an increasing amount of data and actionable insights and create value through patient behavior and payer/provider behavior. These players will need to learn how they can best plug into broader healthcare ecosystems to drive adoption and engagement.

Most healthcare services and technology players will likely act as (one or many) point solutions plugging into and providing key functions within evolving healthcare ecosystems.

Therefore, these players should maximize the number of situations/ecosystems where their capabilities can be deployed. Often, companies string solutions together within or across topical domains that may stretch beyond a single layer of the ecosystem. This action requires technical flexibility and APIs that interface with other ecosystem participants, especially in the core infrastructure and intelligence layers. Additionally, healthcare services and technology players could create modular solutions that facilitate adding capabilities to an ecosystem.

Finally, although less common than acting as point solutions, some healthcare services and technology players may be able to curate effective sub-ecosystems (centered on either a specific population, such as those with diabetes, or use case, such as payments).

For example, a patient-engagement technology focused on a specific condition may believe that with given engagement levels with patients, it can curate an ecosystem for these patients directly. This approach would require players to bring in underlying data infrastructure and intelligence capabilities, and curate a complete or near-complete continuum of digital and physical services focused on diabetic patients.

Ecosystems have proven to be a powerful force in reshaping and disrupting industries.

Healthcare ecosystems have tremendous potential to do the same and could lead to improved health outcomes and affordability by delivering a personalized, intuitive, and integrated experience to patients. In addition, providers would be able to enhance productivity and engage with a broad set of caregivers.

As industry forces combine to drive the technological innovation that enables these ecosystems, we pose three questions:

- What is a clear strategic path (including strategy for leveraging cross-industry technology services and augmenting those services with healthcare-specific capabilities) that allows a company to benefit from the evolution of healthcare ecosystems?

- Do healthcare industry stakeholders have the requisite technology capabilities, operating models, and talent required across the infrastructure, intelligence, and engagement layers of future healthcare ecosystems?

- Do stakeholders have a structured framework to determine whether to build, partner, or acquire in closing any capability gaps? How does this framework consider what capabilities are truly differentiating and therefore should be owned?

Answering these three questions could help healthcare incumbents and new entrants successfully realize the potential value at stake from the emergence of healthcare ecosystems by improving the healthcare experience, outcomes, and costs, ultimately benefiting patients and the public.

Author’s Note: This paper was originally completed for publishing in early 2020 prior to the major outbreak of the COVID-19 pandemic in the United States.

We believe that the COVID-19 pandemic, and economic downturn, has only accelerated the evolution of healthcare ecosystems.

As we move forward, organizations can consider ways to use healthcare ecosystems to improve patient experience and health, while reducing total costs. Originally published at mckinsey.com