Health Tranformation Institute (HTI)

Joaquim Cardoso MSc*

Chief Researcher and Editor

November 6, 2022

(*MSc from London Business School — MIT Sloan Programme)

Key messages:

- Insurers and employers are optimistic about the possibilities of virtual care, but they’re not very enthusiastic about the care modality’s larger influence on the healthcare industry

- Just 29% of employers and 34% of payers and benefits consultants said that virtual care will drastically change the way healthcare is provided and outcomes are achieved.

- A lack of understanding of what virtual care really means, the industry’s loose definitions, and inconsistent deployment models are some reasons why benefits buyers remain doubtful about virtual care’s ability to revolutionize care delivery

- “Telemedicine simply digitizes in-person care — conversely, impactful virtual care redesigns how care is delivered, putting the patient at the center and leveraging technology to enable proactive, continuous management.

- This transition is essential to make significant strides in patient care,”

Infographic:

Source: Medcity News

KATIE ADAMS

Nov 7, 2022

ORIGINAL PUBLICATION (full version)

Why Payers and Employers Are Still Doubtful That Virtual Care Will Have a Revolutionary Impact

Insurers and employers are optimistic about the possibilities of virtual care, but they’re not as enthusiastic about the care modality’s larger impact on the healthcare industry as a whole, according to a new report.

The Digital Medicine Society and Omada Health surveyed nearly 800 buyers for the report — 528 employers, 107 payers and 129 benefits consultants.

Buyers Report Broad Experience With Virtual CareBuyers Report Broad Experience With Virtual Care

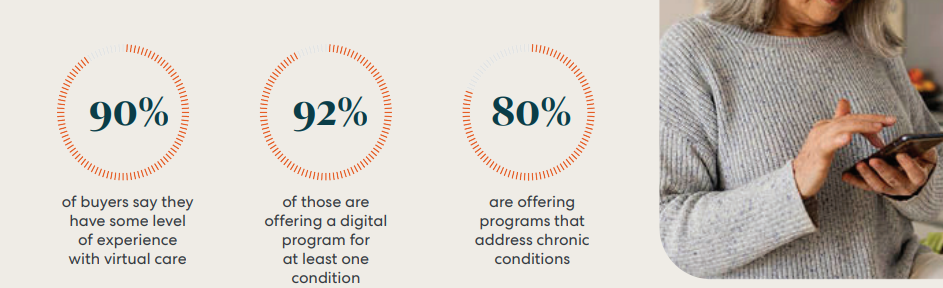

Given the rapid expansion of telemedicine during the COVID-19 pandemic, it wasn’t surprising that almost all buyers surveyed reported some level of experience with virtual care, or are offering a platform focusing on a specific condition.

There is a near-universal openness to expanding offerings beyond the most common programs (diabetes, mental health, and weight management).

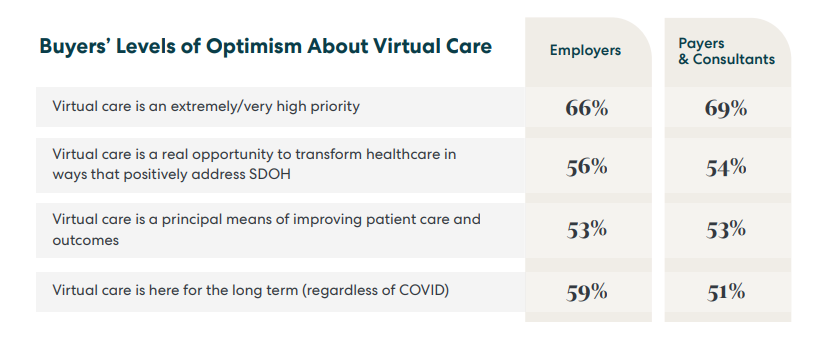

Two thirds of employers and 69% of payers and consultants said that virtual care is an extremely high priority for their organizations.

This is because they think the care modality can have a positive effect on workforces — for example, more than half of respondents believed that virtual care can improve patients’ health outcomes and the way providers address social determinants of health.

However, respondents weren’t as passionate about virtual care’s larger influence on the healthcare industry.

When asked specific questions about the care modality’s impact on the industry, less than half of respondents reported positively.

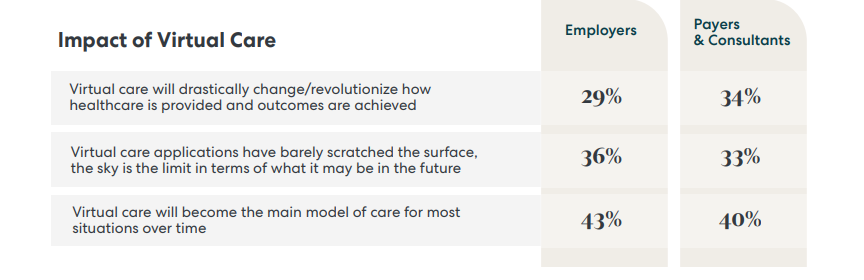

- Just 29% of employers and 34% of payers and consultants said that virtual care will drastically change the way healthcare is provided and outcomes are achieved.

- When asked whether they agree that “the sky is the limit” in terms of what virtual care applications can accomplish in the future, 36% of employers and 33% of payers and consultants agreed.

- Most respondents were doubtful that virtual care will become healthcare’s main model of care for most situations over time.

A lack of understanding of what virtual care really means, the industry’s loose definitions, and inconsistent deployment models are some reasons why benefits buyers remain doubtful …

… about virtual care’s ability to revolutionize care delivery, according to the report.

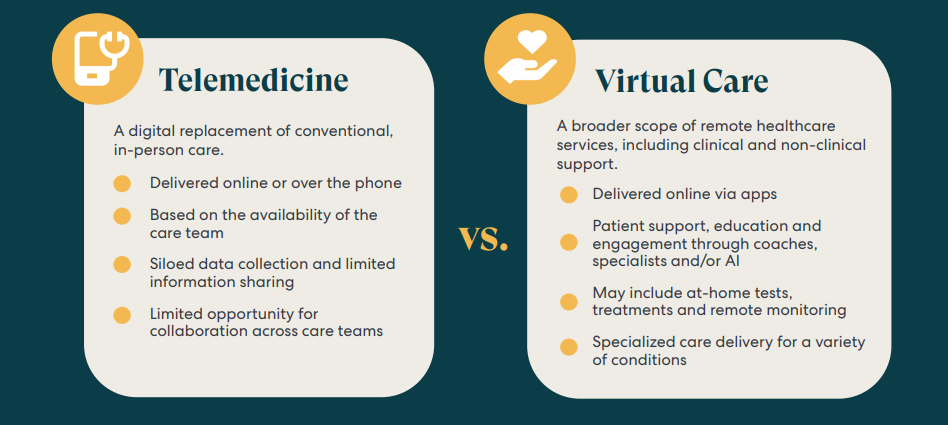

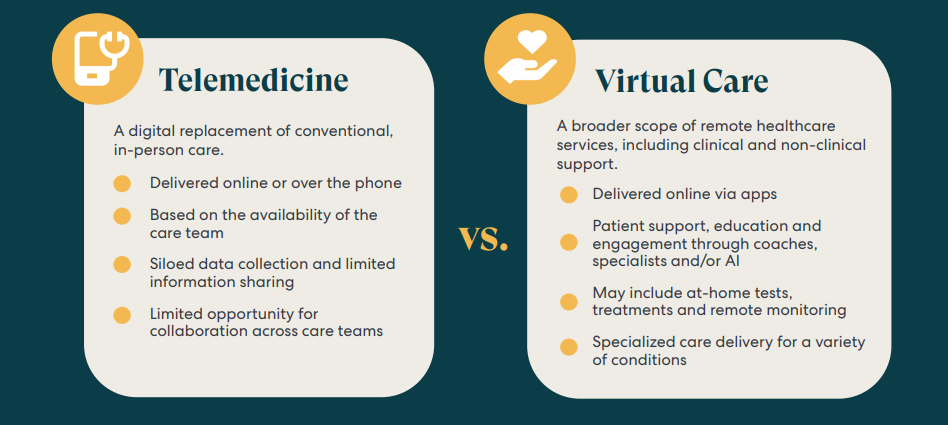

For example, many healthcare stakeholders still don’t understand the difference between telemedicine and virtual care.

With telemedicine, providers are aiming to recreate the 1:1 experience of traditional in-person care without changing the model of a patient’s care journey. But with virtual care, providers are seeking to deliver a wider scope of remote services, such as clinical and non-clinical treatment for a variety of conditions, the report said.

A lack of understanding of what virtual care really means, the industry’s loose definitions, and inconsistent deployment models are some reasons why benefits buyers remain doubtful about virtual care’s ability to revolutionize care delivery …

For example, many healthcare stakeholders still don’t understand the difference between telemedicine and virtual care.

Most benefits buyers are currently only using telemedicine, so they’re probably lacking the experience required to think about use cases that go further than this model, according to the report.

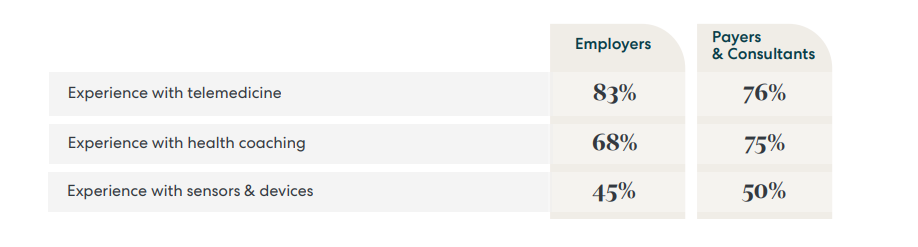

It showed that nearly 85% of employers have used telemedicine, but only 68% had used health coaching and just 45% had used remote monitoring devices.

“Telemedicine simply digitizes in-person care — conversely, impactful virtual care redesigns how care is delivered, putting the patient at the center and leveraging technology to enable proactive, continuous management.

This transition is essential to make significant strides in patient care,” Megan Zweig, Rock Health ‘s chief operating officer, said in a statement.

“Telemedicine simply digitizes in-person care — conversely, impactful virtual care redesigns how care is delivered, putting the patient at the center and leveraging technology to enable proactive, continuous management

There is some overlap between telemedicine and virtual care, but they are actually two different care delivery models.

Telemedicine is the entry point for virtual care.

It aims to replicate 1:1 the experience of in-person care in a digital environment without fundamentally changing the care journey.

Virtual care, as described to our surveyees, aims to deliver a broader scope of remote healthcare services, including clinical and non-clinical support for a wide variety of conditions.

The report also pointed out that today’s benefits buyers are facing a seemingly endless sea of companies that call themselves virtual care providers, regardless of the type of care model they offer.

This fact is not improving buyers’ cloudy understandings of virtual care.

Photo: ipopba, Getty Images

Originally published at https://medcitynews.com on November 7, 2022.

REFERENCE PUBLICATION

Names mentioned

Omada Health,

The Digital Medicine Society,

Rock Health

Megan Zweig, Rock Health ‘s chief operating officer,